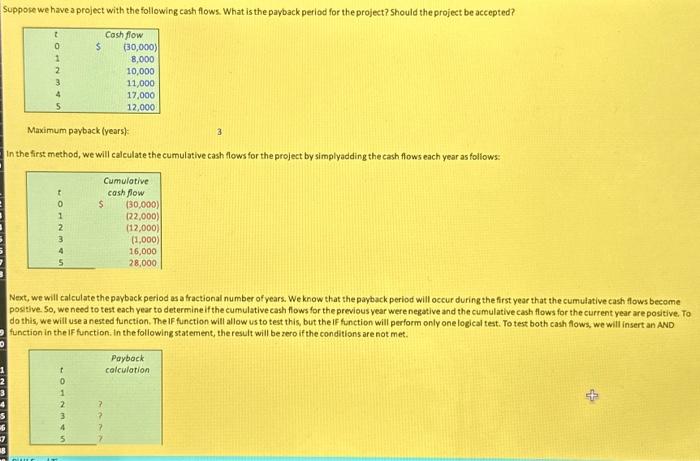

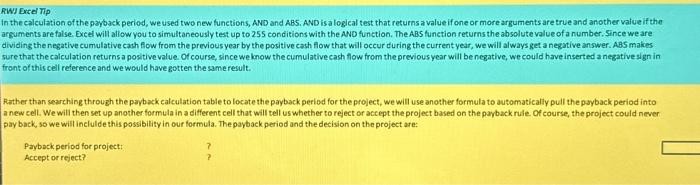

Maximum payback (years) 3 In the firs method, we will caleulate the cumulative cash flows for the project by simplyadding the cash flows each year as follows: Next, we will calculate the payback period as a fractional number of years. We know that the payback period will occur during the first year that the cumulative cash flows become postive. 50 , we need to test each year to determine if the cumulative cash flows for the previous year were negative and the cumulative cash flows for the current year are positive. To do this, we will use a nested function. The If function will allow us to test this, but the If function will perform only one logical test. To test both cash flows, we will insert an AND function in the If function. In the following statement, the result will be zero if the conditions are not met. W the calculation of the payback period, we used two new functions, AND and AB5. AND is a logleal test that returns a value if one or more arguments are true and another value if the irguments are false. Excel will allow you to simultaneously test up to 255 conditions with the AND function. The ABS function returns the absolute value of a number. Since we are ividing the negative cumulative cach fow from the previous year by the positive cash flow that will occur during the current year, we will always get a negative answer. AB5 makes iure that the calculation returns a positive value Of course, since we know the cumulative cash flow from the previous year will be negative, we could have inserted a negative sign in iront of this cell reference and we would have gotten the same result. father than searching through the payback calculation table to locate the payback period for the project, we will use another formula to automatically pull the payback period into a new celL We will then set up another formula in a different cell that will tell us whether to reject or accept the project based on the payback rule Of course, the project could never pay back, so we will inclulde this possibitity in our formula. The payback period and the decision on the project are: Payback period for project: ? Accept or reject