Answered step by step

Verified Expert Solution

Question

1 Approved Answer

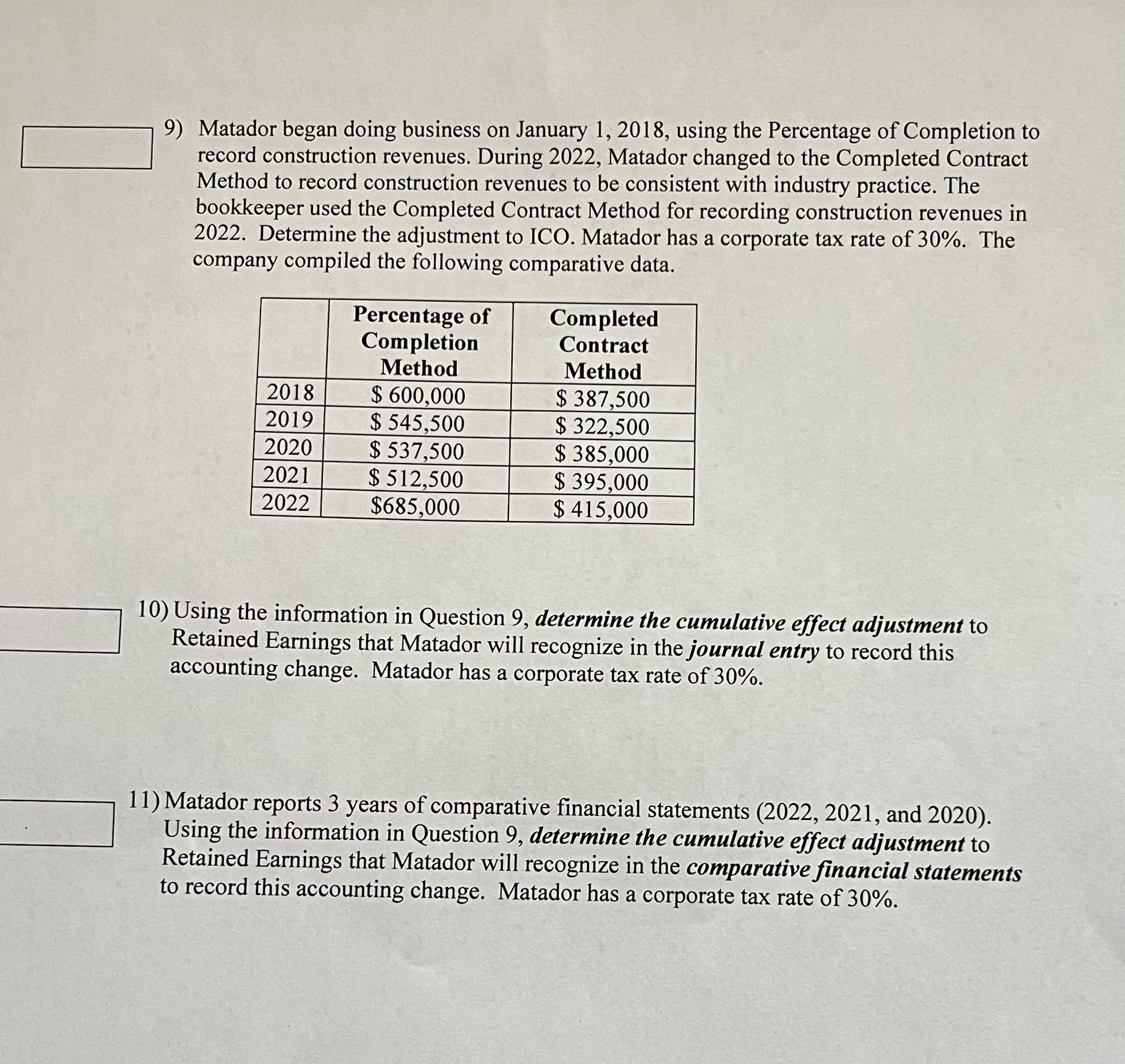

Matador began doing business on January 1 , 2 0 1 8 , using the Percentage of Completion to record construction revenues. During 2 0

Matador began doing business on January using the Percentage of Completion to

record construction revenues. During Matador changed to the Completed Contract

Method to record construction revenues to be consistent with industry practice. The

bookkeeper used the Completed Contract Method for recording construction revenues in

Determine the adjustment to ICO. Matador has a corporate tax rate of The

company compiled the following comparative data.

Using the information in Question determine the cumulative effect adjustment to

Retained Earnings that Matador will recognize in the journal entry to record this

accounting change. Matador has a corporate tax rate of

Matador reports years of comparative financial statements and

Using the information in Question determine the cumulative effect adjustment to

Retained Earnings that Matador will recognize in the comparative financial statements

to record this accounting change. Matador has a corporate tax rate of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started