Question

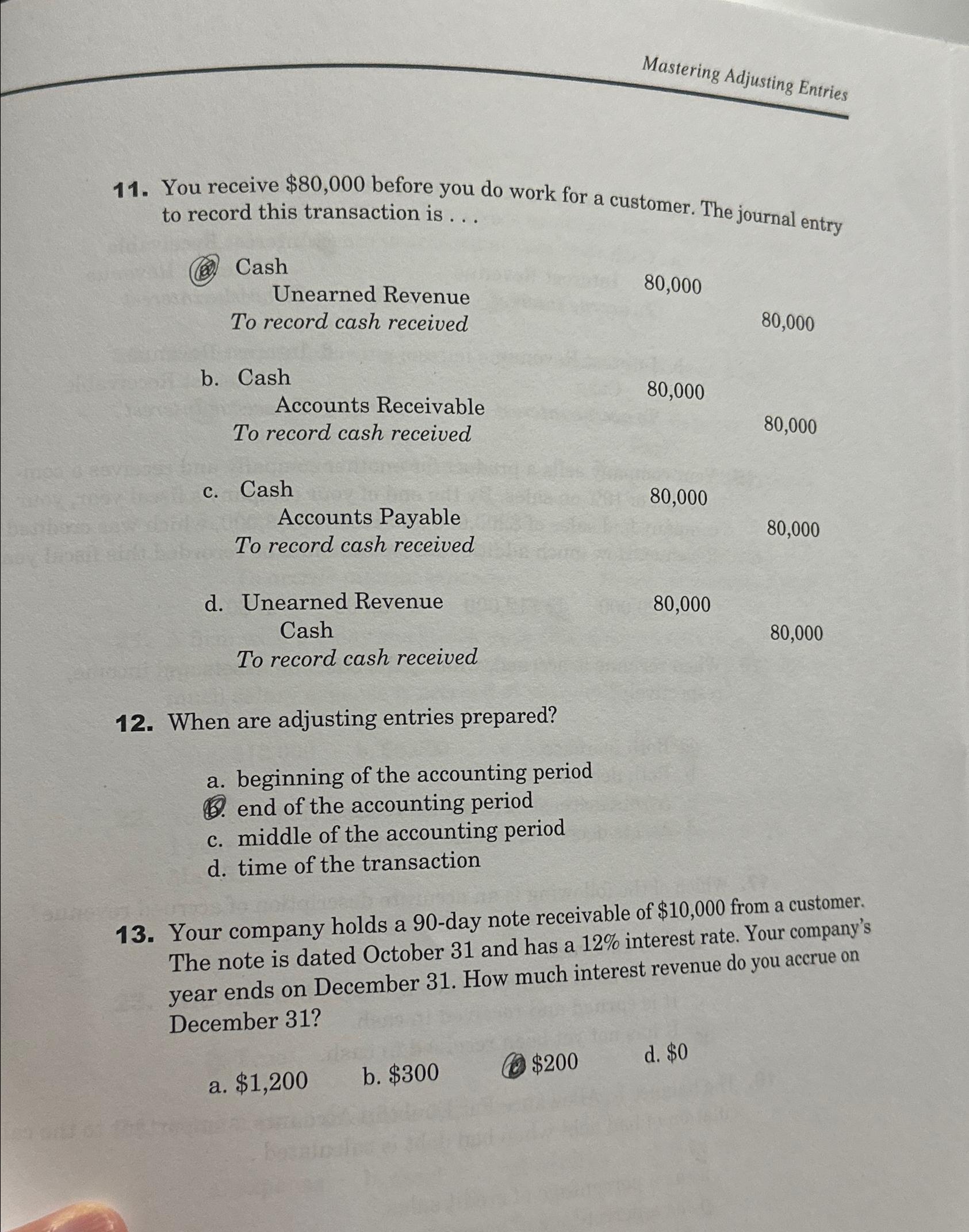

Mastering Adjusting Entries 11. You receive $80,000 before you do work for a customer. The journal entry to record this transaction is . . .

Mastering Adjusting Entries\ 11. You receive

$80,000before you do work for a customer. The journal entry to record this transaction is . . .\ Cash\ Unearned Revenue\

80,000,80,000\ To record cash received\ b. Cash\ Accounts Receivable\ 80,000\ To record cash received\ 80,000\ c. Cash\ Accounts Payable\ 80,000\ To record cash received\ 80,000\ d. Unearned Revenue\ 80,000\ Cash\ To record cash received\ 80,000\ 12. When are adjusting entries prepared?\ a. beginning of the accounting period\ 9. end of the accounting period\ c. middle of the accounting period\ d. time of the transaction\ 13. Your company holds a 90-day note receivable of

$10,000from a customer. The note is dated October 31 and has a

12%interest rate. Your company's year ends on December 31. How much interest revenue do you accrue on December 31 ?\ a.

$1,200\ b.

$300\

$200\ d.

$0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started