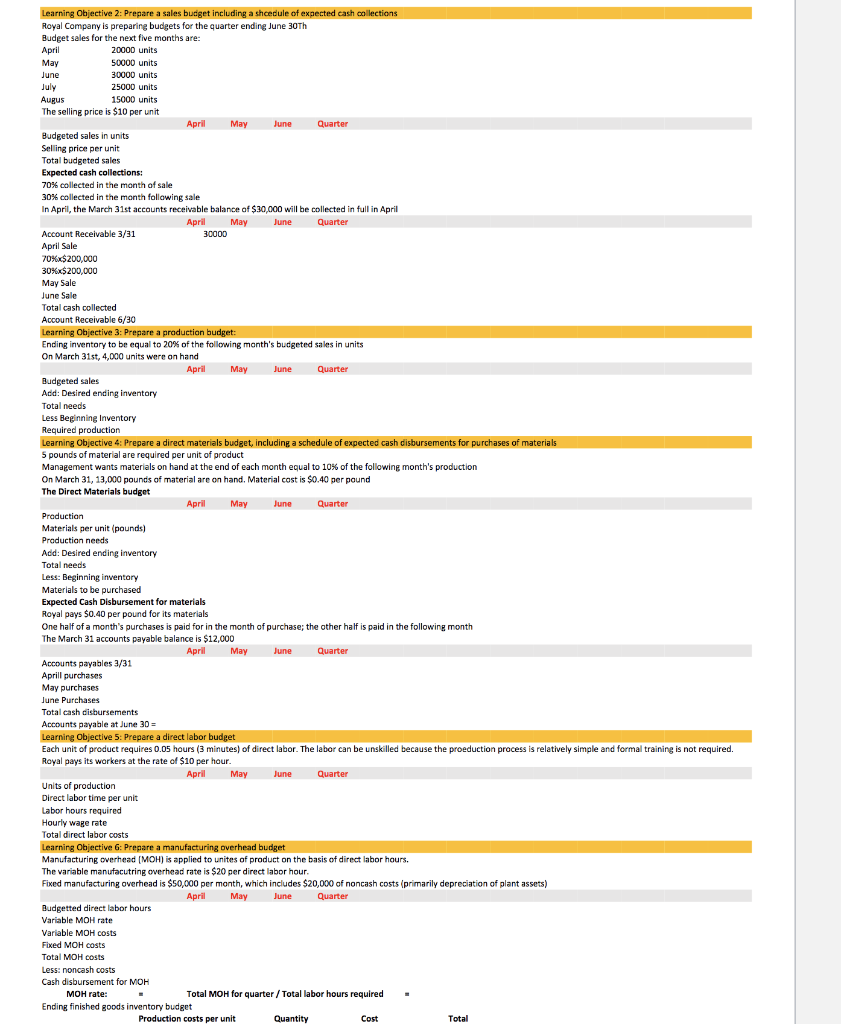

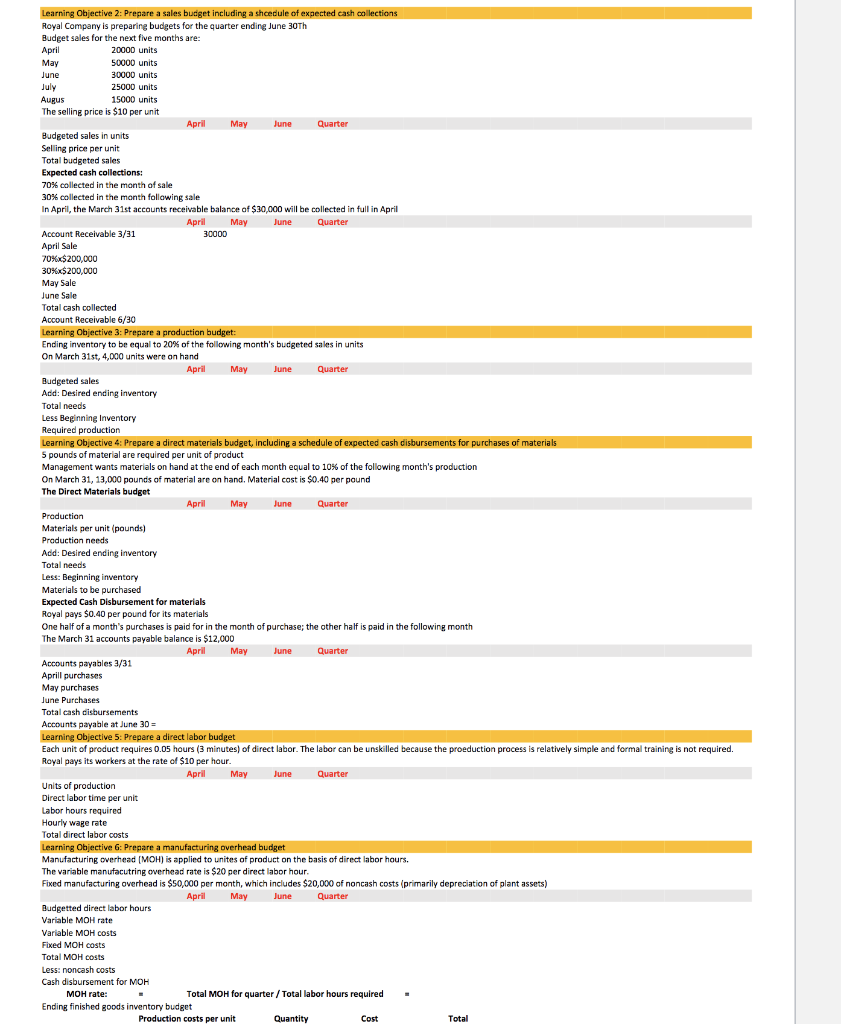

May Learning Objective 2: Prepare a sales budget including a shedule of expected cash collections Royal Company is preparing budgets for the quarter ending June 30th Budget sales for the next five months are: April 20000 units 50000 units June 30000 units 25000 units Augus 15000 units The selling price is $10 per unit April May June Quarter Budgeted sales in units Selling price per unit Total budgeted sales Expected cash collections: 70% collected in the month of sale 30% collected in the month following sale In April, the March 31st accounts receivable balance of $30,000 will be collected in full in April April May June Quarter Account Receivable 3/31 30000 April Sale 70%.x$200,000 30%x$200,000 May Sale June Sale Total cash collected Account Receivable 6/30 Learning Objective 3: Prepare a production budget: Ending inventory to be equal to 20% of the following month's budgeted sales in units On March 31st, 4,000 units were on hand April May May June Quarter Budgeted sales Add: Desired ending inventory Total needs Less Beginning Inventory Required production Learning Objective 4: Prepare a direct materials budget, including a schedule of expected cash disbursements for purchases of materials 5 pounds of material are required per unit of product Management wants materials on hand at the end of each month equal to 10% of the following month's production On March 31, 13,000 pounds of material are on hand. Material cost is $0.40 per pound The Direct Materials budget April May June Quarter Production Materials per unit (pounds) Production needs Add: Desired ending inventory Total needs Less: Beginning inventory Materials to be purchased Expected Cash Disbursement for materials Royal pays $0.40 per pound for its materials One half of a month's purchases is paid for in the month of purchase; the other half is paid in the following month The March 31 accounts payable balance is $12,000 April May June Quarter Accounts payables 3/31 Aprill purchases May purchases June Purchases Total cash disbursements Accounts payable at June 30 = Learning Objective 5: Prepare a direct labor budget Each unit of product requires 0.05 hours (3 minutes) of direct labor. The labor can be unskilled because the proeduction process is relatively simple and formal training is not required. Royal pays its workers at the rate of $10 per hour. April May June Quarter Units of production Direct labor time per unit Labor hours required Hourly wage rate Total direct labor costs Learning Objective G: Prepare a manufacturing overhead budget Manufacturing overhead (MOH) is applied to unites of product on the basis of direct labor hours. The variable manufacutring overhead rate is $20 per direct labor hour. Fixed manufacturing overhead is $50,000 per month, which includes $20,000 of noncash costs (primarily depreciation of plant assets) April May June Quarter Budgetted direct labor hours Variable MOH rate Variable MOH costs Fixed MOH costs Total MOH costs Less: noncash costs Cash disbursement for MOH MOH rate: - Total MOH for quarter / Total labor hours required - Ending finished goods inventory budget