Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maython Manufacturers Limited (MML) is a resident company located in Jinja dealing in the manufacture of household items. The following is an extract of

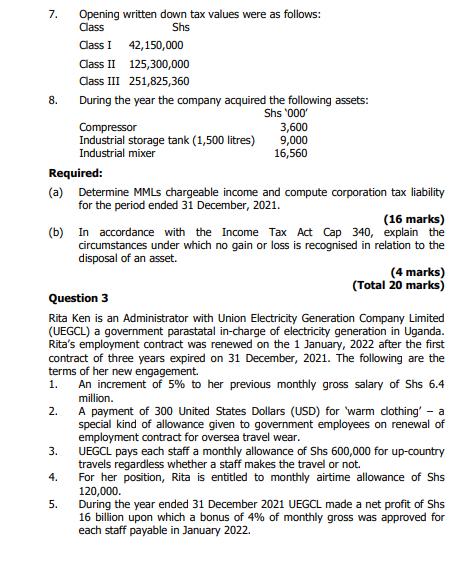

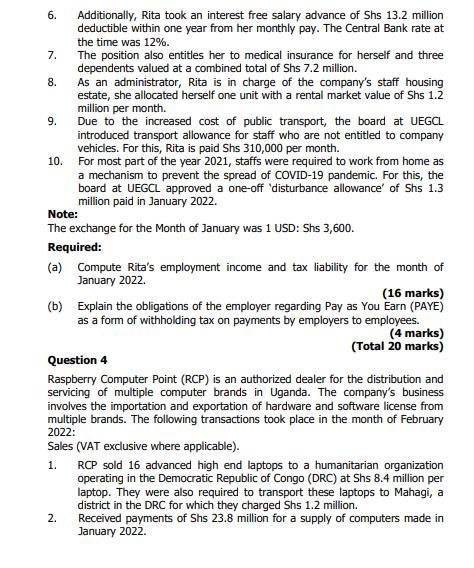

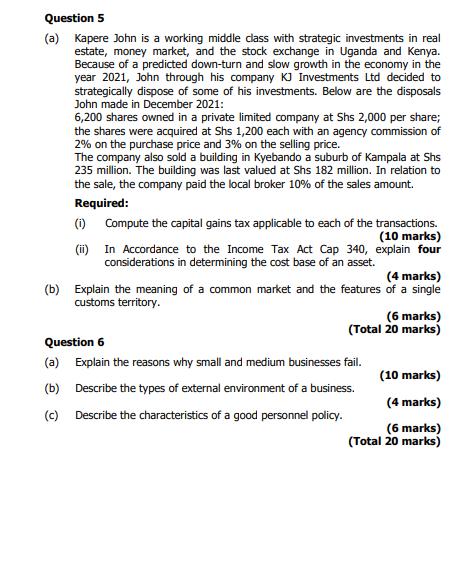

Maython Manufacturers Limited (MML) is a resident company located in Jinja dealing in the manufacture of household items. The following is an extract of MML's financial statements for the year ended 31 December, 2021: Notes Net revenue Cost of sales Gross profit Other income Distribution costs Administrative expenses Donations Provision for bad and doubtful debts Depreciation Operating profit Finance costs Profit before tax 1. 2. 3. 4. 2 6345 (b) (c) 5 Additional Information: MML carried forward assessed tax loss of Shs 16.2 million from the previous financial year. Included in the cost of sales is Shs 16.2 million spent on designing, branding, and installing display racks at two supermarkets in Kampala. Distribution costs included Shs 32 million used to purchase and brand a distribution van. Shs '000' 578,726 (315,947) 262,779 52,034 (57,611) (87,256) (3,600) (3,120) (12,558) 150,668 (8,140) 142,528 Administrative expenses include: (a) 5% NSSF employee contribution of Shs 23.4 million which was already expensed under salaries and wages. A gift of Shs 1.5 million to the best marketer for the year. Activate Payment in advance to a local Radio Station for adverts to be aired 7. 8. 2. Opening written down tax values were as follows: Class Shs Class I 42,150,000 Class II 125,300,000 Class III 251,825,360 Required: (a) Determine MMLS chargeable income and compute corporation tax liability for the period ended 31 December, 2021. 3. During the year the company acquired the following assets: Shs '000' (16 marks) (b) In accordance with the Income Tax Act Cap 340, explain the circumstances under which no gain or loss is recognised in relation to the disposal of an asset. 4. Compressor Industrial storage tank (1,500 litres) Industrial mixer 5. 3,600 9,000 16,560 Question 3 Rita Ken is an Administrator with Union Electricity Generation Company Limited (UEGCL) a government parastatal in-charge of electricity generation in Uganda. Rita's employment contract was renewed on the 1 January, 2022 after the first contract of three years expired on 31 December, 2021. The following are the terms of her new engagement. 1. An increment of 5% to her previous monthly gross salary of Shs 6.4 million. A payment of 300 United States Dollars (USD) for warm clothing' - a special kind of allowance given to government employees on renewal of employment contract for oversea travel wear. (4 marks) (Total 20 marks) UEGCL pays each staff a monthly allowance of Shs 600,000 for up-country travels regardless whether a staff makes the travel or not. For her position, Rita is entitled to monthly airtime allowance of Shs 120,000. During the year ended 31 December 2021 UEGCL made a net profit of Shs 16 billion upon which a bonus of 4% of monthly gross was approved for each staff payable in January 2022. 6. 7. The position also entitles her to medical insurance for herself and three dependents valued at a combined total of Shs 7.2 million. As an administrator, Rita is in charge of the company's staff housing estate, she allocated herself one unit with a rental market value of Shs 1.2 million per month. Due to the increased cost of public transport, the board at UEGCL introduced transport allowance for staff who are not entitled to company vehicles. For this, Rita is paid Shs 310,000 per month. 