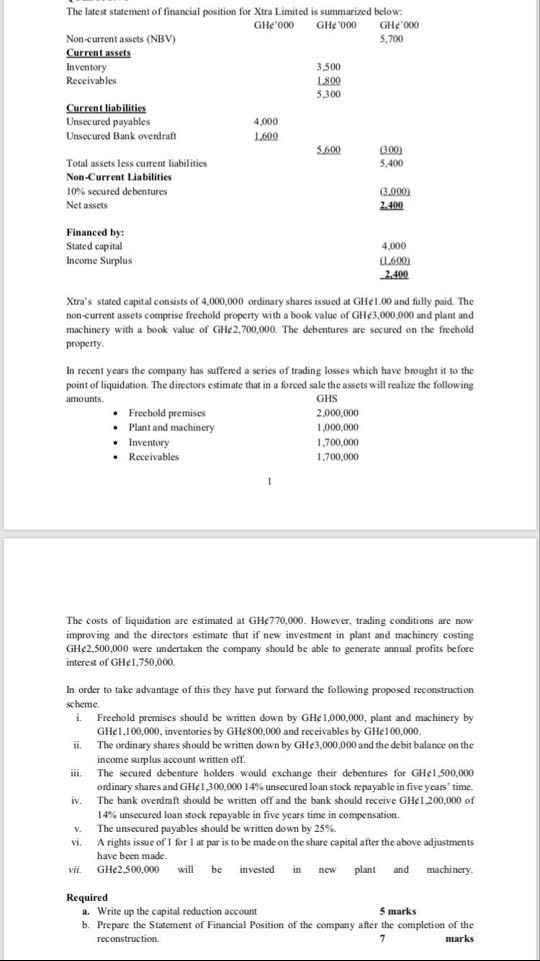

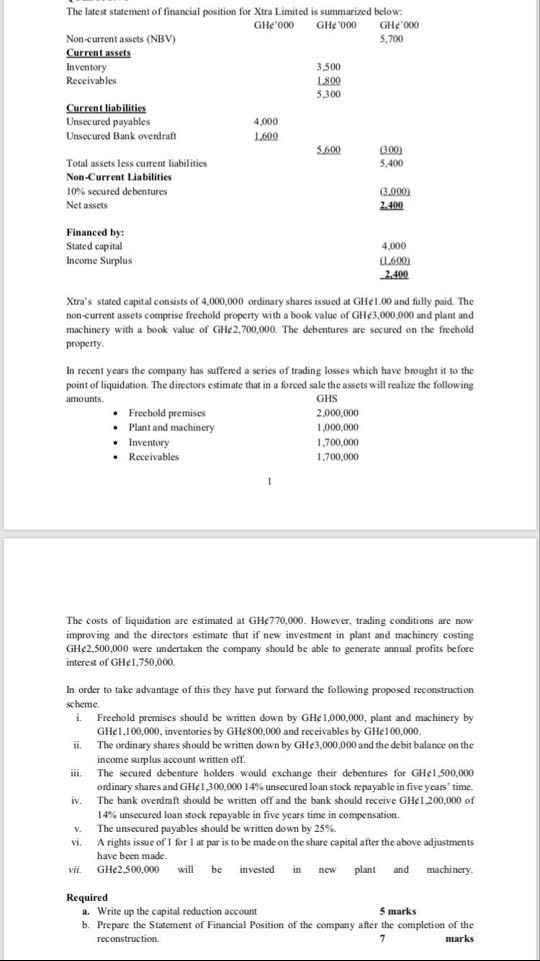

The latest statement of financial position for Xtra Limited is summarized below. : GH'000 GH'000 GH'000 Non-current assets (NBV) 5,700 Current assets Inventory 3.500 Receivables 1800 5.300 Current liabilities Unsecured payables 4,000 Unsecured Bank overdraft 16:00 5.600 300) Total assets less current liabilities 5,400 Non-Current Liabilities 10% secured debentures (3.000) Net assets Financed by: Stated capital Income Surplus 4,000 (1.600) 2.400 Xtra's stated capital consists of 4,000,000 ordinary shares issued at GH1.00 and fully paid. The non-current assets comprise freehold property with a book value of GH3,000,000 and plant and machinery with a book value of GH2,700,000. The debentures are secured on the freehold property In recent years the company has suffered a series of trading losses which have brought it to the point of liquidation. The directors estimate that in a forced sale the assets will realize the following amounts. GHS Freehold premises 2,000,000 Plant and machinery 1,000,000 Inventory 1,700,000 Receivables 1.700,000 The costs of liquidation are estimated at GH770,000. However, trading conditions are now improving and the directors estimate that if new investment in plant and machinery costing GH2,500,000 were undertaken the company should be able to generate annual profits before interest of GH1,750,000. i. In order to take advantage of this they have put forward the following proposed reconstruction scheme Freehold premises should be written down by GH 1,000,000, plant and machinery by GH1,100,000, inventories by GH800,000 and receivables by GH 100,000 ii. The ordinary shares should be written down by GH43,000,000 and the debit balance on the income surplus account written oft. iii. The secured debenture holders would exchange their debentures for GH1,500,000 ordinary shares and GHc1,300,000 14% unsecured loan stock repayable in five years' time. The bank overdraft should be written off and the bank should receive GH1.200,000 of 14% unsecured loan stock repayable in five years time in compensation The unsecured payables should be written down by 25% vi. A rights issue of 1 for 1 at par is to be made on the share capital after the above adjustments have been made. GH2,500,000 will be invested in new plant and machinery IV. Vil Required a. Write up the capital reduction account 5 marks b. Prepare the Statement of Financial Position of the company after the