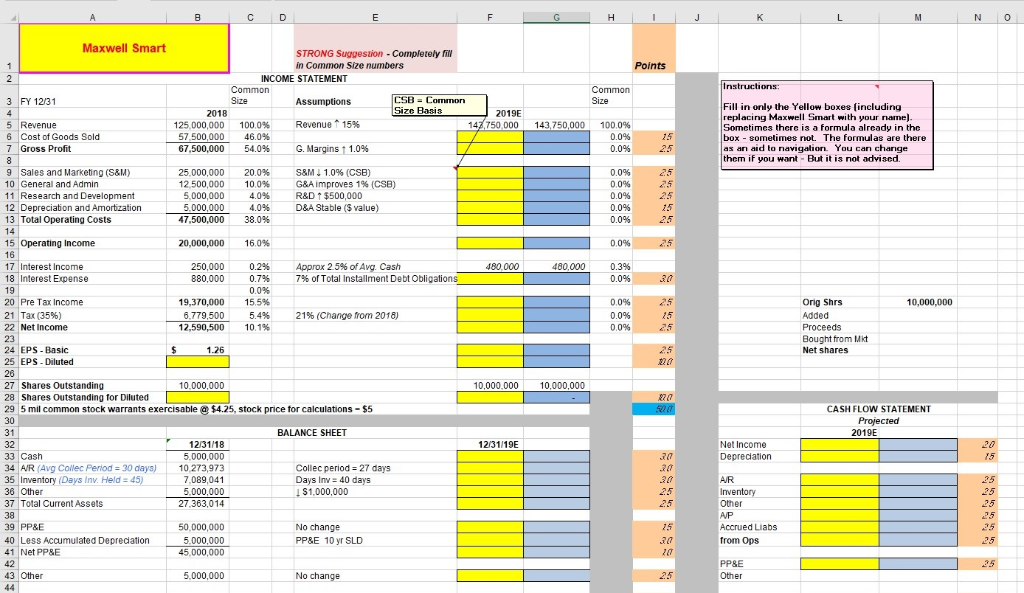

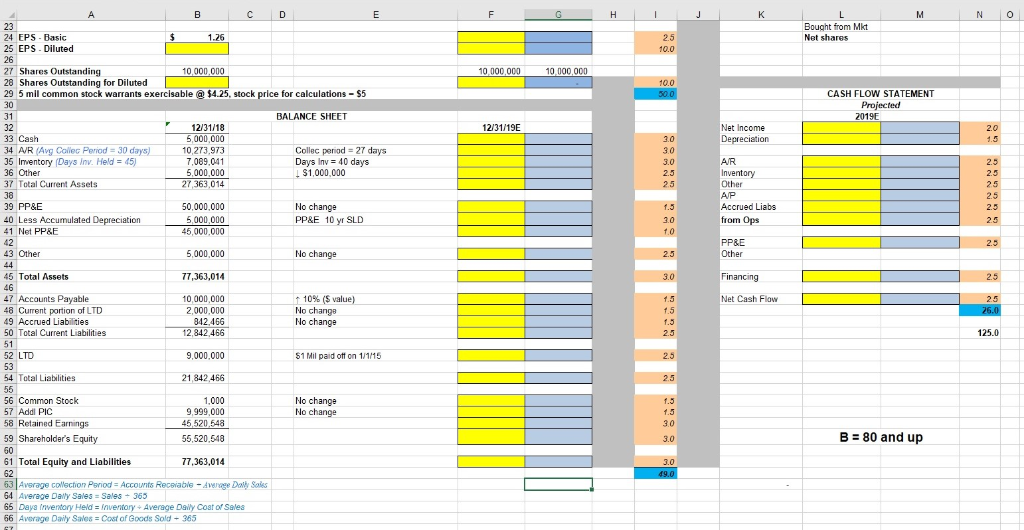

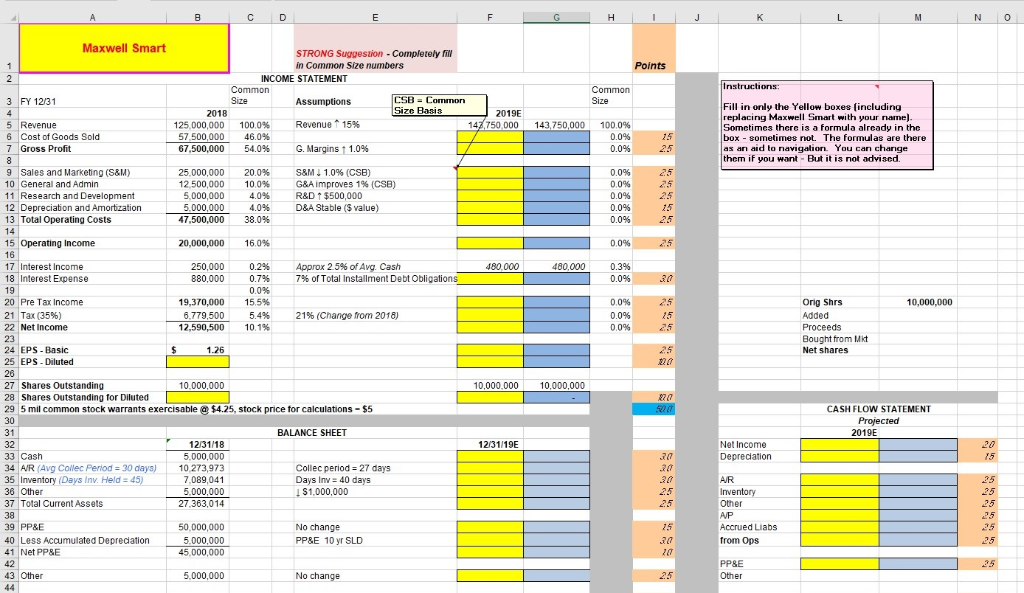

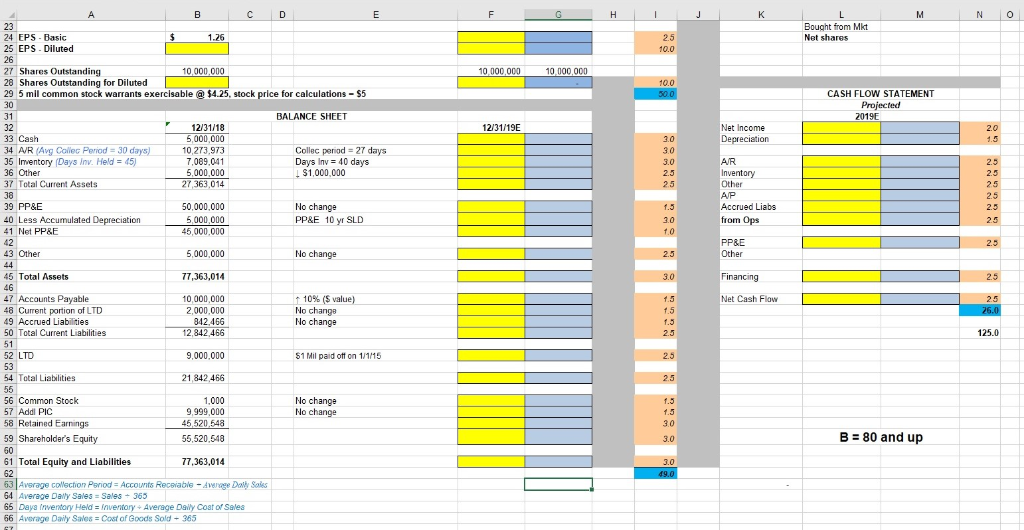

Maxwell Smart STRONG Suggestion- Completely fill in Common Size numbers INCOME STATEMENT Common 3 FY 12/31 2018 125,000,000 57500.000 67,500,000 Assumptions Revenue 115% G. Margins!1.0% Fill in only the Yellow boxes [including eplacing Maxwell Smart with your name Sometimes there is a formula alrcady in thc box sometimes not. The formulas a 2019E 5 Revenue 6 Cost of Goods Sold 7 Gross Profit 1000% 46.096 54.0% 147,750 000 143,750,000 100.0% 0.0% are there as an aid to navigation You can charnge them if you want But it is not advised. 9 Sales and Marketing (S&M) 10 General and Admin 11 Research and Development 12 Depreciation and Amortzation 13 Total Operating Costs 25000.000 12.500,000 5,000,000 5000.000 47,500,000 20.0% 100% 4.0% 4.0% 38.0% S&M 10% (CSB) G&A improves 1% (CSB) R&D 1 $500,000 D&A Stable (S value) 0,0% 0.0% 25 15 Operating Income 20,000,000 16.0% 17 Interest Income 250,000 880,000 0.2% 0.7% 0.0% 15.5% Approx 2.5% ofAvg Cash 7% of Total Installment Debt Obligations 480,000 480,000 0.3% 18 Interest Expense 19,370,000 6.779,500 10,000,000 20 Pre Tax Income 21 Tax (35%) 22 Net Income 23 24 EPS-Basic 25 Orig Shrs Added Proceeds Bought from Mkt Net shares 21% (Change from 2018) 12,590,500 10.1% EPS-Diluted 26 27 Shares Outstanding 28 Shares Outstanding for Diluted 29 5 mil common stock warrants exercisable@$4.25, stock price for calculations-$5 10,000,000 10,000,000 10,000,000 CASH FLOW STATEMENT BALANCE SHEET 2019E 12/31/19E 32 33 Cash 34 AR (Avg Collec Period 30 days) 