Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marwicks Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,505 per unit and then sells them to retail customers for

Marwicks Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,505 per unit and then sells them to retail customers for an average price of $2,500 each. The companys selling and administrative costs for a typical month are presented below:

| Costs | Cost Formula | |

| Selling: | ||

| Advertising | $ | 947 per month |

| Sales salaries and commissions | $ | 4,790 per month, plus 4% of sales |

| Delivery of pianos to customers | $ | 62 per piano sold |

| Utilities | $ | 666 per month |

| Depreciation of sales facilities | $ | 4,956 per month |

| Administrative: | ||

| Executive salaries | $ | 13,562 per month |

| Insurance | $ | 715 per month |

| Clerical | $ | 2,496 per month, plus $39 per piano sold |

| Depreciation of office equipment | $ | 895 per month |

During August, Marwicks Pianos, Inc., sold and delivered 64 pianos.

Required:

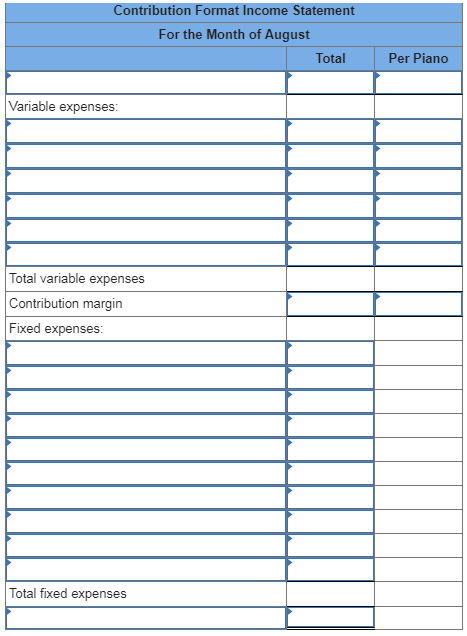

2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per unit basis down through contribution margin.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started