Max and Veronica Develop a Bond Investment Program - Case Problem 10.1 - Fundamentals of Investing

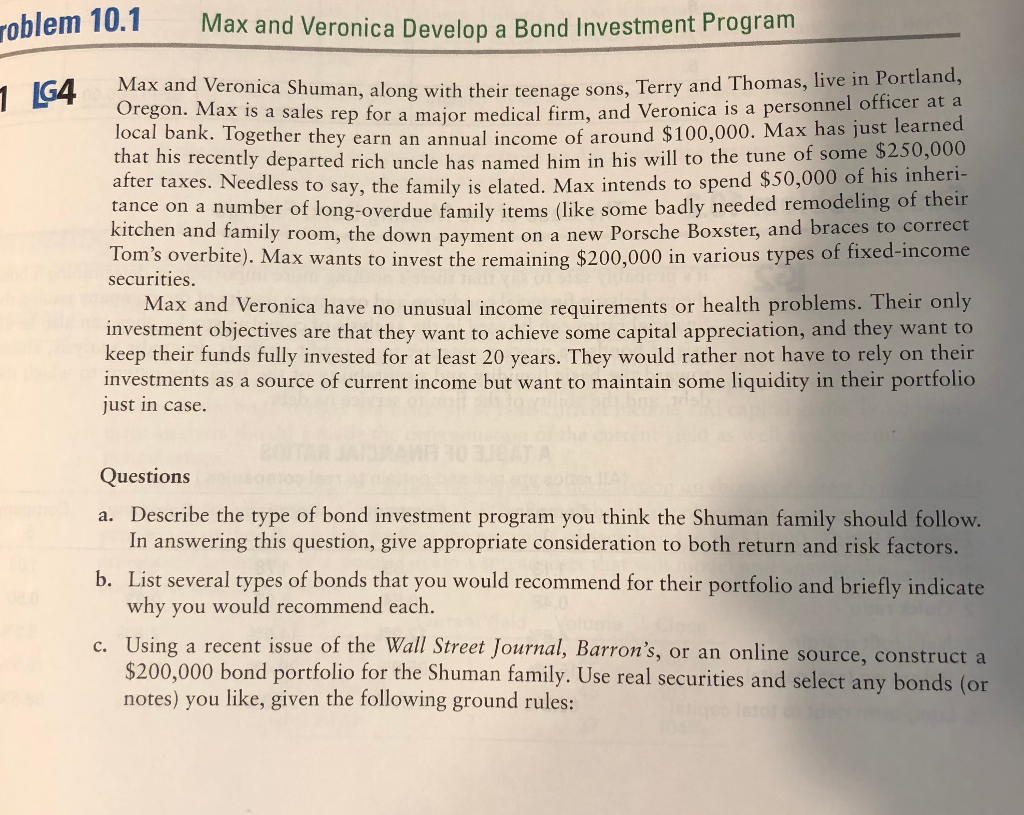

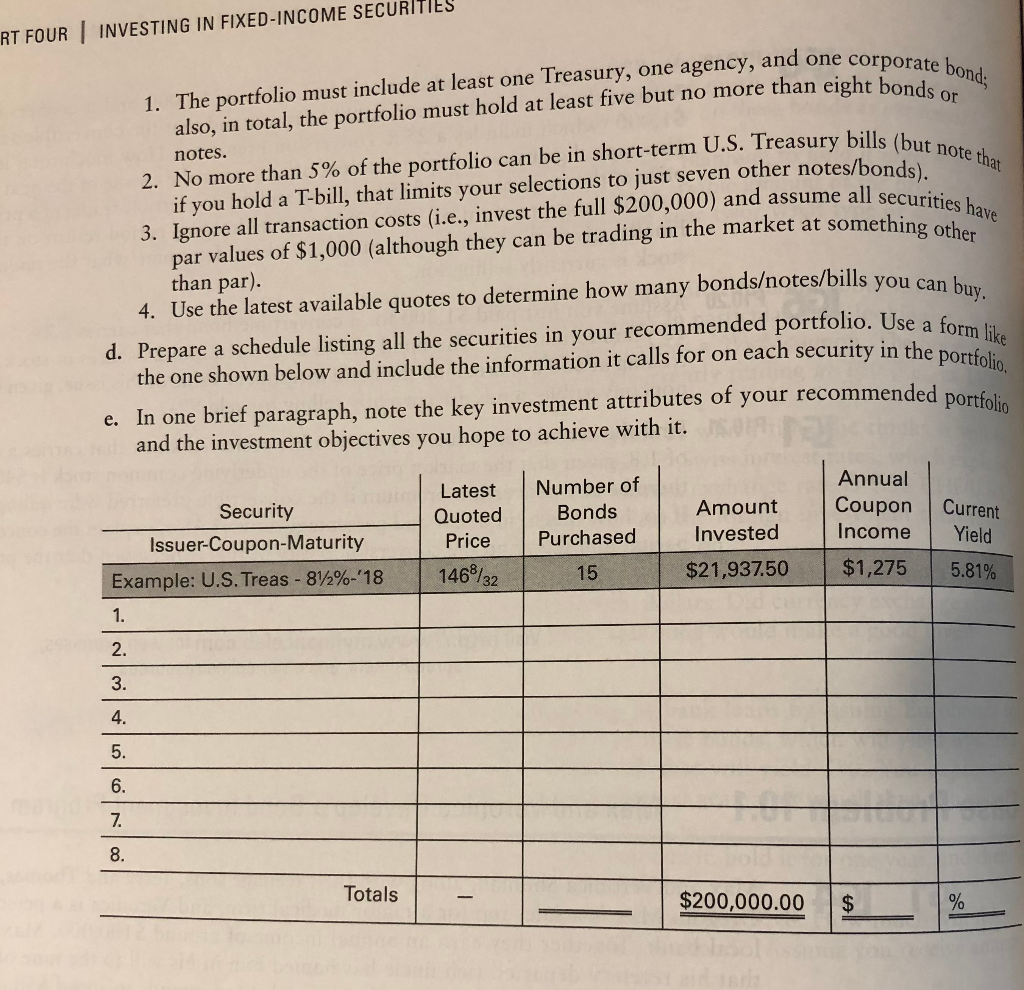

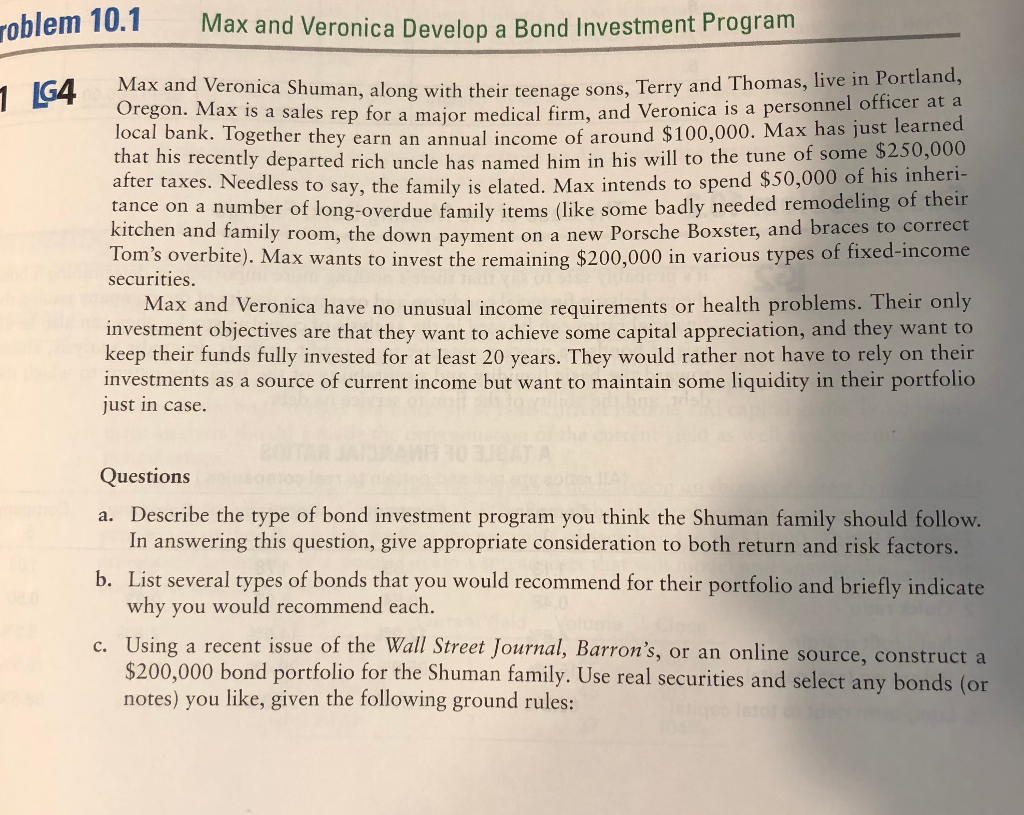

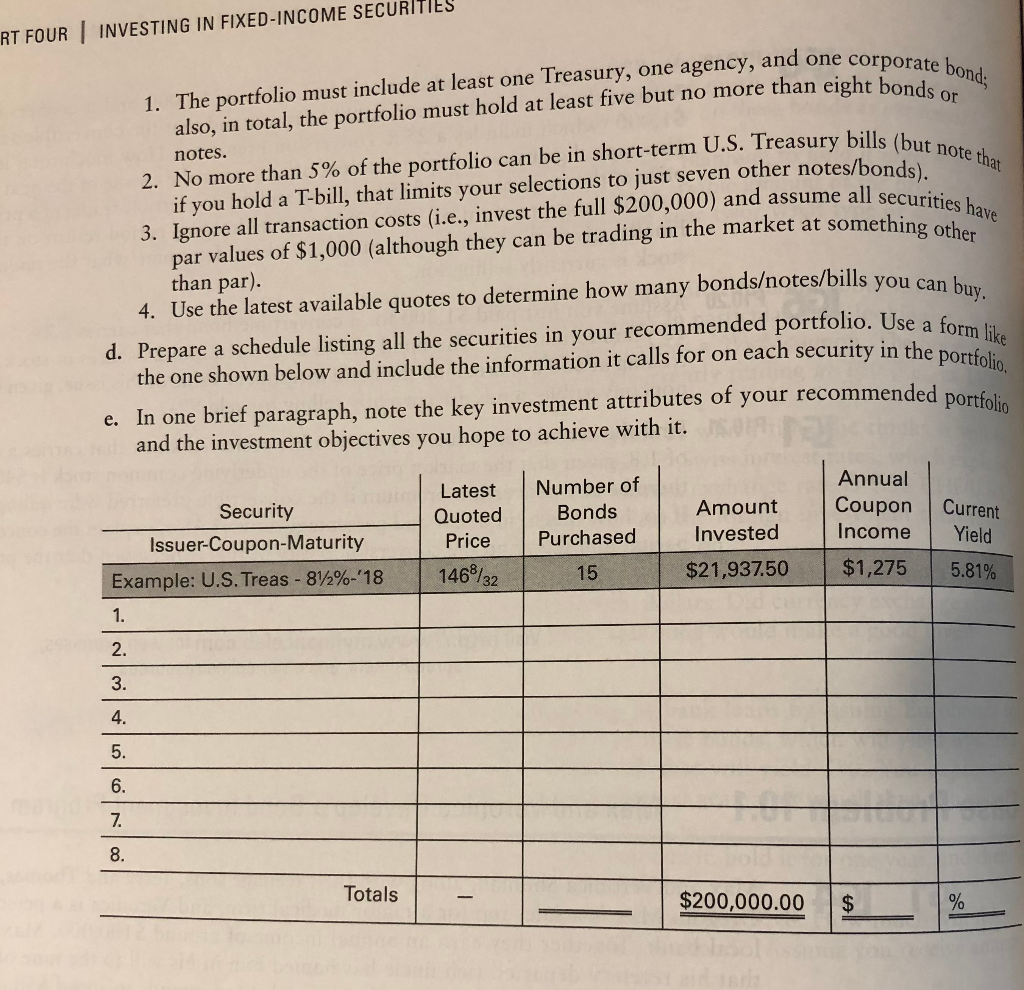

oblem 10.1 Max and Veronica Develop a Bond Investment Program Max and Veronica Shuman, along with their teenage sons, Terry and Thomas, live in Portland Oregon. Max is a sales rep for a maior medical firm, and Veronica is a personnel office local bank. Together they earn an annual income of around $100,000. Max that his recently departed rich after taxes. Needless to say, the family is tance on a number of long-overdue family items (like some badly needed remodeling of their kitchen and family room, the down payment on a new Porsche Boxster, and braces to correct has just learned uncle has named him in his will to the tune of some $250,000 elated. Max intends to spend $50,000 of his inheri t on a new Porsche Boxster, and Di Tom's overbite). Max wants to invest the remaining $200,000 in various types ot fixed-income securities Max and Veronica have no unusual income requirements or health problems. Their only investment objectives are that they want to achieve some capital appreciation, and they want to keep their funds fully invested for at least 20 years. They would rather not have to rely on their investments as a source of current income but want to maintain some liquidity in their portfolio just in case Questions a. Describe the type