Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary Jervis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevase information:

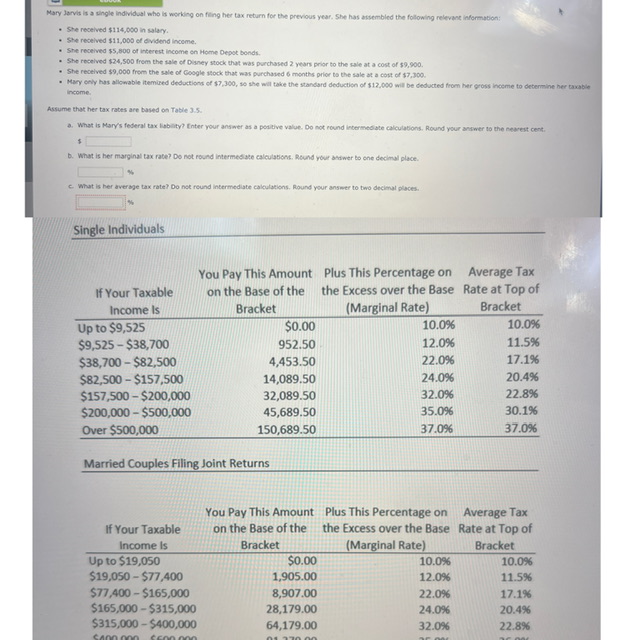

Mary Jervis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevase information: - She received $114,000 in salary. - She recelved $11,000 of evidend income. - She received $5,800 of interest income on Home Depot bonds. - She recelved \$24,500 from the sale of Disney szock that was purchased 2 years prior to the sale at a cost of $9,900. - She received $9,000 from the sale of Coogle 1 tock that was purchased 6 months prior to the sale at a cost of $7,300. - Mary enly has allowable itemised deductions of $7,300, so she wal take the standard deduction of $12,000 wil be deducted from her pross inceme to debermine her taxable income. Assume that her tax rates are based on Table 3.5. a. What is Mary's foderal tax libbity? Cnter your answer as a potitive value. Do not round inoermedate calculabions. Round your answer to the nearest cent. s b. What is her marginat tax rate? Do not round intermedate calculations. Round your batwer to one decimul place. c. What is her averbje tax rate? 00 hot round intermediate caleulations. Round your answer to two decimat places

Mary Jervis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevase information: - She received $114,000 in salary. - She recelved $11,000 of evidend income. - She received $5,800 of interest income on Home Depot bonds. - She recelved \$24,500 from the sale of Disney szock that was purchased 2 years prior to the sale at a cost of $9,900. - She received $9,000 from the sale of Coogle 1 tock that was purchased 6 months prior to the sale at a cost of $7,300. - Mary enly has allowable itemised deductions of $7,300, so she wal take the standard deduction of $12,000 wil be deducted from her pross inceme to debermine her taxable income. Assume that her tax rates are based on Table 3.5. a. What is Mary's foderal tax libbity? Cnter your answer as a potitive value. Do not round inoermedate calculabions. Round your answer to the nearest cent. s b. What is her marginat tax rate? Do not round intermedate calculations. Round your batwer to one decimul place. c. What is her averbje tax rate? 00 hot round intermediate caleulations. Round your answer to two decimat places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started