Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Matties Discount Store sells furniture. They bought a laptop for the receptionist for R7 590 (including VAT) on credit from Diya Computers. The VAT rate

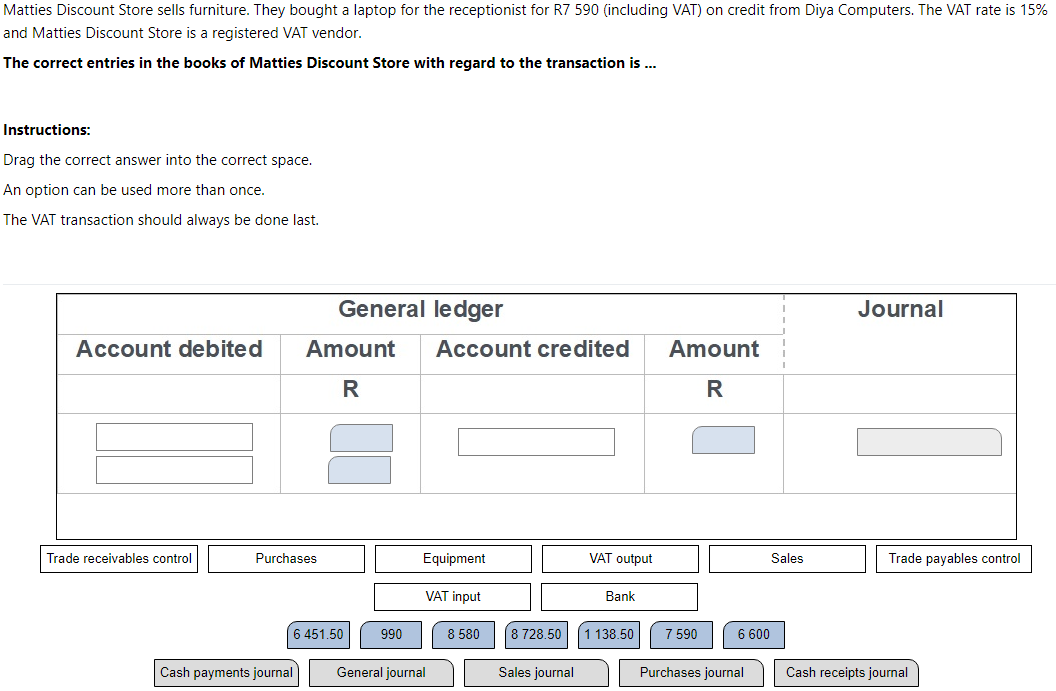

Matties Discount Store sells furniture. They bought a laptop for the receptionist for R7 590 (including VAT) on credit from Diya Computers. The VAT rate is 15% and Matties Discount Store is a registered VAT vendor. The correct entries in the books of Matties Discount Store with regard to the transaction is ... Instructions: Drag the correct answer into the correct space. An option can be used more than once. The VAT transaction should always be done last

Matties Discount Store sells furniture. They bought a laptop for the receptionist for R7 590 (including VAT) on credit from Diya Computers. The VAT rate is 15% and Matties Discount Store is a registered VAT vendor. The correct entries in the books of Matties Discount Store with regard to the transaction is ... Instructions: Drag the correct answer into the correct space. An option can be used more than once. The VAT transaction should always be done last Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started