of bond investment program you think the Shuman family should follow. In answering this question, give appropriate consideration to both return and risk factors b. List several types of bonds that you would recommend for their portfolio and briefly indicate why you would recommend each c. Using a recent issue of the Wall Street Journal, Barron's, or an online source, construct a bond portfolio for the Shuman family. Use real securities an $200,000 notes) you like, given the following ground rules: d select any bonds (or RT FOUR I INVESTING IN FIXED-INCOME SECURITIES 1. The portfolio must include at least one Treasury, one agency, and one cor 2. No more than 5% of the portfolio can be in short-term 3. Ignore all transaction costs (i.e., invest the full $200,00 4. Use the latest available quotes to determine how many bondsotes/bills you ca the one shown below and include the information it calls for on each security in the and the investment objectives you hope to achieve with it. also, in total, the portfolio must hold at least five but no more than eight if you hold a T-bill, that limits your selections to just seven other notes/bonds) par values of $1,000 (although they can be trading in the market at something ofh 2 US. Treasury bills (but no 0) and assume all securities ha notes. than par). d. Prepare a schedule listing all the securities in your recommended portfolio. Use a form b portfoli ed portfoli Annual Latest Number of Quoted Bonds Price Purchased 146%2 Amount Coupon Current Invested Income Yield Security Issuer-Coupon-Maturity $21,93750 | $1,275 | 5.81% Example: U.S. Treas-896-'18 1. 