10,273,973 5 Inventory (Days Inv. Held 12/31/18 5,000,000 Net Income Collec period 27 days Days Inv- 40 days 7,089,041 5,000,000 27,363,014 36 Other 37 Total Current Assets 38 39 PP&E 40 Less Accumulated Depreciation S 1,000,000 Inventory 50,000,000D 5,000,000 45,000,000 AVP ccrued Liabs from Ops No change PP&E 10 yr SLD 41 Net PP&E PP&E 43 Other 5,000,000 No change 2.5 C D Bought from Mkt Net shares 24 EPS- Basic 25 EPS Diluted 26 27 Shares Outstanding 28 Shares Outstanding for Diluted 29 5 mll common stock warrants exercisable@$4.25, stock price for calculations- S5 1.26 10,000,000 10,000,000 10.0 CASH FLOW STATEMENT BALANCE SHEET 2019E 12/31/18 5,000,000 10,273,973 7,069,041 5,000,000 27,36301 12/31/19E Net Income 33 Cash 34 AVR (Avg Coliec Period 30 35 Inventory (Days inv. Held 45) 36 Other 37 Total Current Assets 3.0 3.0 3.0 2.3 Collec period 27 days Days Inv 40 days 2.5 2.5 25 2.5 2.5 1,000,000 No change PP&E 10 yr SLD 39 PP&E 50,000,000 Accrued Liabs from Ops PP&E 40 Less Accumulated Depreciation 41 Net PP&E 3.0 5,000,000 5,000,000 77,363,014 43 Other No change 2.3 45 Total Assets 47 Accounts Payable 4Cnt portion of LTD 49 Accrued Liabilities 50 Total Current Liabilities 51 52 LTD 10,000,000 2,000,000 42.466 12,842,466 110% ($ No chang8 1.5 Net Cash Flaw No change f.5 125.0 9,000,000 51 Mil paid ott on 1/115 54 Total Liabilities 21,842 466 56 Common Stock 7 Addl PIC 58 Retained Earnings 1,000 9,999,000 No change No change 1.5 3.0 B 80 and up 59 Shareholder's Equity 50 61 Total Equity and Liabilities 55,520,548 77,363,014 3.0 53 Avsrage collsction Pariod Accounts Receiable Aage Dally Salks 54 Average Daily Sales Sales 365 65 Daya (nventory