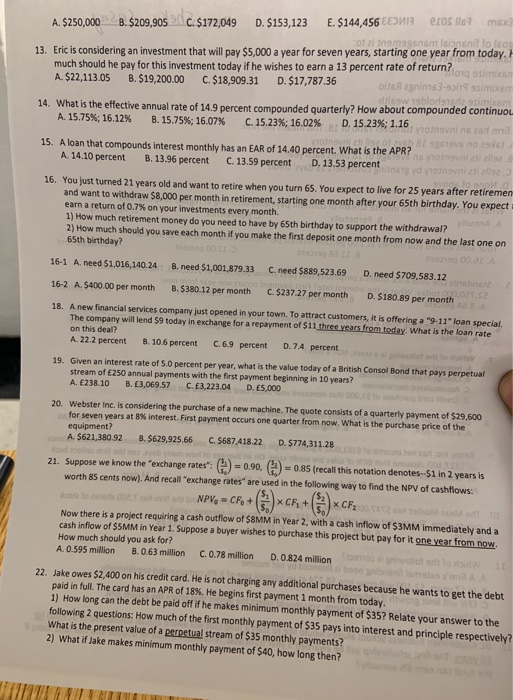

max eros lle E. $144,456 EE D.$153,123 A. $250,000 8.$209,90s c$172,049 01 2i 1nemeg606m lsionsnil to leos 13. Eric is considering an investment that will pay $5,000 a year for seven years, starting one year from today. H Mlo1g 9timixsn oiteR agnims3-9ah9 9simixsm dilesw 1sblords1sde,9simixsm 14. What is the effective annual rate of 14.9 percent compounded quarterly? How about compounded continuou ynotnsvni n6 26d mi noinoyni 2ti g 01.2vsh 81 99619Vs no 29is 19 ns ynotnsvni ati allse. uneg yd ynoinavni zti allsz svods to anot.a 16. You just turned 21 years old and want to retire when you turn 65. You expect to live for 25 years after retiremen and want to withdraw $8,000 per month in retirement, starting one month after your 65th birthday. You expect much should he pay for this investment today if he wishes to earn a 13 percent rate of return? A. $22,113.05 D.$17,787.36 C.$18,909.31 B. $19,200.00 D. 15.23 %; 1.16 B. 15.75 % ; 16.07 % C. 15.23 %; 16.02% 8/ A. 15.75 % ; 16.12 % 15. A loan that compounds interest monthly has an EAR of 14.40 percent. What is the APR? A. 14.10 percent D. 13.53 percent B. 13.96 percent C. 13.59 percent earn a return of 0.7% on your investments every month. 1) How much retirement money do you need to have by 65th birthday to support the withdrawal? uts vliunnA A 2) How much should you save each month if you make the first deposit one month from now and the last one on 65th birthday? h 00 S1 ns19g 00.ar A 16-1 A. need $1,016,140.24 B. need $1,001,879.33 C. need $889,523.69 D. need $709,583.12 9 2016b12 bor ggp.02rc2 mot 1sav B. $380.12 per month 2919t0 C.$237.27 per month 16-2 A. $400.00 per month D. $180.89 per month A new financial services company just opened in your town. To attract customers, it is offeringa "9-11" loan special. The company will lend $9 today in exchange for a repayment of $11 three years from today. What is the loan rate on this deal? A. 22.2 percent 18. B. 10.6 percent C. 6.9 percent D.7.4 percent al anwollo slo di oo 19. Given an interest rate of 5.0 percent per year, what is the value today of a British Consol Bond that pays perpetual stream of 250 annual payments with the first payment beginning in 10 years? A. 238.10 C.E3,223.04 D. E5,000 B. E3,069.57 bson d 20. Webster Inc. is considering the purchase of a new machine. The quote consists of a quarterly payment of $29,600 for seven years at 8 % interest. First payment occurs one quarter from now. What is the purchase price of the equipment? sonA $621,380.92 bed toeloo mil s nysb ymwod lo 21. Suppose we know the "exchange rates": worth 85 cents now). And recall "exchange rates" are used in the following way to find the NPV of cashflows: C. $687,418.22 B. $629,925.66 D. $774,311.28 toad an =0.90, ) =0.85 (recall this notation denotes-$1 in 2 years is i bNPVe CFo+ x CF, +| x CF0 oe lo asd 002 Now there is a project requiring a cash outflow of $8MM in Year 2, with a cash inflow of $3MM immediately and a cash inflow of $5MM in Year 1. Suppose a buyer wishes to purchase this project but pay for it one year from now. How much should you ask for? A. 0.595 million Stpemo l gniolliat s boon pnlams o iw 'mAA B. 0.63 million C. 0.78 million D. 0.824 million 22. Jake owes $2,400 on his credit card. He is not charging any additional purchases because he wants to get the debt paid in full. The card has an APR of 18 % , He begins first payment 1 month from today, 1) How long can the debt be paid off if he makes minimum monthly payment of $35? Relate your answer to the following 2 questions: How much of the first monthly payment of $35 pays into interest and principle respectively? What is the present value of a perpetual stream of $35 monthly payments? 2) What if Jake makes minimum monthly payment of $40, how long then? wo sm