Question

Massona Inc. will need to pay a foreign-denominated short-term debt of SGD 886,000 in 90 days. The spot rate is USD 1.7181/SGD. The 90-day

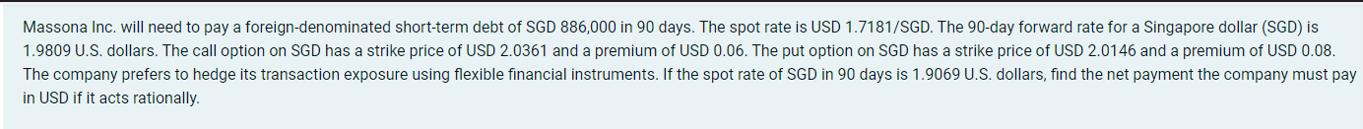

Massona Inc. will need to pay a foreign-denominated short-term debt of SGD 886,000 in 90 days. The spot rate is USD 1.7181/SGD. The 90-day forward rate for a Singapore dollar (SGD) is 1.9809 U.S. dollars. The call option on SGD has a strike price of USD 2.0361 and a premium of USD 0.06. The put option on SGD has a strike price of USD 2.0146 and a premium of USD 0.08. The company prefers to hedge its transaction exposure using flexible financial instruments. If the spot rate of SGD in 90 days is 1.9069 U.S. dollars, find the net payment the company must pay in USD if it acts rationally.

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

the net payment the company must pay in USD is 1665835 Firstly Massona ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App