2. 3. 4. 5. 6. 15 8. Totals $200,000.00 oblem 10.1 Max and Veronica Develop a Bond Investment Program Max and Veronica Shuman, along with their teenage sons, Terry and Thomas, live in Portland Oregon. Max is a sales rep for a maior medical firm, and Veronica is a personnel office local bank. Together they earn an annual income of around $100,000. Max that his recently departed rich after taxes. Needless to say, the family is tance on a number of long-overdue family items (like some badly needed remodeling of their kitchen and family room, the down payment on a new Porsche Boxster, and braces to correct has just learned uncle has named him in his will to the tune of some $250,000 elated. Max intends to spend $50,000 of his inheri t on a new Porsche Boxster, and Di Tom's overbite). Max wants to invest the remaining $200,000 in various types ot fixed-income securities Max and Veronica have no unusual income requirements or health problems. Their only investment objectives are that they want to achieve some capital appreciation, and they want to keep their funds fully invested for at least 20 years. They would rather not have to rely on their investments as a source of current income but want to maintain some liquidity in their portfolio just in case Questions a. Describe the type of bond investment program you think the Shuman family should follow. In answering this question, give appropriate consideration to both return and risk factors b. List several types of bonds that you would recommend for their portfolio and briefly indicate why you would recommend each c. Using a recent issue of the Wall Street Journal, Barron's, or an online source, construct a bond portfolio for the Shuman family. Use real securities an $200,000 notes) you like, given the following ground rules: d select any bonds (or RT FOUR I INVESTING IN FIXED-INCOME SECURITIES 1. The portfolio must include at least one Treasury, one agency, and one cor 2. No more than 5% of the portfolio can be in short-term 3. Ignore all transaction costs (i.e., invest the full $200,00 4. Use the latest available quotes to determine how many bondsotes/bills you ca the one shown below and include the information it calls for on each security in the and the investment objectives you hope to achieve with it. also, in total, the portfolio must hold at least five but no more than eight if you hold a T-bill, that limits your selections to just seven other notes/bonds) par values of $1,000 (although they can be trading in the market at something ofh 2 US. Treasury bills (but no 0) and assume all securities ha notes. than par). d. Prepare a schedule listing all the securities in your recommended portfolio. Use a form b portfoli ed portfoli Annual Latest Number of Quoted Bonds Price Purchased 146%2 Amount Coupon Current Invested Income Yield Security Issuer-Coupon-Maturity $21,93750 | $1,275 | 5.81% Example: U.S. Treas-896-'18 1. 2. 3. 4. 5. 6. 15 8. Totals $200,000.00