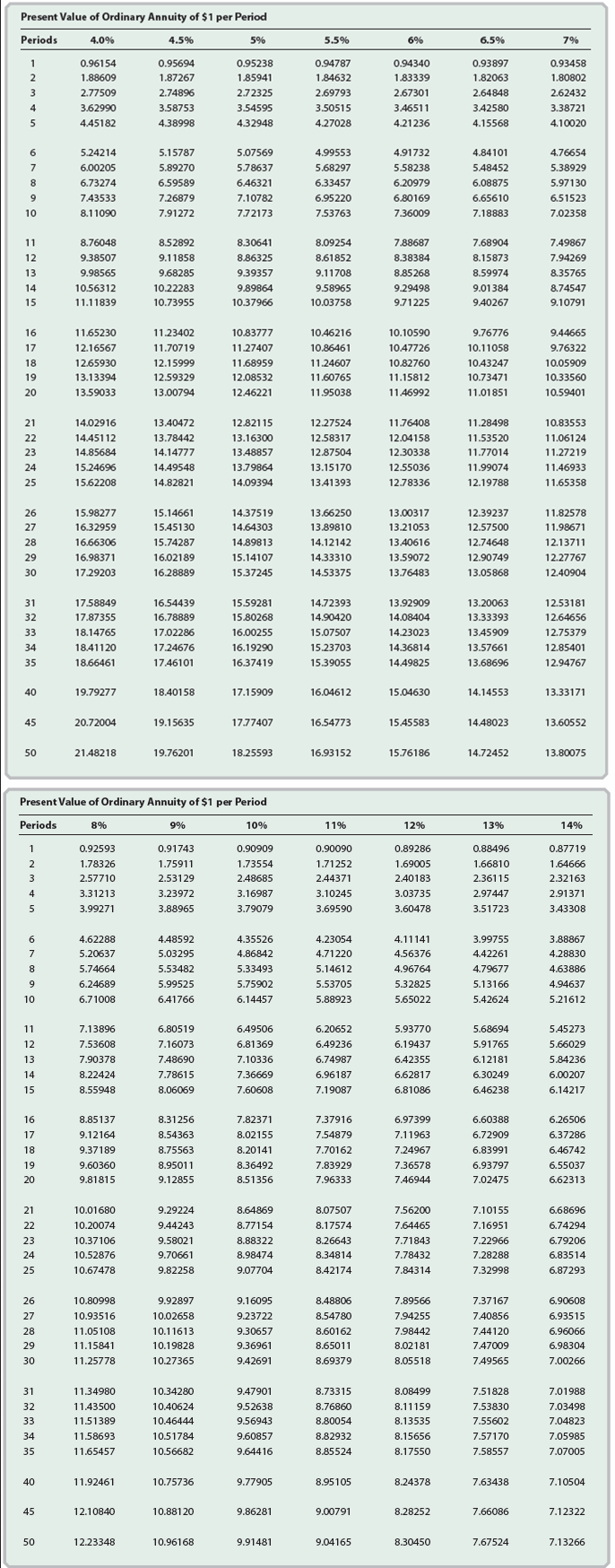

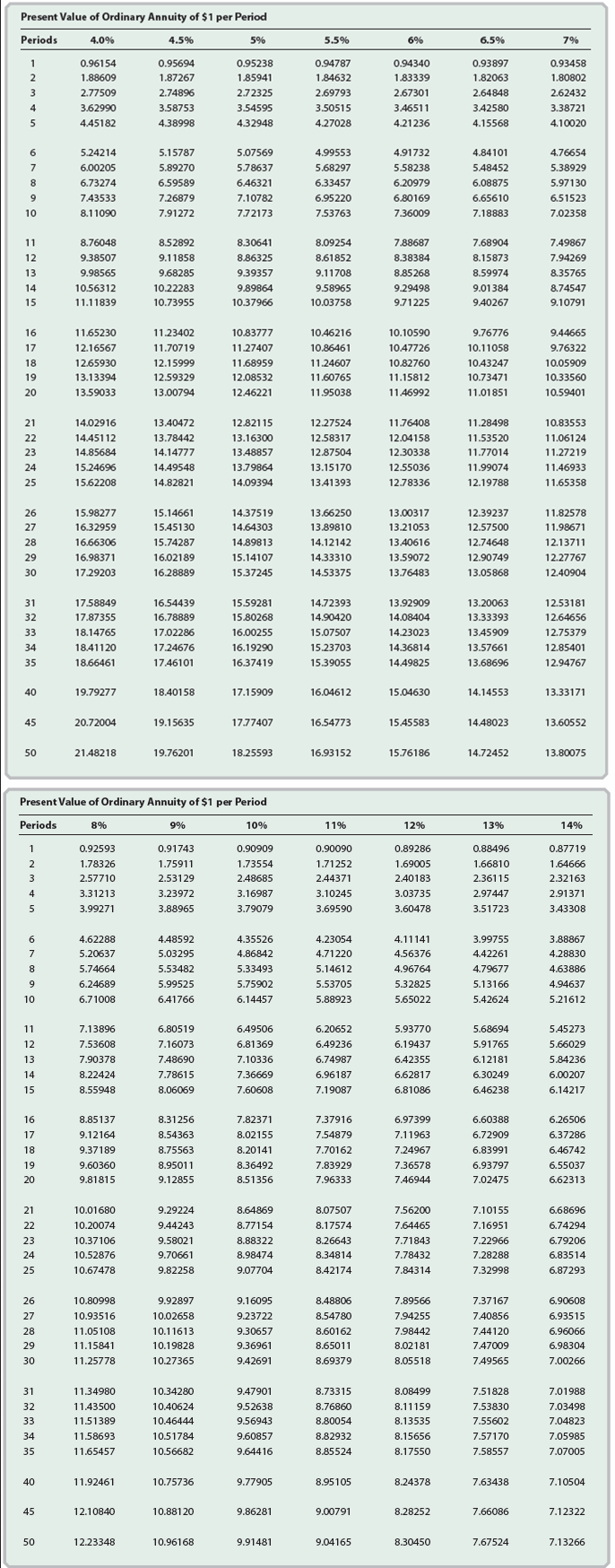

Present Value of an Annuity On January 1 you win $3,900,000 in the state lottery. The $3,900,000 prize will be paid in equal installments of $390,000 over 10 years. The payments will be made on December 31 of each year, beginning on December 31. If the current interest rate is 7%, determine the present value of your winnings. Use the present value tables in Exhibit 7. Round to the nearest whole dollar. Present Value of Ordinary Annuity of $1 per Period Periods 4.0% 4,5% 5% 5.5% 5% 6,5% za 0.96154 1.88609 2.77509 36290 4.45182 0.95694 1.87267 2.7486 3.58753 4.38998 0.95238 1.35941 2.72325 3,54595 432948 0.94787 1.84632 2.69793 3.50515 4.27028 0.94340 1.83339 2.67301 3.46511 4.21236 0.93897 1.82063 2,64848 3,42580 4.15568 0.93458 1.80802 2.62432 3.38721 4.10020 5.24214 6.00205 6.73274 7.43533 8.1100 515787 5.89270 6,59539 7.26879 7.91272 5.07569 5.78637 6.46321 7.10782 7.72173 499553 5.68297 633457 6.95220 7.53763 4.91732 5.58238 6.20979 6,80169 7.36009 4.84101 5,48452 6.03875 6.65610 7.18883 4.76654 5.38929 5.97130 6.51523 7.02358 8.76048 9.38507 9.98565 10.56312 11.11839 8.52892 9.11858 9.58285 10.22283 10.73955 8.30641 8.86325 9,39357 9.89864 10.37966 8.09254 8,61852 9.11708 9.58965 10.03758 7.88687 8.38384 8.85268 9.29498 9.71225 7.68904 8.15873 8.59974 9.01 384 9.40267 7,49867 7.94269 8,35765 874547 9.10791 1165230 12.16567 12.65930 13.13344 13.59033 11.23402 11.70719 12.15999 12.59329 13.00734 10.83777 1127407 11,63959 12.08532 12.46221 10.46216 10.6461 11.24607 11.60765 11.95038 10.10590 10.47726 10.32760 11.15812 11.46992 9,76776 10.11058 10.43247 10.73471 11.01851 9.44665 