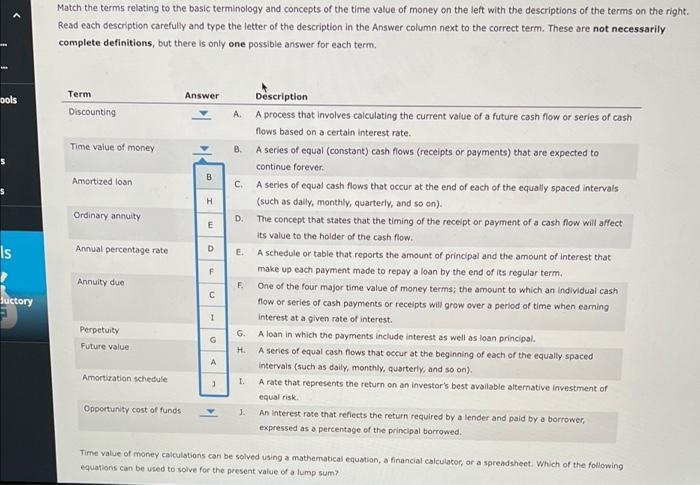

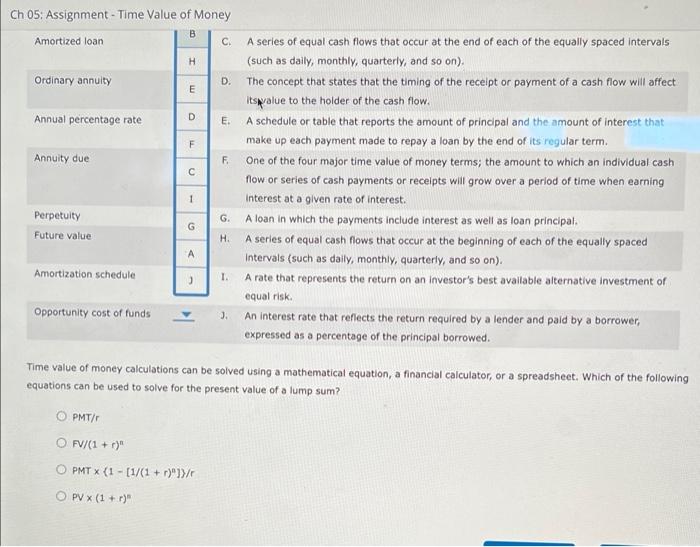

Match the terms relating to the basic terminology and concepts of the time value of money on the left with the descriptions of the terms on the right Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term, Term bols Answer Discounting A Time value of money B Amortized loan c $ H Ordinary annuity D. E Description A process that involves calculating the current value of a future cash flow or series of cash flows based on a certain interest rate. B. A series of equal (constant) cash flows (receipts or payments) that are expected to continue forever. C. A series of equal cash flows that occur at the end of each of the equally spaced intervals (such as dally, monthly, quarterly, and so on). The concept that states that the timing of the receipt or payment of a cash flow will affect its value to the holder of the cash flow. A schedule or table that reports the amount of principal and the amount of interest that make up each payment made to repay a loan by the end of its regular term. One of the four major time value of money terms; the amount to which an individual cash How or series of cash payments or receipts will grow over a period of time when earning Interest at a given rate of interest. G. A loan in which the payments include interest as well as loan principal. A series of equal cash flows that occur at the beginning of each of the equally spaced intervals (such as dally, monthly, quarterly, and so on) A rate that represents the return on an investor's best available alternative investment of Annual percentage rate Is D E E F F Annuity due F. Juctory 1 Perpetuity Future value G H. A Amortization schedule 1. equal risk Opportunity cost of funds 1. An interest rate that reflects the return required by a lender and paid by a borrower, expressed as a percentage of the principal borrowed. Time value of money calculations can be solved using a mathematical equation, a financial calculator, or a spreadsheet. Which of the following equations can be used to solve for the present value of a lump sum? Ch 05. Assignment - Time Value of Money B Amortized loan . H Ordinary annuity D. E Annual percentage rate D E. F Annuity due F A series of equal cash flows that occur at the end of each of the equally spaced intervals (such as daily, monthly, quarterly, and so on). The concept that states that the timing of the receipt or payment of a cash flow will affect Itspalue to the holder of the cash flow. A schedule or table that reports the amount of principal and the amount of interest that make up each payment made to repay a loan by the end of its regular term. One of the four major time value of money terms; the amount to which an individual cash flow or series of cash payments or receipts will grow over a period of time when earning Interest at a given rate of interest. A loan in which the payments include interest as well as loan principal. A series of equal cash flows that occur at the beginning of each of the equally spaced Intervals (such as daily, monthly, quarterly, and so on). A rate that represents the return on an investor's best available alternative Investment of equal risk An interest rate that reflects the return required by a lender and paid by a borrower, expressed as a percentage of the principal borrowed. 1 G. Perpetuity Future value G I H. A A Amortization schedule ) 1. Opportunity cost of funds J. Time value of money calculations can be solved using a mathematical equation, a financial calculator, or a spreadsheet. Which of the following equations can be used to solve for the present value of a lump sum? O PMT OFV/(1+r)" O PMT X (1 - [1/(1+r)"]}/ OPVX (1+)