Answered step by step

Verified Expert Solution

Question

1 Approved Answer

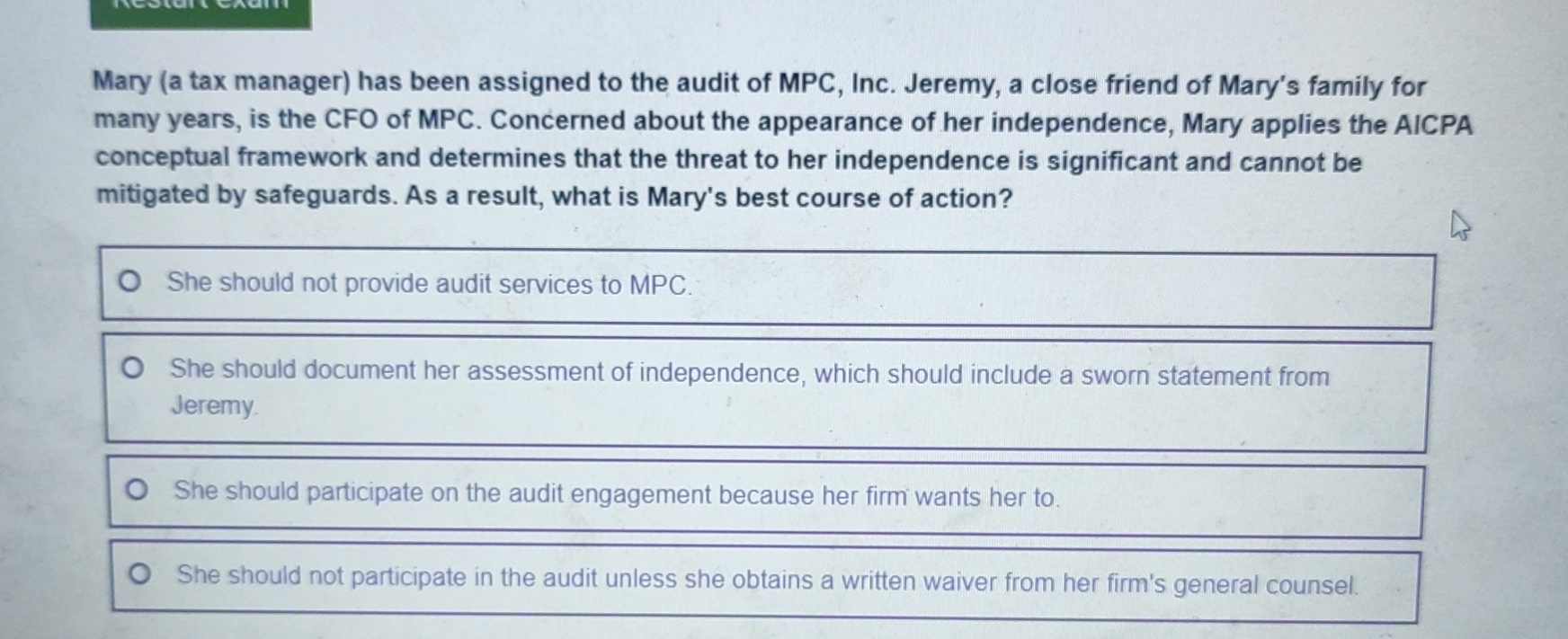

Mary ( a tax manager ) has been assigned to the audit of MPC , Inc. Jeremy, a close friend of Mary's family for many

Mary a tax manager has been assigned to the audit of MPC Inc. Jeremy, a close friend of Mary's family for

many years, is the CFO of MPC Concerned about the appearance of her independence, Mary applies the AICPA

conceptual framework and determines that the threat to her independence is significant and cannot be

mitigated by safeguards. As a result, what is Mary's best course of action?

She should document her assessment of independence, which should include a sworn statement from

Jeremy.

She should not participate in the audit unless she obtains a written waiver from her firm's general counsel.

She should not provide audit services to MPC

She should not participate on the audit engagement because her firm wants her to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started