Held Inventory Average Daily Cost of Sales 66 Average Daily SaveCost of Goods Sold365 Maxwell Smart STRONG Suggestion- Completely fill in Common Size numbers INCOME STATEMENT Common 3 FY 12/31 2018 125,000,000 57500.000 67,500,000 Assumptions Revenue 115% G. Margins!1.0% Fill in only the Yellow boxes [including eplacing Maxwell Smart with your name Sometimes there is a formula alrcady in thc box sometimes not. The formulas a 2019E 5 Revenue 6 Cost of Goods Sold 7 Gross Profit 1000% 46.096 54.0% 147,750 000 143,750,000 100.0% 0.0% are there as an aid to navigation You can charnge them if you want But it is not advised. 9 Sales and Marketing (S&M) 10 General and Admin 11 Research and Development 12 Depreciation and Amortzation 13 Total Operating Costs 25000.000 12.500,000 5,000,000 5000.000 47,500,000 20.0% 100% 4.0% 4.0% 38.0% S&M 10% (CSB) G&A improves 1% (CSB) R&D 1 $500,000 D&A Stable (S value) 0,0% 0.0% 25 15 Operating Income 20,000,000 16.0% 17 Interest Income 250,000 880,000 0.2% 0.7% 0.0% 15.5% Approx 2.5% ofAvg Cash 7% of Total Installment Debt Obligations 480,000 480,000 0.3% 18 Interest Expense 19,370,000 6.779,500 10,000,000 20 Pre Tax Income 21 Tax (35%) 22 Net Income 23 24 EPS-Basic 25 Orig Shrs Added Proceeds Bought from Mkt Net shares 21% (Change from 2018) 12,590,500 10.1% EPS-Diluted 26 27 Shares Outstanding 28 Shares Outstanding for Diluted 29 5 mil common stock warrants exercisable@$4.25, stock price for calculations-$5 10,000,000 10,000,000 10,000,000 CASH FLOW STATEMENT BALANCE SHEET 2019E 12/31/19E 32 33 Cash 34 AR (Avg Collec Period 30 days) 10,273,973 5 Inventory (Days Inv. Held 12/31/18 5,000,000 Net Income Collec period 27 