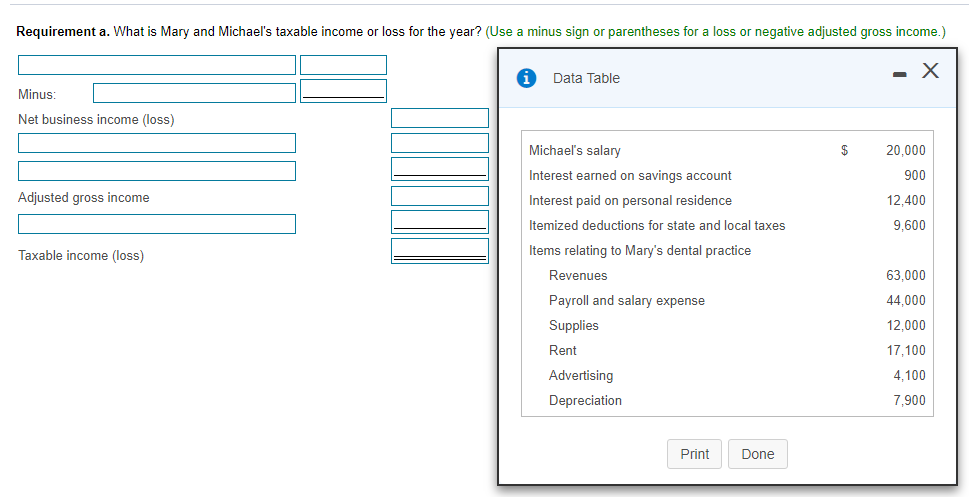

Mary and Michael are married and file a joint return. Mary owns an unincorporated dental practice. Michael works part-time as a high school math teacher, and spends the remainder of his time caring for their daughter. During 2018, they report the following items:

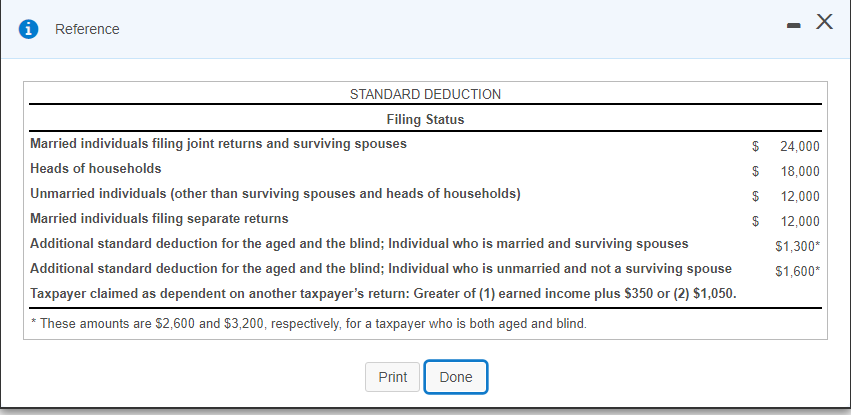

Requirement a. What is Mary and Michael's taxable income or loss for the year? (Use a minus sign or parentheses for a loss or negative adjusted gross income.) Data Table Minus Net business income (loss) 20,000 900 12,400 9,600 Michael's salary Interest earned on savings account Interest paid on personal residence Adjusted gross income Itemized deductions for state and local taxes Items relating to Mary's dental practice Taxable income (loss) 63,000 44,000 12,000 17,100 4,100 7,900 Revenues Payroll and salary expense Supplies Rent Advertising Depreciation PrintDone Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse$1,600 Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,050 $ 24,000 $ 18,000 $12,000 $ 12,000 $1,300* These amounts are $2,600 and $3,200, respectively, for a taxpayer who is both aged and blind Requirement a. What is Mary and Michael's taxable income or loss for the year? (Use a minus sign or parentheses for a loss or negative adjusted gross income.) Data Table Minus Net business income (loss) 20,000 900 12,400 9,600 Michael's salary Interest earned on savings account Interest paid on personal residence Adjusted gross income Itemized deductions for state and local taxes Items relating to Mary's dental practice Taxable income (loss) 63,000 44,000 12,000 17,100 4,100 7,900 Revenues Payroll and salary expense Supplies Rent Advertising Depreciation PrintDone Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse$1,600 Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,050 $ 24,000 $ 18,000 $12,000 $ 12,000 $1,300* These amounts are $2,600 and $3,200, respectively, for a taxpayer who is both aged and blind