Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MB STUDY UNISEX MBL5903 Module Overview_jun X C:/Users/daisy/Desktop/MBL5903%20Module%20Overview%20 June%202020.pdf 16 marks Question 8 Mr Patel has approached you for advice on how best to invest

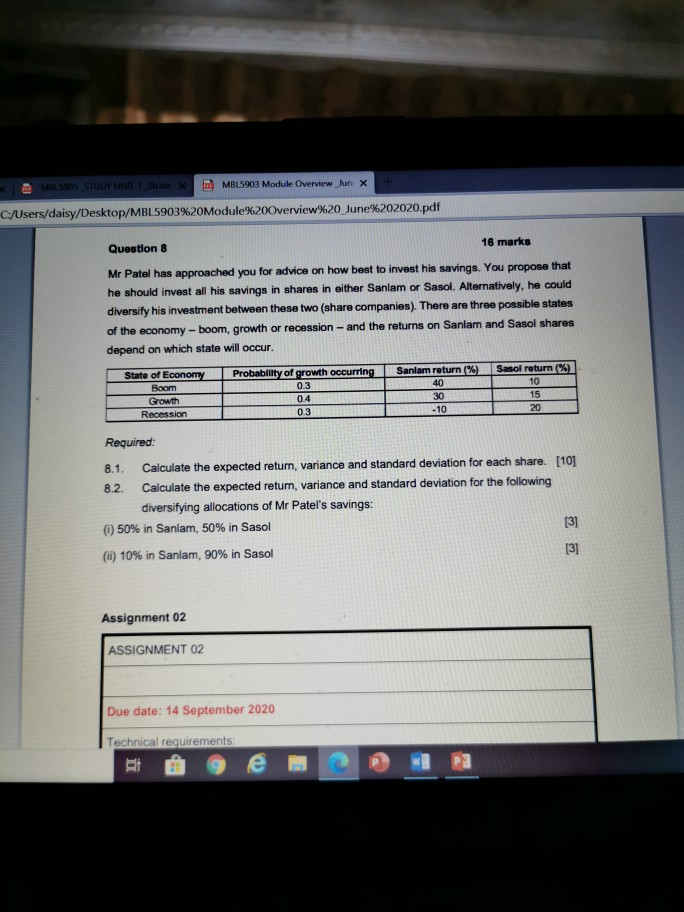

MB STUDY UNISEX MBL5903 Module Overview_jun X C:/Users/daisy/Desktop/MBL5903%20Module%20Overview%20 June%202020.pdf 16 marks Question 8 Mr Patel has approached you for advice on how best to invest his savings. You propose that he should invest all his savings in shares in either Sanlam or Sasol. Alternatively, he could diversify his investment between these two (share companies). There are three possible states of the economy - boom, growth or recession - and the returns on Sanlam and Sasol shares depend on which state will occur. State of Economy Boom Growth Recession Probability of growth occurring 0.3 0.4 0.3 Sanlam return %) 40 30 -10 Sasol return (%) 10 15 20 Required: 8.1 Calculate the expected return, variance and standard deviation for each share. [10] 8.2. Calculate the expected return, variance and standard deviation for the following diversifying allocations of Mr Patel's savings: (50% in Sanlam, 50% in Sasol [3] (ii) 10% in Sanlam, 90% in Sasol [3] Assignment 02 ASSIGNMENT 02 Due date: 14 September 2020 Technical requirements: RI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started