3.76322 10.05909 10.33560 10.59401 14,02916 14.45112 14.85684 15.2466 1562208 13.40472 13.78442 14.14777 14.49548 14.82821 12.82115 13.1630 13.48857 13.79864 14.09394 12.27524 12.58317 12.87504 13.15170 13.41393 11.76408 12.04158 12.30338 12.55036 12.78336 11.28498 11.53520 11.77014 11.99074 12.19788 10.83553 11.06124 11.27219 11.46933 11.65358 15.98277 16.32959 16,66306 16.98371 1729203 15.1466 15.45130 15.74287 16.02189 16,28889 14.37519 1464303 14,39813 15.14107 15.37245 13.66250 13.89810 14.12142 14.33310 14,53375 13.00317 13.21053 13.40616 13.59072 13.76483 12.39237 12.57500 12.74648 12.30749 13.0586 11.32578 11.98671 1213711 12.27767 12.40904 17.58849 17.87355 18.14765 18.41120 1866461 16,54439 16.78889 17.02236 17.24676 17.46101 15.59281 15.80268 16.00255 16.1920 16.37419 14.72393 14.90420 1507507 15.23703 15.39055 13.92909 1408404 1423023 14.36814 14.49825 13.20O63 13.33393 13.45909 13.57661 13.68696 12.53181 12.64656 12.75379 12.35401 12.94767 19.79277 18.40158 17.15909 16.04612 15.04630 14.14553 13.33171 20.72004 19.15635 1777407 16.54773 15.45583 14.48023 13.60552 21.48218 19.76201 18.25593 16.93152 15.76186 14.72452 13.80075 Present Value of Ordinary Annuity of $1 per Period Periods 8% 9 10% 116 1296 136 14, 0.92593 178326 2.57710 3.31213 3.99271 0.91743 175911 2.53129 3.23972 3.88965 0.90909 173554 2.43685 3.15987 3.79079 0.90090 171252 2.44371 3.10245 3.69590 0.89286 1.69005 2.40183 3.03735 3.60478 0.88496 1.66810 2.36115 2.7447 3.51723 0.87719 154666 2.32163 2.31371 3.43308 4.62288 5.20537 5.74664 6.24689 6,71008 4,48592 5.03295 5.53482 5.99525 6.41766 4.35526 4.86842 5.33493 5.7502 6.14457 4.23054 471220 5.14612 5.53705 5.88923 4.11141 4.56376 4.96764 