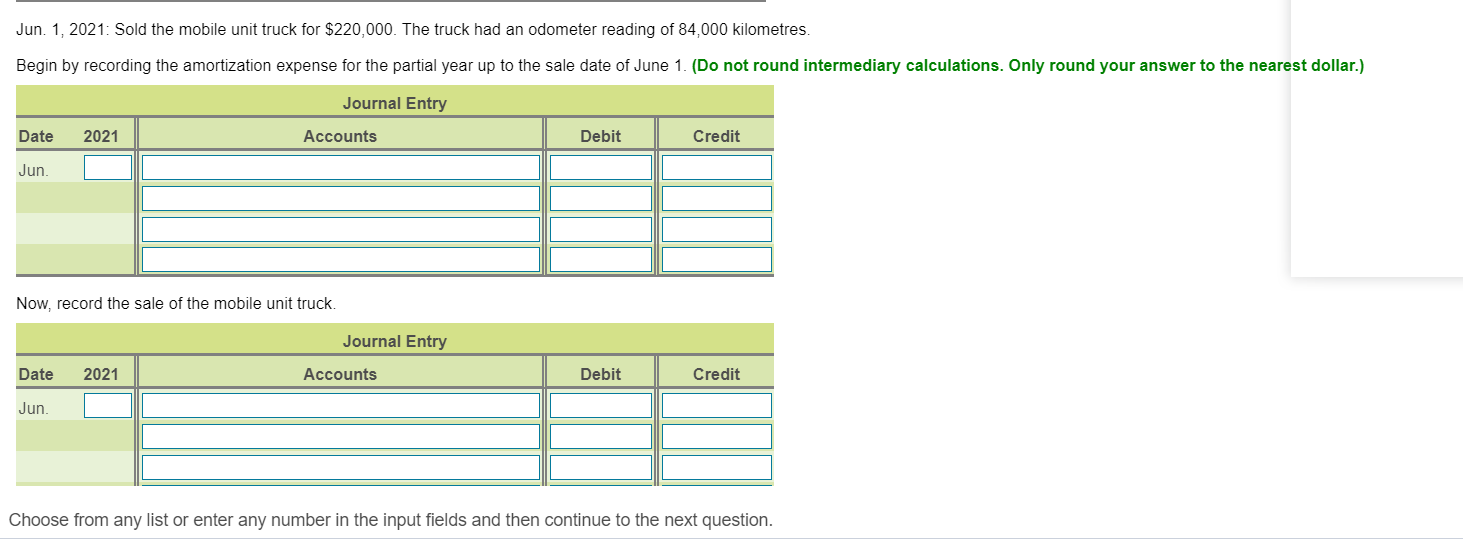

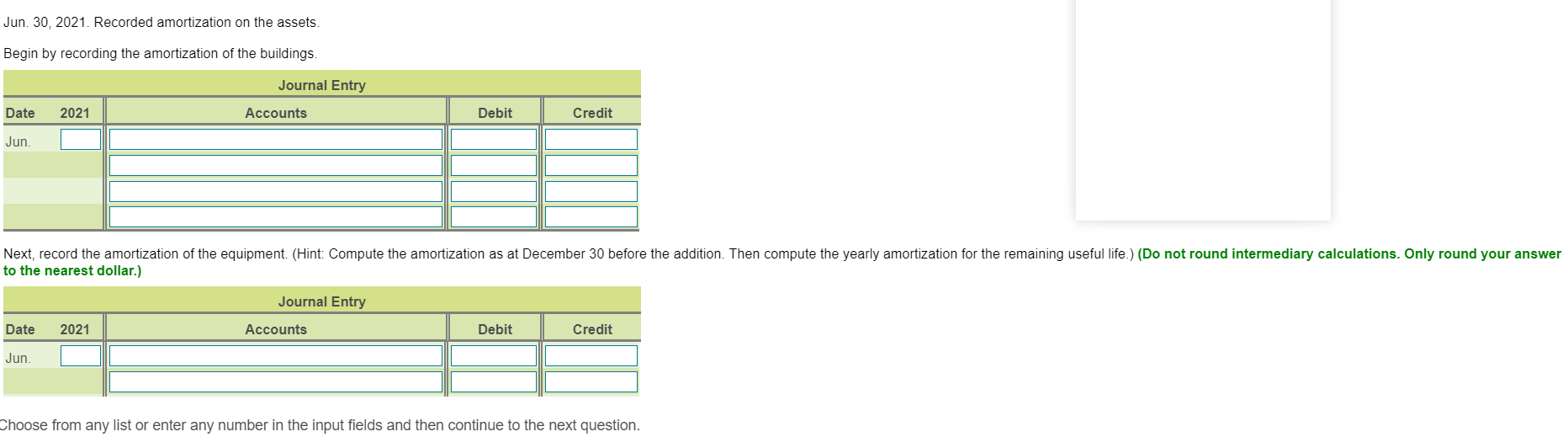

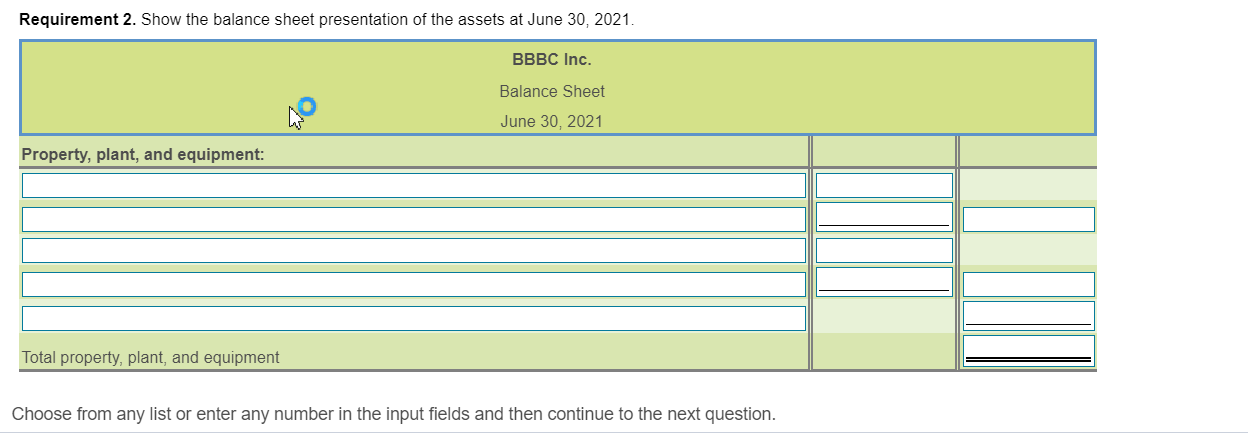

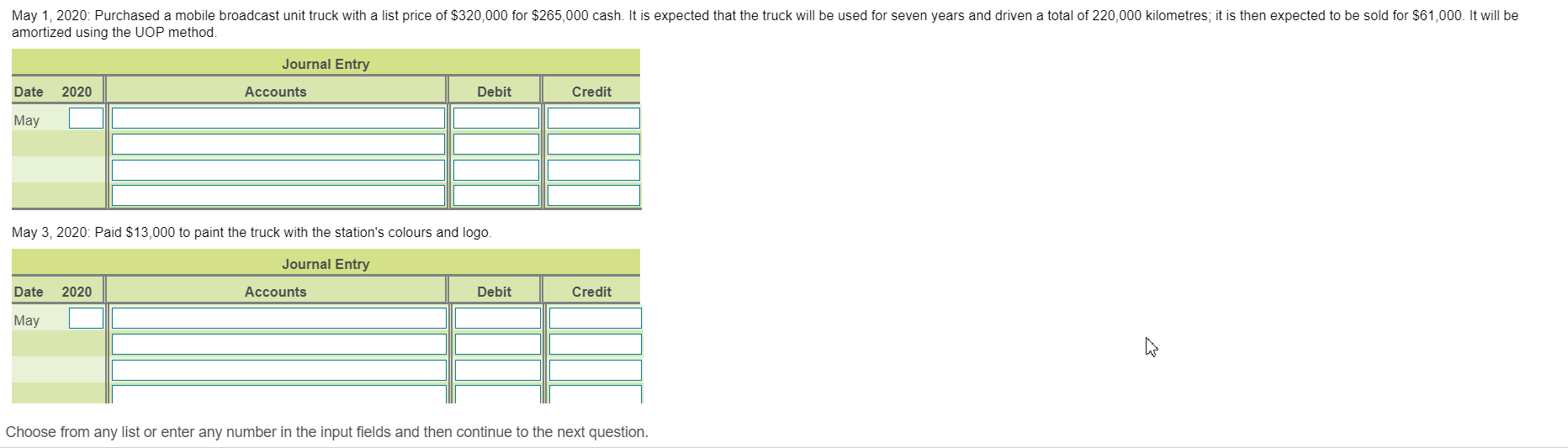

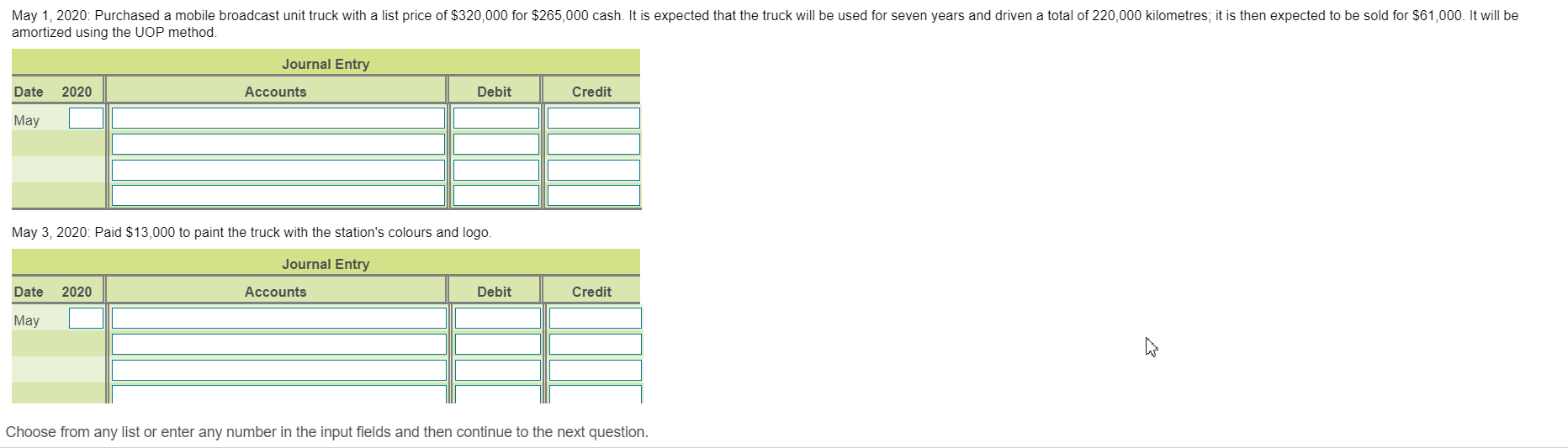

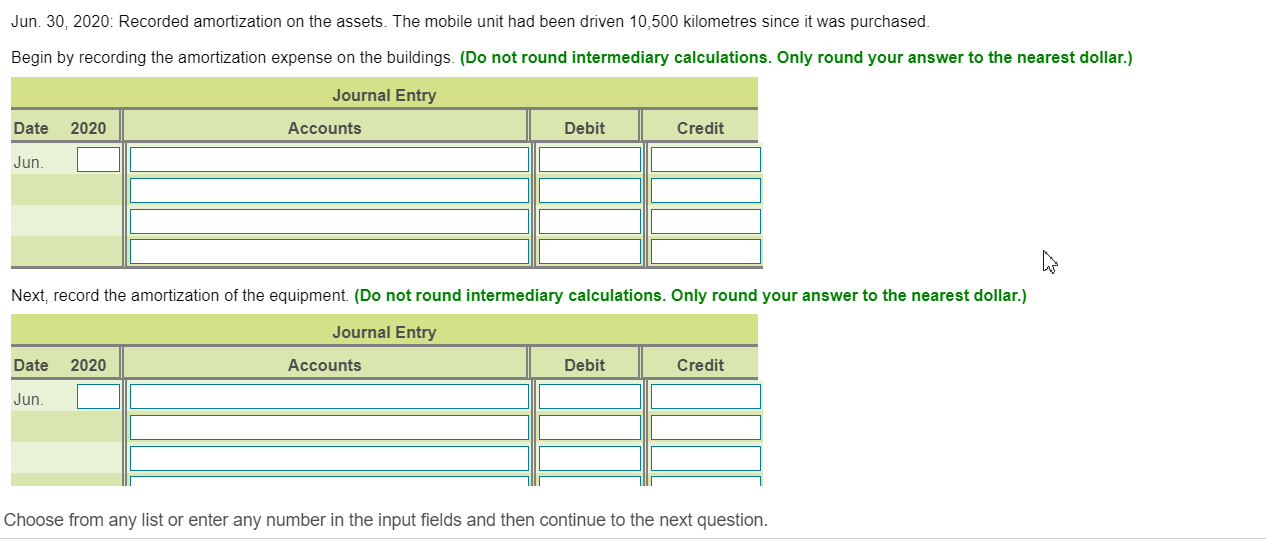

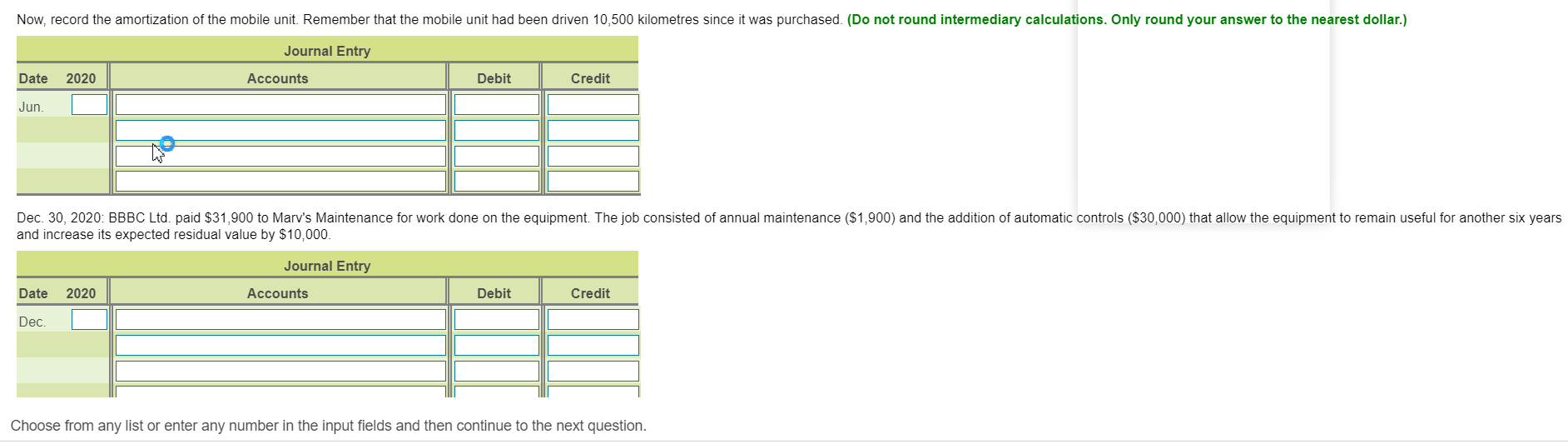

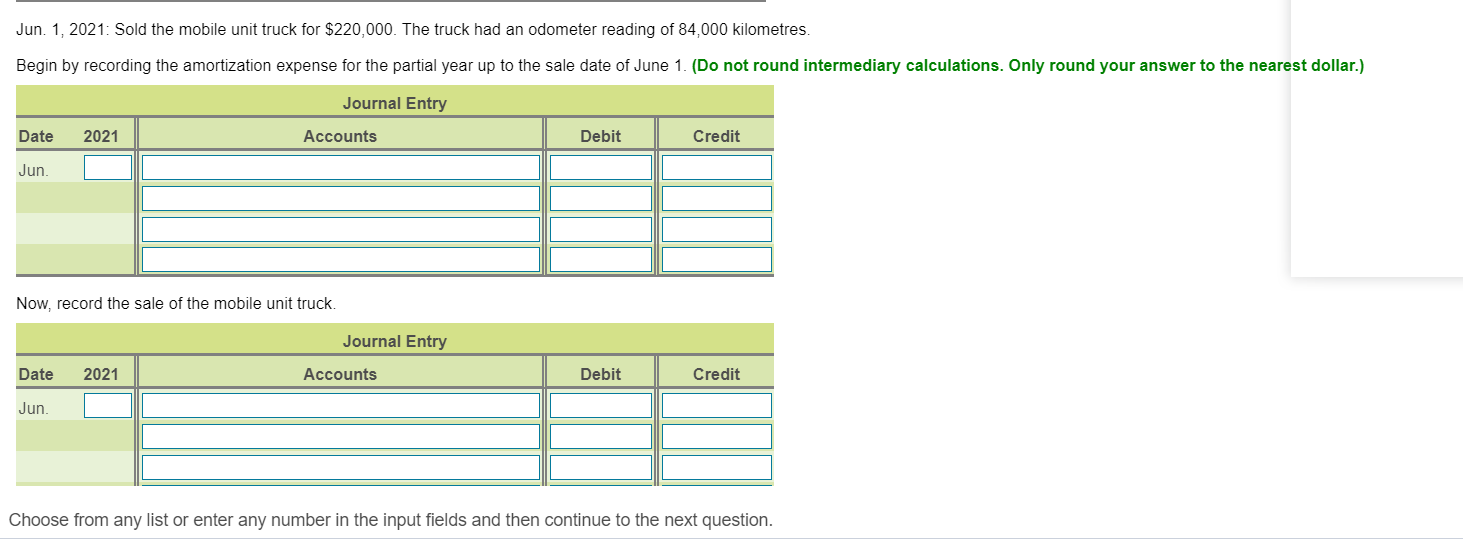

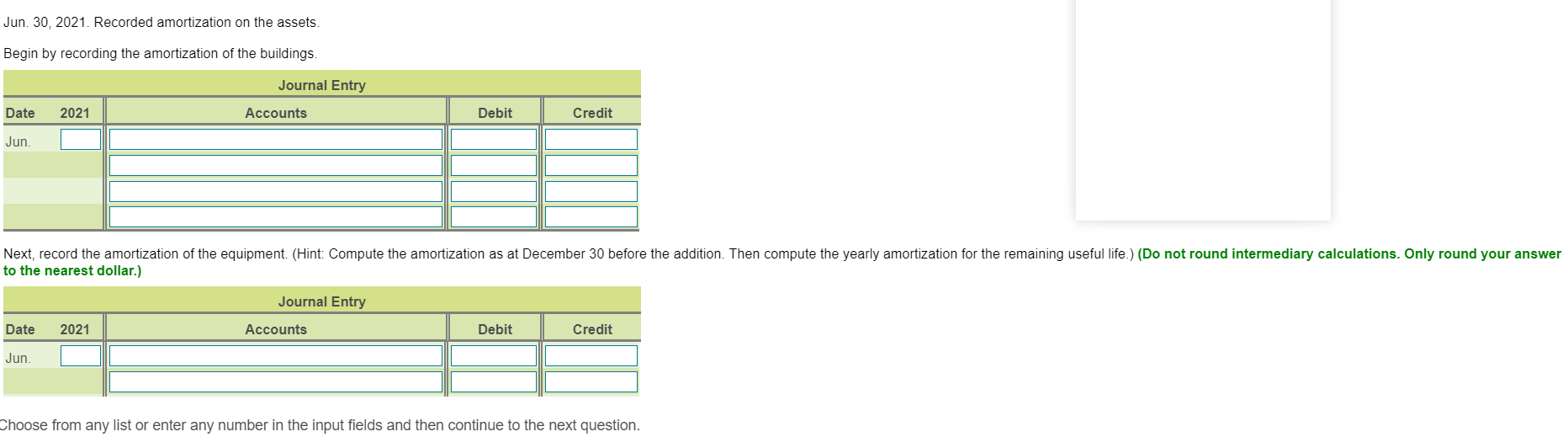

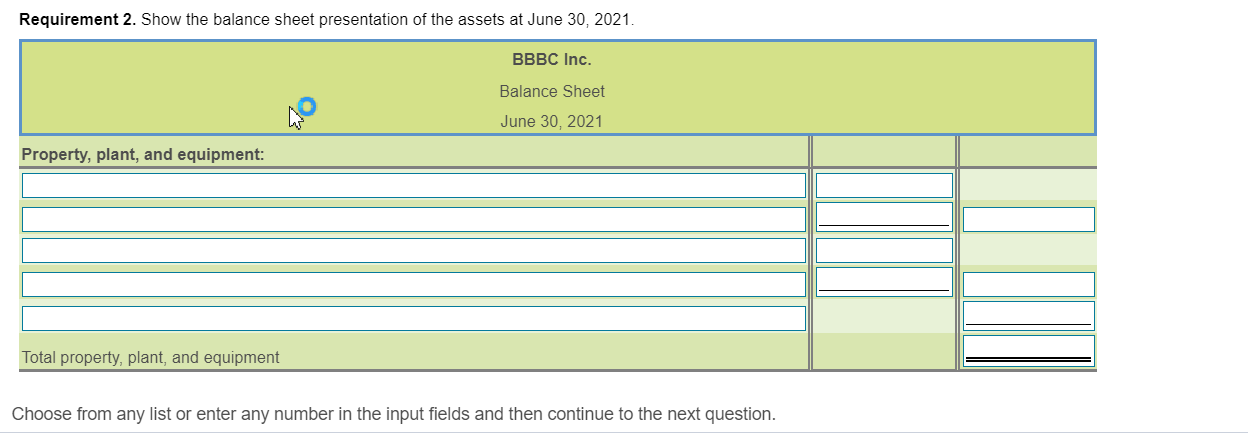

May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo Journal Entry Date 2020 Accounts Debit Credit May Choose from any list or enter any number in the input fields and then continue to the next question. May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo Journal Entry Date 2020 Accounts Debit Credit May Choose from any list or enter any number in the input