Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September22, 2020, Danimoved from Montral to Toronto to start a new job. Details relating to his move are as follows: Dani found a

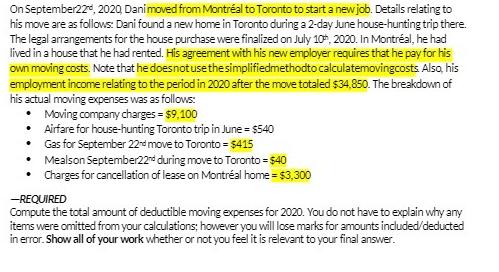

On September22, 2020, Danimoved from Montral to Toronto to start a new job. Details relating to his move are as follows: Dani found a new home in Toronto during a 2-day June house-hunting trip there. The legal arrangements for the house purchase were finalized on July 10, 2020. In Montral, he had lived in a house that he had rented. His agreement with his new employer requires that he pay for his own moving costs. Note that he does not use the simplifiedmethodto calculatemovingcosts. Also, his employment income relating to the period in 2020 after the move totaled $34,850. The breakdown of his actual moving expenses was as follows: Moving company charges = $9,100 Airfare for house-hunting Toronto trip in June = $540 Gas for September 22nd move to Toronto = $415 Mealson September22nd during move to Toronto = $40 Charges for cancellation of lease on Montral home = $3,300 -REQUIRED Compute the total amount of deductible moving expenses for 2020. You do not have to explain why any items were omitted from your calculations; however you will lose marks for amounts included/deducted in error. Show all of your work whether or not you feel it is relevant to your final answer.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To be eligible for a deduction the moving expenses must meet the following conditions The expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started