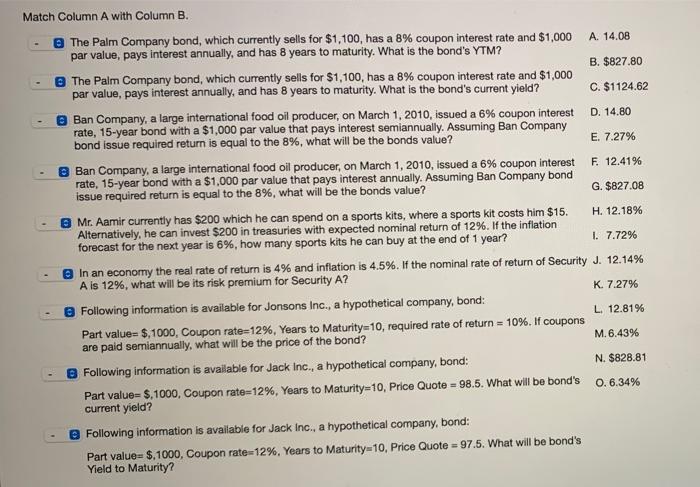

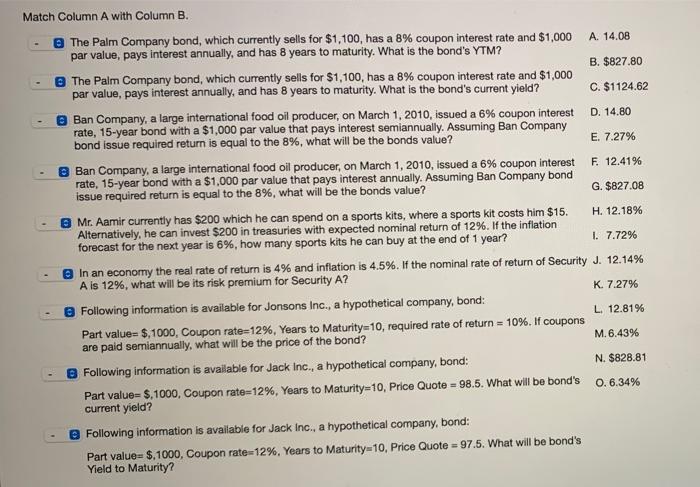

Match Column A with Column B. The Palm Company bond, which currently sells for $1,100, has a 8% coupon interest rate and $1,000 A. 14.08 par value, pays interest annually, and has 8 years to maturity. What is the bond's YTM? B. $827.80 The Palm Company bond, which currently sells for $1,100, has a 8% coupon interest rate and $1,000 par value, pays interest annually, and has 8 years to maturity. What is the bond's current yield? C. $1124.62 Ban Company, a large international food oil producer, on March 1, 2010, issued a 6% coupon interest D. 14.80 rate, 15-year bond with a $1,000 par value that pays interest semiannually. Assuming Ban Company bond issue required return is equal to the 8%, what will be the bonds value? E. 7.27% Ban Company, a large international food oil producer, on March 1, 2010, issued a 6% coupon interest F. 12.41% rate, 15-year bond with a $1,000 par value that pays interest annually. Assuming Ban Company bond issue required return is equal to the 8%, what will be the bonds value? G. $827.08 Mr. Aamir currently has $200 which he can spend on a sports kits, where a sports kit costs him $15. H. 12.18% Alternatively, he can invest $200 in treasures with expected nominal return of 12%. If the inflation forecast for the next year is 6%, how many sports kits he can buy at the end of 1 year? I. 7.72% In an economy the real rate of return is 4% and inflation is 4.5%. If the nominal rate of return of Security J. 12.14% A is 12%, what will be its risk premium for Security A? K. 7.27% Following information is available for Jonsons Inc., a hypothetical company, bond: L. 12.81% Part value=$, 1000, Coupon rate=12%, Years to Maturity=10, required rate of return = 10%. If coupons are paid semiannually, what will be the price of the bond? M. 6.43% Following information is available for Jack Inc., a hypothetical company, bond: N. $828.81 Part value= $. 1000, Coupon rate=12%, Years to Maturity=10, Price Quote = 98.5. What will be bond's 0.6.34% current yield? Following information is available for Jack Inc., a hypothetical company, bond: Part value=$,1000, Coupon rate=12%, Years to Maturity=10, Price Quote= 97.5. What will be bond's Yield to Maturity