fields and then continue to the next question. Jun 30, 2020: Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased. Begin by recording the amortization expense on the buildings. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Now, record the amortization of the mobile unit. Remember that the mobile unit had been driven 10,500 kilometres since it was purchased. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Dec. 30, 2020: BBBC Ltd. paid $31,900 to Mary's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to remain useful for another six years and increase its expected residual value by $10,000. Journal Entry Date 2020 Accounts Debit Credit Dec. Choose from any list or enter any number in the input fields and then continue to the next question. Jun. 1, 2021: Sold the mobile unit truck for $220,000. The truck had an odometer reading of 84,000 kilometres. Begin by recording the amortization expense for the partial year up to the sale date of June 1. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Now, record the sale of the mobile unit truck. Journal Entry Date 2021 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Jun 30, 2021. Recorded amortization on the assets. Begin by recording the amortization of the buildings. Journal Entry Date 2021 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Hint: Compute the amortization as at December 30 before the addition. Then compute the yearly amortization for the remaining useful life.) (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Show the balance sheet presentation of the assets at June 30, 2021. BBBC Inc. Balance Sheet June 30, 2021 Property, plant, and equipment: Total property, plant, and equipment Choose from any list or enter any number in the input fields and then continue to the next question. May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo Journal Entry Date 2020 Accounts Debit Credit May Choose from any list or enter any number in the input fields and then continue to the next question. May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo Journal Entry Date 2020 Accounts Debit Credit May Choose from any list or enter any number in the input fields and then continue to the next question. Jun 30, 2020: Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased. Begin by recording the amortization expense on the buildings. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Now, record the amortization of the mobile unit. Remember that the mobile unit had been driven 10,500 kilometres since it was purchased. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Dec. 30, 2020: BBBC Ltd. paid $31,900 to Mary's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to remain useful for another six years and increase its expected residual value by $10,000. Journal Entry Date 2020 Accounts Debit Credit Dec. Choose from any list or enter any number in the input fields and then continue to the next question. Jun. 1, 2021: Sold the mobile unit truck for $220,000. The truck had an odometer reading of 84,000 kilometres. Begin by recording the amortization expense for the partial year up to the sale date of June 1. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Now, record the sale of the mobile unit truck. Journal Entry Date 2021 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Jun 30, 2021. Recorded amortization on the assets. Begin by recording the amortization of the buildings. Journal Entry Date 2021 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Hint: Compute the amortization as at December 30 before the addition. Then compute the yearly amortization for the remaining useful life.) (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Show the balance sheet presentation of the assets at June 30, 2021. BBBC Inc. Balance Sheet June 30, 2021 Property, plant, and equipment: Total property, plant, and equipment Choose from any list or enter any number in the input fields and then continue to the next