Question

Max and Harry are in partnership. Profits for the year to 31 October 2019 are 120,000. Max and Harry have agreed to share profits

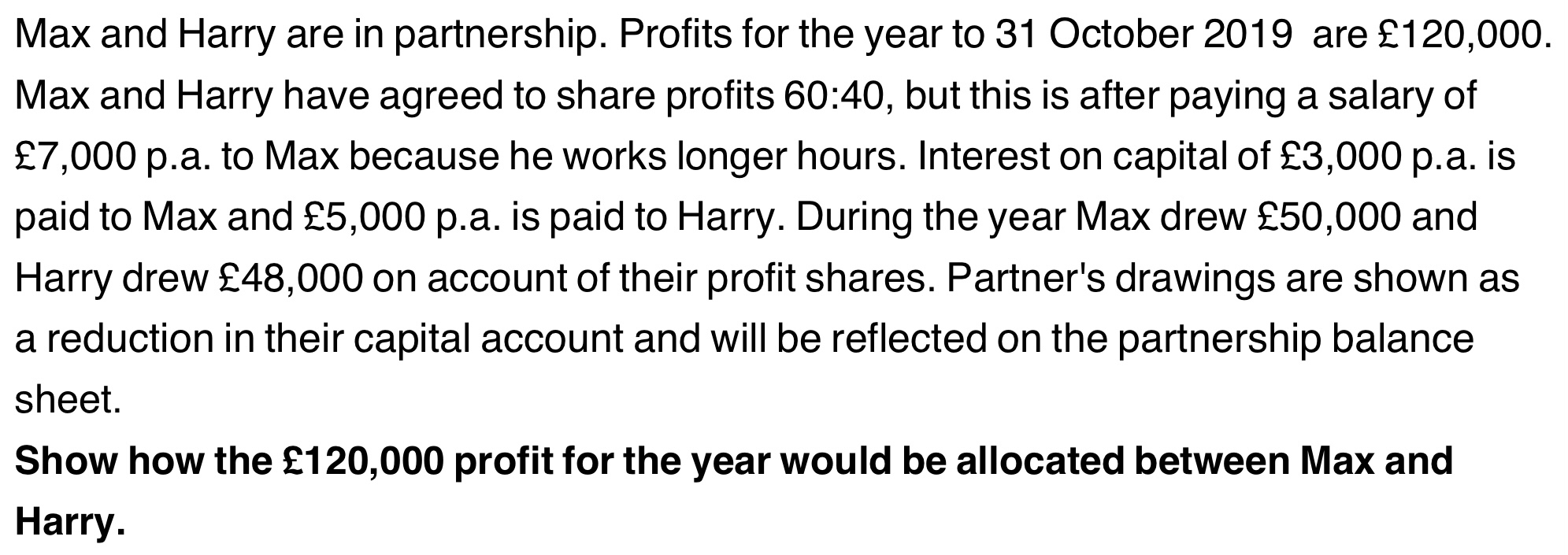

Max and Harry are in partnership. Profits for the year to 31 October 2019 are 120,000. Max and Harry have agreed to share profits 60:40, but this is after paying a salary of 7,000 p.a. to Max because he works longer hours. Interest on capital of 3,000 p.a. is paid to Max and 5,000 p.a. is paid to Harry. During the year Max drew 50,000 and Harry drew 48,000 on account of their profit shares. Partner's drawings are shown as a reduction in their capital account and will be reflected on the partnership balance sheet. Show how the 120,000 profit for the year would be allocated between Max and Harry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting For Business

Authors: Peter Scott

3rd Edition

0198807791, 978-0198807797

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App