5.32825 5.65022 3.99755 4.42261 479677 5.13166 5.42624 3.88867 4.28830 4.53886 4.94637 5.21612 7.13896 7.53608 7.90378 8.22424 8.55948 6.80519 7.16073 7.48690 7,78615 8.06069 6.49506 6.81369 7.10336 7.36659 7.60608 6.20552 6.49236 6.74987 6.96187 7.19087 5.93770 6.19437 6.42355 6,52817 6.81086 5.68594 5.91765 6.12181 6.30249 6,46238 5.45273 5.66029 5.84236 6.00207 6.14217 8.85137 9.12164 9.37189 9.60360 9.81815 8.31256 8.54363 8.75563 8.95011 9.12855 7.82371 8.02155 8.20141 8.36492 8.51356 7.37916 7.54873 7.70162 7.83929 7.96333 6.97399 7.11963 7.24967 7.36578 7.46944 6.60388 6.72909 6.83991 6.93797 7.02475 6.26506 6.37286 6.46742 6.55037 662313 10.01680 10.20074 10.37106 10.52876 10.67478 9.29224 9.44243 9.58021 9.70661 9.82258 8.64869 8.77154 8.88322 8.98474 9.07704 8.07507 8.17574 8.26643 8.34814 8.42174 7.562OD 7.64465 7.71843 7.78432 7.84314 7.10155 7.16951 7.22966 7.28288 7.32998 6.68696 6,74294 6.79206 6.83514 6.87293 2 10.80998 10.93516 11.05108 11.15841 11.25778 9.92897 10.02558 10.11613 10.19828 10.27365 9.16095 9.23722 9.30657 9.36951 9.42691 8.48806 8.54780 8.50162 8.65011 8.69379 7.89566 7.94255 7.98442 8.02181 8.05518 7.37167 7.40856 7.44120 7.47OD9 7.49565 6.9O508 6.93515 6.96066 6.98304 7.00266 11.34980 11.43500 11.51389 11.58693 11.65457 10.3428) 10.40624 10.46444 10.51784 10.56682 9.47901 9.52638 9.56943 9.50857 9.54416 8.73315 8.76860 8.80054 8.32932 8.85524 8.08499 8.11159 8.13535 8.15656 8.17550 7.51828 7.53830 7.55602 7.57170 7.58557 7.01988 7.03498 7.04823 7.05985 7.07005 11.92461 10.75736 9.77905 8.95105 8.24378 7.63438 7.10504 12.10840 10.88120 9.86281 9.00791 8.28252 7.66086 7.12322 12.23348 10.96168 9.91481 904165 8.30450 7.67524 7.13266