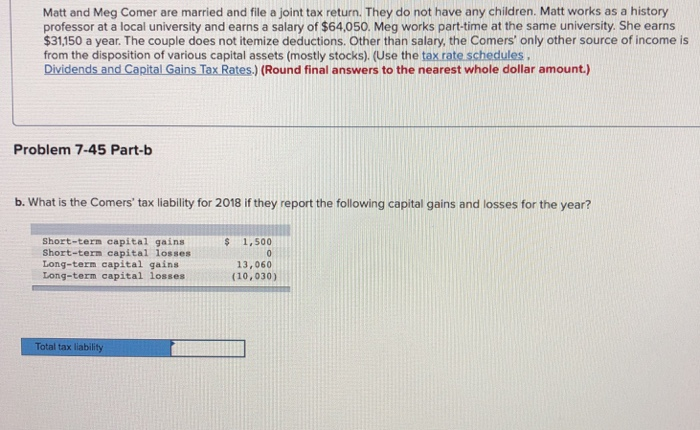

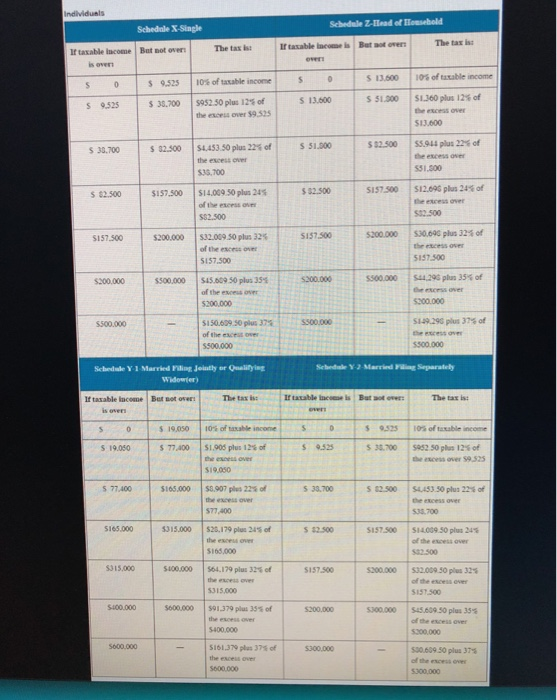

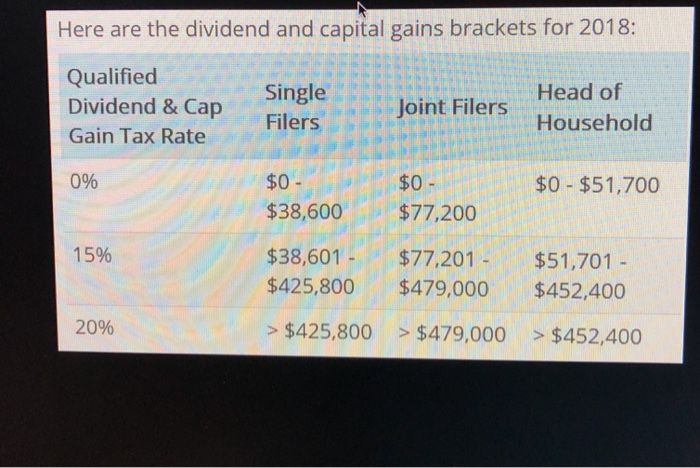

Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $64,050. Meg works part-time at the same university. She earns $31,150 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules Dividends and Capital Gains Tax Rates.) (Round final answers to the nearest whole dollar amount.) Problem 7-45 Part-b b. What is the Comers' tax liability for 2018 if they report the following capital gains and losses for the year? Short-tern capital gains Short-tern capital losses Long-term capital gains Long-term capital losses $ 1,500 13,060 (10,030) Total tax liability Sebedale Z!lead of Eleiebold Schedule X-Single The tax is: The tax is: If taxable lncome is But aot over If taxable lacome But not over is overt S 13,60010% of taxable income $ 51,000 | SLJ60 plus i2% of $13600 ss2.500 Issus plus 22% of 531.300 157 500 $12.696 plus 24% of 532.500 5200.000 1530.696 plus 32% of 157.500 $ 0.525 | 10% of taxable income s 13.600 S 9.525 38.700 $952.50 plus 12'% of the excess over the excess over $9.525 S 51 51.300 l s 32.500 suus3.50 plus 22%of | the excess over s 30.700 35,700 $2.500 $157500 $14,00950 plus 24 32.500 of the excess ove the excess over $82.500 $157.500 $200,000 1532.009 so plus 32% 5157.500 the etcess over of the escess over 5157.500 su290 pin 35% of e excess over $200,000 500,000 $45.609 50 plus 354 sso oo of the escess over 5200,000 I sue290 plus 37% of $150.609 50 plus 37 of the excest 500000 $500.000 Schedule Y 1 Married rling Jeintly or Quelitying Sehedule Y-2-Married Fing Separately If tazable lncome But et over The tax is If tatable lncsese is Bat ot ove The tax is 952510% of taxable income s 9.525 77,400 51.905 plus 12% of 19050 $165,000 S8.907 plus 22% of S 19.050 the escess over the excess over 59,525 5 77,400 33,700 s 12.500 su53.50 plu 22% of the excess over 77400 533.700 5165.000 s $2.500 SI 57500 |SI4009.50 plus 24% the exceus over $165,000 of the excess over $82.500 315,000 si00.000 1564.179 plul 32% ef 157.500 S200.000 |532.00950 plus 32% the excea 5315000 of the escess over $157.500 $400.000 I sg 1.379 plul 35% of soooooo 5300.000 | sseoag0 plus 35% of the excess over S600.000 S161.379 plas 37% of the excess ove | S00609.50 plus 37% Here are the dividend and capital gains brackets for 2018: Qualified Dividend & Cap Gain Tax Rate Single Filers Head of Household Joint Filers 096 $0 - $38,600$77,200 $0- $0 $51,700 $38,601-$77.201$51.701 $425,800 $479,000 $452,400 15% 20% >$425,800 >$479,000 >$452,400