days Days Inv- 40 days 7,089,041 5,000,000 27,363,014 36 Other 37 Total Current Assets 38 39 PP&E 40 Less Accumulated Depreciation S 1,000,000 Inventory 50,000,000D 5,000,000 45,000,000 AVP ccrued Liabs from Ops No change PP&E 10 yr SLD 41 Net PP&E PP&E 43 Other 5,000,000 No change 2.5 C D Bought from Mkt Net shares 24 EPS- Basic 25 EPS Diluted 26 27 Shares Outstanding 28 Shares Outstanding for Diluted 29 5 mll common stock warrants exercisable@$4.25, stock price for calculations- S5 1.26 10,000,000 10,000,000 10.0 CASH FLOW STATEMENT BALANCE SHEET 2019E 12/31/18 5,000,000 10,273,973 7,069,041 5,000,000 27,36301 12/31/19E Net Income 33 Cash 34 AVR (Avg Coliec Period 30 35 Inventory (Days inv. Held 45) 36 Other 37 Total Current Assets 3.0 3.0 3.0 2.3 Collec period 27 days Days Inv 40 days 2.5 2.5 25 2.5 2.5 1,000,000 No change PP&E 10 yr SLD 39 PP&E 50,000,000 Accrued Liabs from Ops PP&E 40 Less Accumulated Depreciation 41 Net PP&E 3.0 5,000,000 5,000,000 77,363,014 43 Other No change 2.3 45 Total Assets 47 Accounts Payable 4Cnt portion of LTD 49 Accrued Liabilities 50 Total Current Liabilities 51 52 LTD 10,000,000 2,000,000 42.466 12,842,466 110% ($ No chang8 1.5 Net Cash Flaw No change f.5 125.0 9,000,000 51 Mil paid ott on 1/115 54 Total Liabilities 21,842 466 56 Common Stock 7 Addl PIC 58 Retained Earnings 1,000 9,999,000 No change No change 1.5 3.0 B 80 and up 59 Shareholder's Equity 50 61 Total Equity and Liabilities 55,520,548 77,363,014 3.0 53 Avsrage collsction Pariod Accounts Receiable Aage Dally Salks 54 Average Daily Sales Sales 365 65 Daya (nventory Held Inventory Average Daily Cost of Sales 66 Average Daily SaveCost of Goods Sold365