Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary and Carol are saving for retirement and have very different saving plans. Carol saves from age 35 to 65, putting $100 in every month.

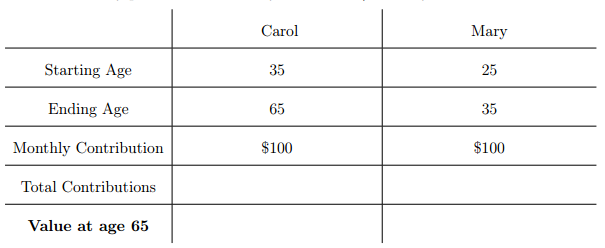

Mary and Carol are saving for retirement and have very different saving plans. Carol saves from age 35 to 65, putting $100 in every month. Mary also puts $100 in every month, but only saves from ages 25 to 35, then allows the money to accrue earnings from ages 35 to 65. Assume the investments receive 6.4% earnings compounded monthly, and fill in the following chart. (Total contributions in the chart below means total amount of money put in the account by the investor). Show your work please.

Starting Age Ending Age Monthly Contribution Total Contributions Value at age 65 Carol 35 65 Mary 25 35 $100 $100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started