completion of the reconstruction 7 marks The latest statement of financial position for Xtra Limited is summarized below. : GH'000 GH'000 GH'000 Non-current assets (NBV) 5,700 Current assets Inventory 3.500 Receivables 1800 5.300 Current liabilities Unsecured payables 4,000 Unsecured Bank overdraft 16:00 5.600 300) Total assets less current liabilities 5,400 Non-Current Liabilities 10% secured debentures (3.000) Net assets Financed by: Stated capital Income Surplus 4,000 (1.600) 2.400 Xtra's stated capital consists of 4,000,000 ordinary shares issued at GH1.00 and fully paid. The non-current assets comprise freehold property with a book value of GH3,000,000 and plant and machinery with a book value of GH2,700,000. The debentures are secured on the freehold property In recent years the company has suffered a series of trading losses which have brought it to the point of liquidation. The directors estimate that in a forced sale the assets will realize the following amounts. GHS Freehold premises 2,000,000 Plant and machinery 1,000,000 Inventory 1,700,000 Receivables 1.700,000 The costs of liquidation are estimated at GH770,000. However, trading conditions are now improving and the directors estimate that if new investment in plant and machinery costing GH2,500,000 were undertaken the company should be able to generate annual profits before interest of GH1,750,000. i. In order to take advantage of this they have put forward the following proposed reconstruction scheme Freehold premises should be written down by GH 1,000,000, plant and machinery by GH1,100,000, inventories by GH800,000 and receivables by GH 100,000 ii. The ordinary shares should be written down by GH43,000,000 and the debit balance on the income surplus account written oft. iii. The secured debenture holders would exchange their debentures for GH1,500,000 ordinary shares and GHc1,300,000 14% unsecured loan stock repayable in five years' time. The bank overdraft should be written off and the bank should receive GH1.200,000 of 14% unsecured loan stock repayable in five years time in compensation The unsecured payables should be written down by 25% vi. A rights issue of 1 for 1 at par is to be made on the share capital after the above adjustments have been made. GH2,500,000 will be invested in new plant and machinery IV. Vil Required a. Write up the capital reduction account 5 marks b. Prepare the Statement of Financial Position of the company after the completion of the reconstruction 7 marks