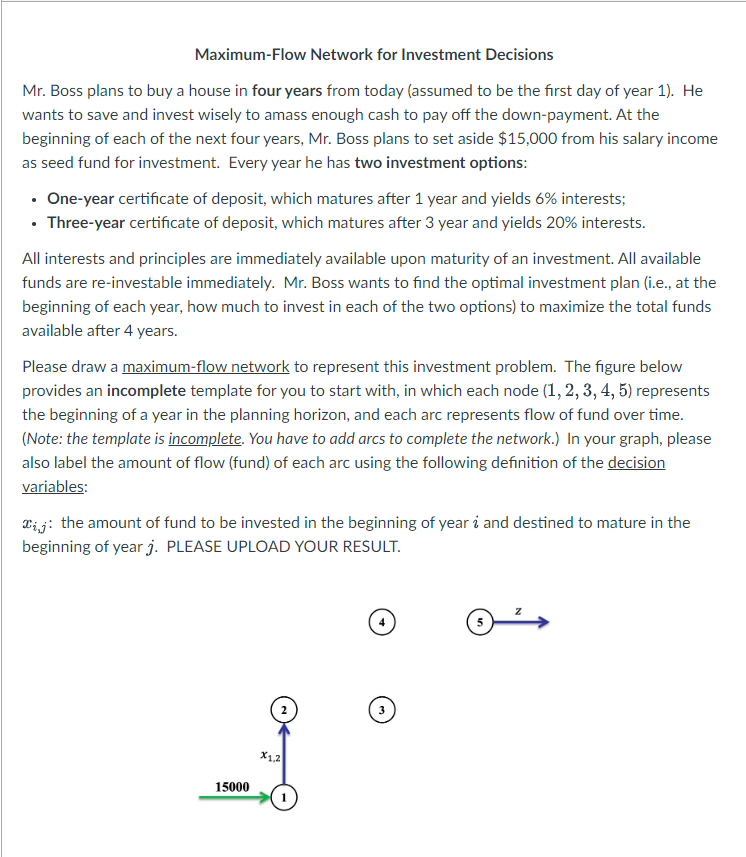

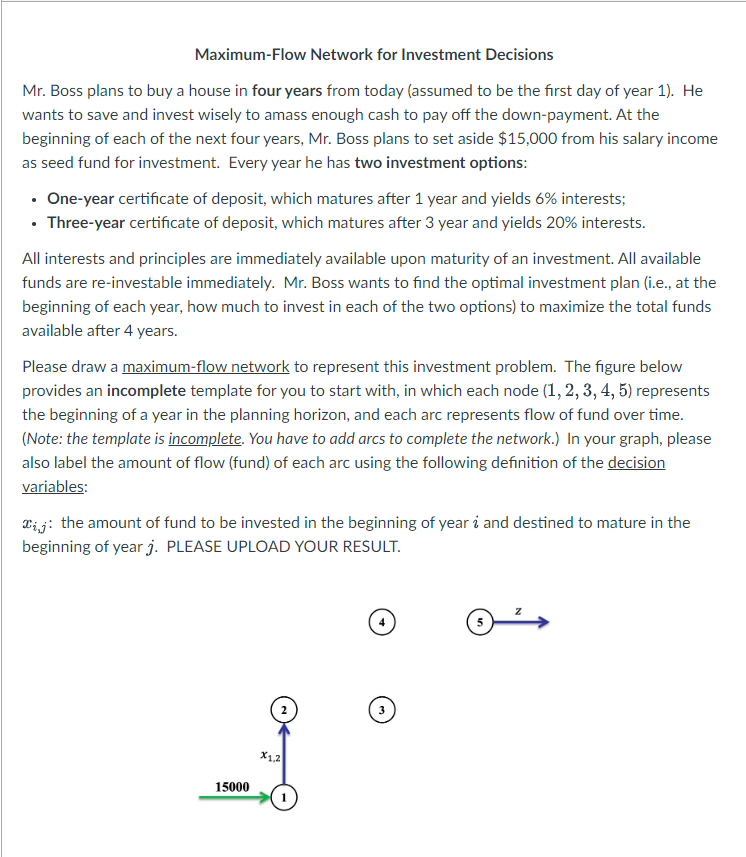

Maximum-Flow Network for Investment Decisions Mr. Boss plans to buy a house in four years from today (assumed to be the first day of year 1). He wants to save and invest wisely to amass enough cash to pay off the down-payment. At the beginning of each of the next four years, Mr. Boss plans to set aside $15,000 from his salary income as seed fund for investment. Every year he has two investment options: - One-year certificate of deposit, which matures after 1 year and yields 6% interests; - Three-year certificate of deposit, which matures after 3 year and yields 20% interests. All interests and principles are immediately available upon maturity of an investment. All available funds are re-investable immediately. Mr. Boss wants to find the optimal investment plan (i.e., at the beginning of each year, how much to invest in each of the two options) to maximize the total funds available after 4 years. Please draw a maximum-flow network to represent this investment problem. The figure below provides an incomplete template for you to start with, in which each node (1,2,3,4,5) represents the beginning of a year in the planning horizon, and each arc represents flow of fund over time. (Note: the template is incomplete. You have to add arcs to complete the network.) In your graph, please also label the amount of flow (fund) of each arc using the following definition of the decision variables: xi,j : the amount of fund to be invested in the beginning of year i and destined to mature in the beginning of year j. PLEASE UPLOAD YOUR RESULT. Maximum-Flow Network for Investment Decisions Mr. Boss plans to buy a house in four years from today (assumed to be the first day of year 1). He wants to save and invest wisely to amass enough cash to pay off the down-payment. At the beginning of each of the next four years, Mr. Boss plans to set aside $15,000 from his salary income as seed fund for investment. Every year he has two investment options: - One-year certificate of deposit, which matures after 1 year and yields 6% interests; - Three-year certificate of deposit, which matures after 3 year and yields 20% interests. All interests and principles are immediately available upon maturity of an investment. All available funds are re-investable immediately. Mr. Boss wants to find the optimal investment plan (i.e., at the beginning of each year, how much to invest in each of the two options) to maximize the total funds available after 4 years. Please draw a maximum-flow network to represent this investment problem. The figure below provides an incomplete template for you to start with, in which each node (1,2,3,4,5) represents the beginning of a year in the planning horizon, and each arc represents flow of fund over time. (Note: the template is incomplete. You have to add arcs to complete the network.) In your graph, please also label the amount of flow (fund) of each arc using the following definition of the decision variables: xi,j : the amount of fund to be invested in the beginning of year i and destined to mature in the beginning of year j. PLEASE UPLOAD YOUR RESULT