Production costs per unit Quantity Cost Total May Learning Objective 2: Prepare a sales budget including a shedule of expected cash collections Royal Company is preparing budgets for the quarter ending June 30th Budget sales for the next five months are: April 20000 units 50000 units June 30000 units 25000 units Augus 15000 units The selling price is $10 per unit April May June Quarter Budgeted sales in units Selling price per unit Total budgeted sales Expected cash collections: 70% collected in the month of sale 30% collected in the month following sale In April, the March 31st accounts receivable balance of $30,000 will be collected in full in April April May June Quarter Account Receivable 3/31 30000 April Sale 70%.x$200,000 30%x$200,000 May Sale June Sale Total cash collected Account Receivable 6/30 Learning Objective 3: Prepare a production budget: Ending inventory to be equal to 20% of the following month's budgeted sales in units On March 31st, 4,000 units were on hand April May May June Quarter Budgeted sales Add: Desired ending inventory Total needs Less Beginning Inventory Required production Learning Objective 4: Prepare a direct materials budget, including a schedule of expected cash disbursements for purchases of materials 5 pounds of material are required per unit of product Management wants materials on hand at the end of each month equal to 10% of the following month's production On March 31, 13,000 pounds of material are on hand. Material cost is $0.40 per pound The Direct Materials budget April May June Quarter Production Materials per unit (pounds) Production needs Add: Desired ending inventory Total needs Less: Beginning inventory Materials to be purchased Expected Cash Disbursement for materials Royal pays $0.40 per pound for its materials One half of a month's purchases is paid for in the month of purchase; the other half is paid in the following month The March 31 accounts payable balance is $12,000 April May June Quarter Accounts payables 3/31 Aprill purchases May purchases June Purchases Total cash disbursements Accounts payable at June 30 = Learning Objective 5: Prepare a direct labor budget Each unit of product requires 0.05 hours (3 minutes) of direct labor. The labor can be unskilled because the proeduction process is relatively simple and formal training is not required. Royal pays its workers at the rate of $10 per hour. April May June Quarter Units of production Direct labor time per unit Labor hours required Hourly wage rate Total direct labor costs Learning Objective G: Prepare a manufacturing overhead budget Manufacturing overhead (MOH) is applied to unites of product on the basis of direct labor hours. The variable manufacutring overhead rate is $20 per direct labor hour. Fixed manufacturing overhead is $50,000 per month, which includes $20,000 of noncash costs (primarily depreciation of plant assets) April May June Quarter Budgetted direct labor hours Variable MOH rate Variable MOH costs Fixed MOH costs Total MOH costs Less: noncash costs Cash disbursement for MOH MOH rate: - Total MOH for quarter / Total labor hours required - Ending finished goods inventory budget Production costs per unit Quantity Cost Total