10. For most part of the year 2021, staffs were required to work from home as a mechanism to prevent the spread of COVID-19 pandemic. For this, the board at UEGCL approved a one-off 'disturbance allowance' of Shs 1.3 million paid in January 2022. 8. 9. Additionally, Rita took an interest free salary advance of Shs 13.2 million deductible within one year from her monthly pay. The Central Bank rate at the time was 12%. Note: The exchange for the Month of January was 1 USD: Shs 3,600. Required: (a) Compute Rita's employment income and tax liability for the month of January 2022. (b) (16 marks) Explain the obligations of the employer regarding Pay as You Earn (PAYE) as a form of withholding tax on payments by employers to employees. (4 marks) (Total 20 marks) Question 4 Raspberry Computer Point (RCP) is an authorized dealer for the distribution and servicing of multiple computer brands in Uganda. The company's business involves the importation and exportation of hardware and software license from multiple brands. The following transactions took place in the month of February 2022: Sales (VAT exclusive where applicable). 1. 2. RCP sold 16 advanced high end laptops to a humanitarian organization operating in the Democratic Republic of Congo (DRC) at Shs 8.4 million per laptop. They were also required to transport these laptops to Mahagi, a district in the DRC for which they charged Shs 1.2 million. Received payments of Shs 23.8 million for a supply of computers made in January 2022. Question 5 (a) Kapere John is a working middle class with strategic investments in real estate, money market, and the stock exchange in Uganda and Kenya. Because of a predicted down-turn and slow growth in the economy in the year 2021, John through his company KJ Investments Ltd decided to strategically dispose of some of his investments. Below are the disposals John made in December 2021: 6,200 shares owned in a private limited company at Shs 2,000 per share; the shares were acquired at Shs 1,200 each with an agency commission of 2% on the purchase price and 3% on the selling price. The company also sold a building in Kyebando a suburb of Kampala at Shs 235 million. The building was last valued at Shs 182 million. In relation to the sale, the company paid the local broker 10% of the sales amount. Required: (i) Compute the capital gains tax applicable to each of the transactions. (10 marks) (ii) In Accordance to the Income Tax Act Cap 340, explain four considerations in determining the cost base of an asset. (4 marks) (b) Explain the meaning of a common market and the features of a single customs territory. (6 marks) (Total 20 marks) Question 6 (a) Explain the reasons why small and medium businesses fail. (10 marks) (4 marks) (6 marks) (Total 20 marks) (b) Describe the types of external environment of a business. (c) Describe the characteristics of a good personnel policy.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

b Associate in relation to a person means any other person who acts or is likely to act in accordance with the directions requests suggestions or wishes of the person whether or not they are communica...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started