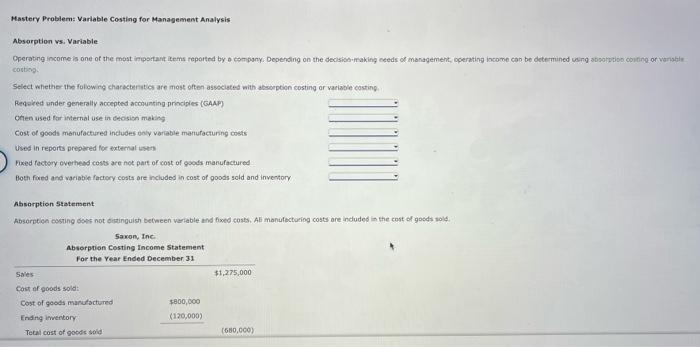

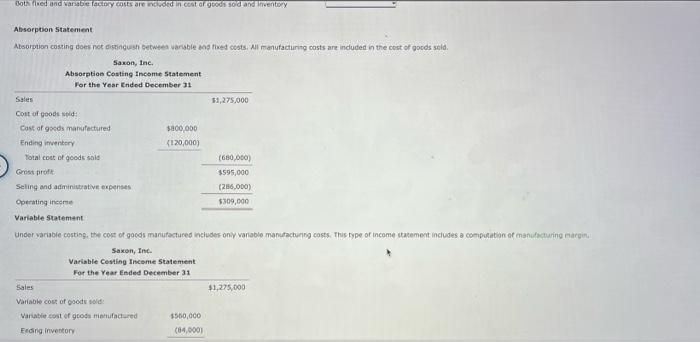

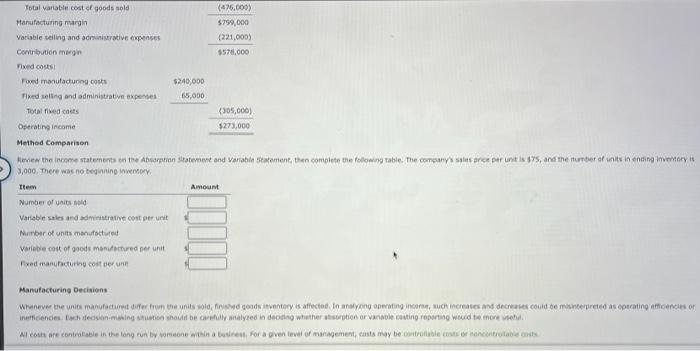

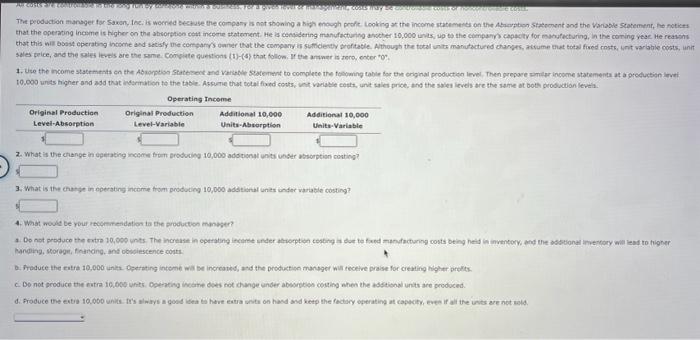

Mastery Problemi Variable Costing for Management Analysis Absorption vs. Variable Operating income is one of the most important items reported by a company. Depending on the decision-making ceeds of management, operating income can be determined using an option couting or venoble cotti Select whether the following characters are most often associated with spion costing or variable casting Recared under generally accepted accounting principles (GAAP often used for internal use in eosion making Cost of goods manufactures includes only variable manufacturing costs Used in reports prepared for extemal use Fixed factory overhead costs are not part of cost of goods manufactured Both food and variable factory costs are included in cost of goods sold and inventory Absorption Statement Absorption costing es not distinguish between variable and fixed costs. All manufacturing costs are included in the cost of goods sold Saxon, Ine Absorption Costing Income Statement For the Year Ended December 31 Sales $1,275,000 Cost of goods sold: Cost of goods manufactured $800,000 Erding twentory (120,000) Total cost of goods sold (680,000) Both thed and are factory costs are made in cost of goods sold and Inventory Absorption Statement Absorption costing does not distinguish betwee variables the costs. All manufacturing costs are induced in the cost of goods sold. Saxon, Inc. Absorption Costing Income Statement For the Year Ended December 31 Sales 51,275.000 Cost of goods sold Cost of goods manufactured $800.000 Ending inventory (120,000) Total cost of goods sold (680,000) Gost profit $595,000 Selling and administrative expenses (286.000) Operating income $309,000 Variable statement Under variable costing, the cost of goods manufactured includes only variable manufacturing costs. This type of income statement includes a computation of manufacturing margin Saxon, Inc. Variable Cesting Income Statement For the Year Ended December 31 Sales $1,275,000 Variable cost of goods sold Variable cost of good manufactured 5560,000 Edding inventory (64,0001 Total variable cost of goods sold (476,000) Manufacturing margin $799,000 Variable selling and administrative expenses (221,000) Contribution margin $570,000 Tixed costs Poved manufacturing costs $240,000 Fixed selling and administrative expenses 65.000 Total fled costs (305,000) Operating income $275,000 Method Comparison Review the income statements on the Absorption Statement and variable Statement, the complete the following table. The company's stare per unit is $75, and the number of units in ending Inventory 3,000. There was no beginning inventory Item Amount Number of its old Variable sales and are cost per unit Number of units manufacture Variable cost of goods manufactured per unit Fixed manufacturing costerunn Manufacturing Decisions Whenever the units manufacture offer from the units old goods inventory affected in anyong operating income, such creates and decreases could be masterpreted as operating modes or inefficiences Echevening to that it be fully alyred in deciding whether stortion or anale conting reporting would be more vseh Al costs are controllable in the long run by someone win a busines. For a given level of management, casts may be controllable or no controls SOLO CASTRO The production manager for Saxon, Inc. is worned because the company is not showing a high enough profit. Looking at the income statements on the Apon Statement and the variable Statement, the notices that the operating income is higher on the absorption cost income statement. He is considering manufacturing another 10,000 units, up to the company's capacity for stacturing, in the coming year. He reasons that this will boost operating come and satisfy the company's own that the company is sufficient profitable. Although the totalit manucured changes, aumentat total freedots, un varbable costs, unit sales trice, and the sales levels are the same come questions (1)-(4) that follow the answer is to enter to 1. Use the income statements on the Absorption Statement and Vale Statement to complete the towing table for the original production level. Then prepare similar income statements at a production et 10.000 units higher and add that women to the table. Assume that total fixed costs, int varie costs, unt sales price, and the sales levels are the same at both production levels Operating Income Original Production Original Production Additional 10,000 Additional 10,000 Level-Absorption Level-Variable Units-Absorption Unit Variable 2. What is the change in operating come from producing 10,000 adtional units under absorption conting? 3. What is the change in operating interme from produtie 10,000 additional units under arable conting? 4. Wat would be your recommendations to the production manager? Do not produce the extra 10,000 unts. The se in operating come under torption costings to doctoring costs being held in inventory, and the additional entory will lead to her Nanding, storage, financing and discence costs D. Produce the catre 10,000 units Operating intome wa be increased, and the production manager will receive praise for creating higher res. Do not produce the extra 10.000 units Operating site does not change under absorption costing when the actional units are produced d. Produce the extra 10.000 units. It's always a good at have extra ta on hand and keep the factory operating at capacity, even if the units are not