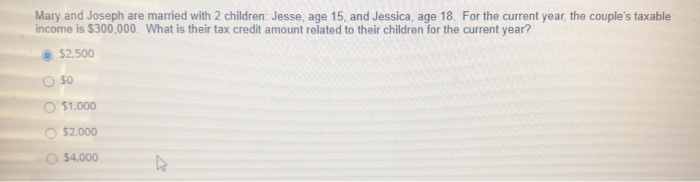

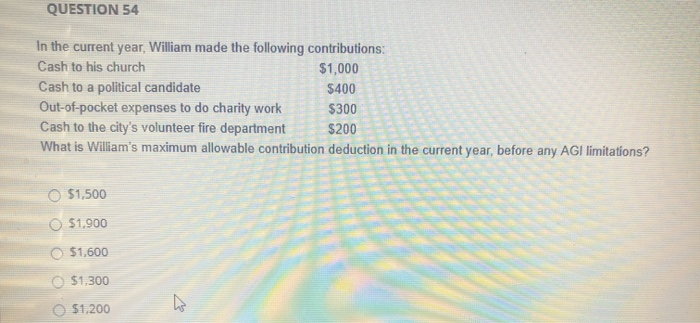

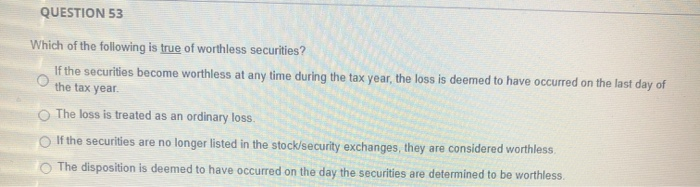

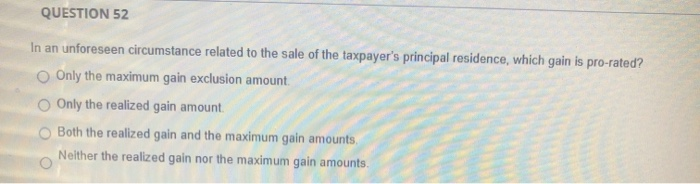

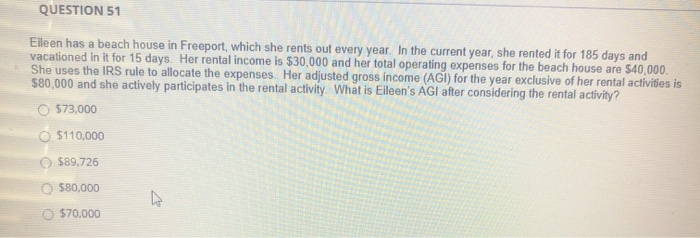

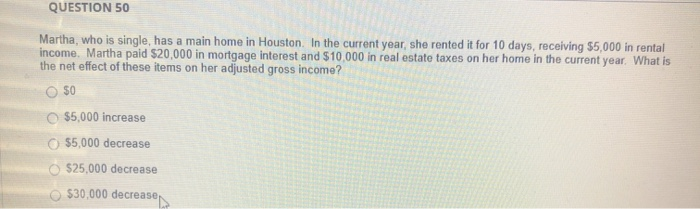

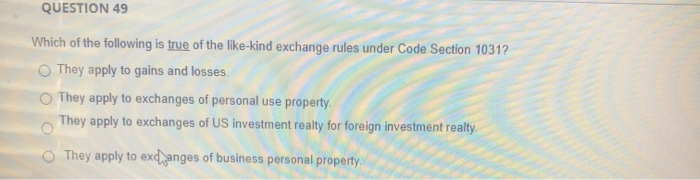

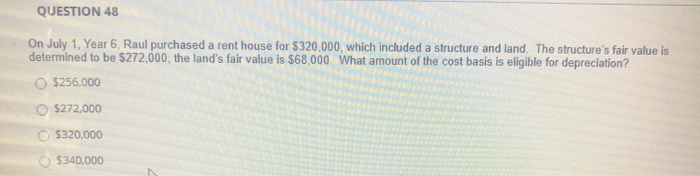

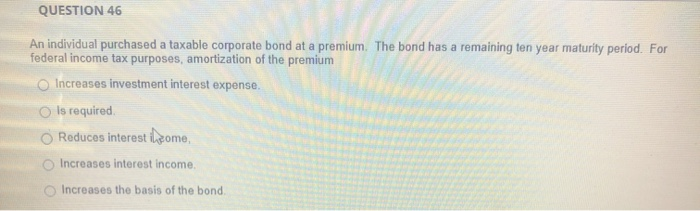

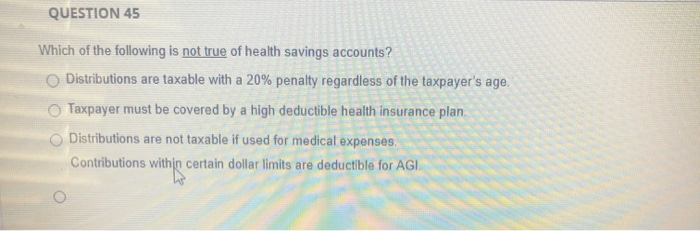

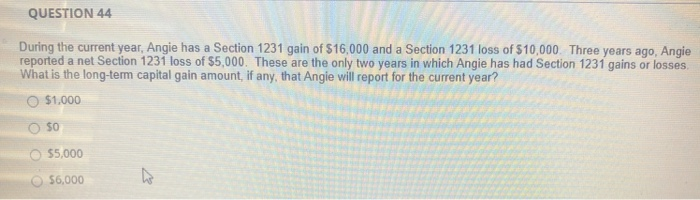

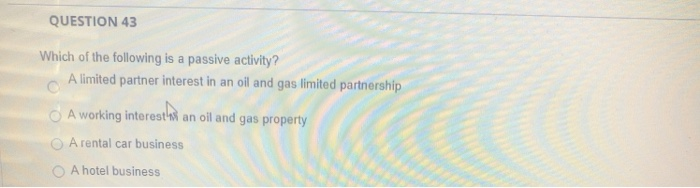

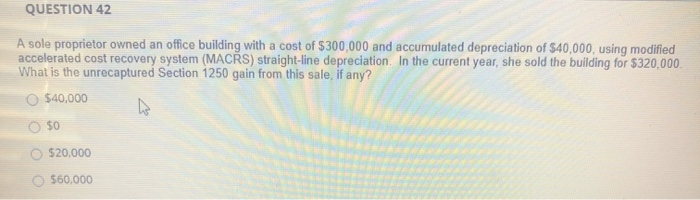

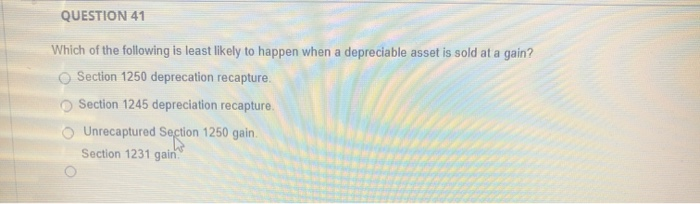

Mary and Joseph are married with 2 children: Jesse, age 15, and Jessica, age 18. For the current year, the couple's taxable income is $300,000. What is their tax credit amount related to their children for the current year? $2,500 50 $1.000 $2.000 54,000 QUESTION 54 In the current year, William made the following contributions: Cash to his church $1,000 Cash to a political candidate $400 Out-of-pocket expenses to do charity work $300 Cash to the city's volunteer fire department $200 What is William's maximum allowable contribution deduction in the current year, before any AGI limitations? O $1,500 $1,900 $1,600 $1,300 $1,200 QUESTION 53 Which of the following is true of worthless securities? If the securities become worthless at any time during the tax year, the loss is deemed to have occurred on the last day of the tax year. The loss is treated as an ordinary loss. If the securities are no longer listed in the stock/security exchanges, they are considered worthless The disposition is deemed to have occurred on the day the securities are determined to be worthless. QUESTION 52 In an unforeseen circumstance related to the sale of the taxpayer's principal residence, which gain is pro-rated? Only the maximum gain exclusion amount. Only the realized gain amount Both the realized gain and the maximum gain amounts Neither the realized gain nor the maximum gain amounts QUESTION 51 Eileen has a beach house in Freeport, which she rents out every year. In the current year, she rented it for 185 days and vacationed in it for 15 days. Her rental income is $30,000 and her total operating expenses for the beach house are $40,000. She uses the IRS rule to allocate the expenses. Her adjusted gross income (AGI) for the year exclusive of her rental activities is $80,000 and she actively participates in the rental activity. What is Eileen's AGI after considering the rental activity? O 573,000 $110,000 $89.726 $80,000 $70.000 QUESTION 50 Martha, who is single, has a main home in Houston. In the current year, she rented it for 10 days, receiving $5,000 in rental income. Martha paid $20,000 in mortgage interest and $10,000 in real estate taxes on her home in the current year. What is the net effect of these items on her adjusted gross income? $0 $5,000 increase $5,000 decrease $25,000 decrease $30,000 decreases QUESTION 49 Which of the following is true of the like-kind exchange rules under Code Section 1031? They apply to gains and losses. They apply to exchanges of personal use property. They apply to exchanges of US investment realty for foreign investment realty. They apply to exdanges of business personal property. QUESTION 48 On July 1, Year 6. Raul purchased a rent house for $320,000, which included a structure and land. The structure's fair value is determined to be $272,000; the land's fair value is $68,000. What amount of the cost basis is eligible for depreciation? $256,000 $272.000 $320,000 $340,000 QUESTION 46 An individual purchased a taxable corporate bond at a premium. The bond has a remaining ten year maturity period. For federal income tax purposes, amortization of the premium Increases investment interest expense. is required Reduces interest isome Increases interest income. Increases the basis of the bond QUESTION 45 Which of the following is not true of health savings accounts? Distributions are taxable with a 20% penalty regardless of the taxpayer's age. Taxpayer must be covered by a high deductible health insurance plan. Distributions are not taxable if used for medical expenses. Contributions within certain dollar limits are deductible for AGI QUESTION 44 During the current year, Angie has a Section 1231 gain of $16,000 and a Section 1231 loss of $10,000. Three years ago, Angie reported a net Section 1231 loss of $5,000. These are the only two years in which Angie has had Section 1231 gains or losses. What is the long-term capital gain amount, if any, that Angie will report for the current year? $1,000 $0 $5,000 $6,000 QUESTION 43 Which of the following is a passive activity? A limited partner interest in an oil and gas limited partnership A working interest has an oil and gas property A rental car business A hotel business QUESTION 42 A sole proprietor owned an office building with a cost of $300,000 and accumulated depreciation of $40,000, using modified accelerated cost recovery system (MACRS) straight-line depreciation. In the current year, she sold the building for $320,000 What is the unrecaptured Section 1250 gain from this sale, if any? $40,000 50 $20,000 560,000 QUESTION 41 Which of the following is least likely to happen when a depreciable asset is sold at a gain? Section 1250 deprecation recapture. Section 1245 depreciation recapture. Unrecaptured Section 1250 gain. Section 1231 gain