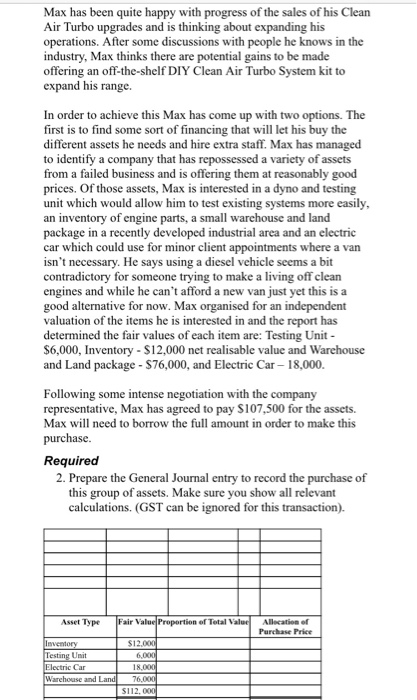

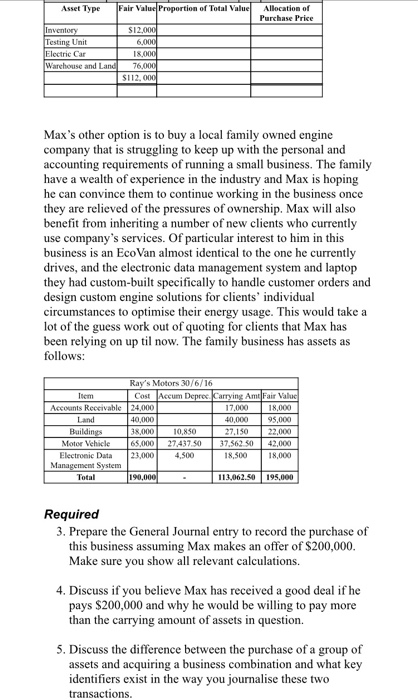

Max has been quite happy with progress of the sales of his Clean Air Turbo upgrades and is thinking about expanding his operations. After some discussions with people he knows in the industry, Max thinks there are potential gains to be made offering an off-the-shelf DIY Clean Air Turbo System kit to expand his range. In order to achieve this Max has come up with two options. The first is to find some sort of financing that will let his buy the different assets he needs and hire extra staff. Max has managed to identify a company that has repossessed a variety of assets from a failed business and is offering them at reasonably good prices. Of those assets, Max is interested in a dyno and testing unit which would allow him to test existing systems more easily, an inventory of engine parts, a small warehouse and land package in a recently developed industrial area and an electric car which could use for minor client appointments where a van isn't necessary. He says using a diesel vehicle seems a bit contradictory for someone trying to make a living off clean engines and while he can't afford a new van just yet this is a good alternative for now. Max organised for an independent valuation of the items he is interested in and the report has determined the fair values of each item are: Testing Unit - $6,000, Inventory - $12,000 net realisable value and Warehouse and Land package - $76,000, and Electric Car - 18,000. Following some intense negotiation with the company representative, Max has agreed to pay $107,500 for the assets. Max will need to borrow the full amount in order to make this purchase. Required 2. Prepare the General Journal entry to record the purchase of this group of assets. Make sure you show all relevant calculations. (GST can be ignored for this transaction). Asset Type Fair Value Proportion of Total Value Allocation of Purchase Price Inventory Testing Unit Electric Car Warehouse and Land $12.000 6,0K 18.000 76.000 S112, 0001 Asset Type Fair Value Proportion of Total Value Allocation of Purchase Price Inventory SI 2.0001 Testing Unit 6.0001 Electric Car 18.000 Warehouse and Land 76,000 $112.000 Max's other option is to buy a local family owned engine company that is struggling to keep up with the personal and accounting requirements of running a small business. The family have a wealth of experience in the industry and Max is hoping he can convince them to continue working in the business once they are relieved of the pressures of ownership. Max will also benefit from inheriting a number of new clients who currently use company's services. Of particular interest to him in this business is an EcoVan almost identical to the one he currently drives, and the electronic data management system and laptop they had custom-built specifically to handle customer orders and design custom engine solutions for clients' individual circumstances to optimise their energy usage. This would take a lot of the guess work out of quoting for clients that Max has been relying on up til now. The family business has assets as follows: Ray's Motors 30/6/16 Tiem Cost Accum Depres. Carrying Amt Fair Valuc Accounts Receivable 24,000 17,000 18,000 Land 40,000 40,000 95,000 Buildings 38,000 10.850 27,150 22.000 Motor Vehicle 65.000 27.437.50 37.56250 42,000 Electronic Data 23,000 4.500 18,500 18,000 Management System Total 190,000 113,062.50 195.000 Required 3. Prepare the General Journal entry to record the purchase of this business assuming Max makes an offer of $200,000. Make sure you show all relevant calculations. 4. Discuss if you believe Max has received a good deal if he pays $200,000 and why he would be willing to pay more than the carrying amount of assets in question. 5. Discuss the difference between the purchase of a of assets and acquiring a business combination and what key identifiers exist in the way you journalise these two transactions. group