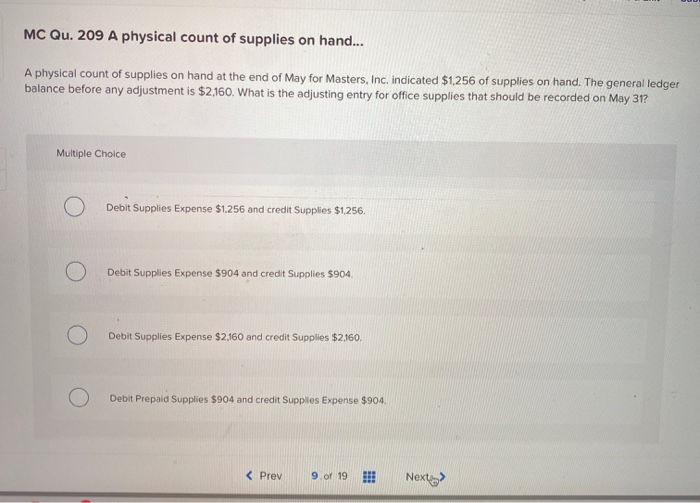

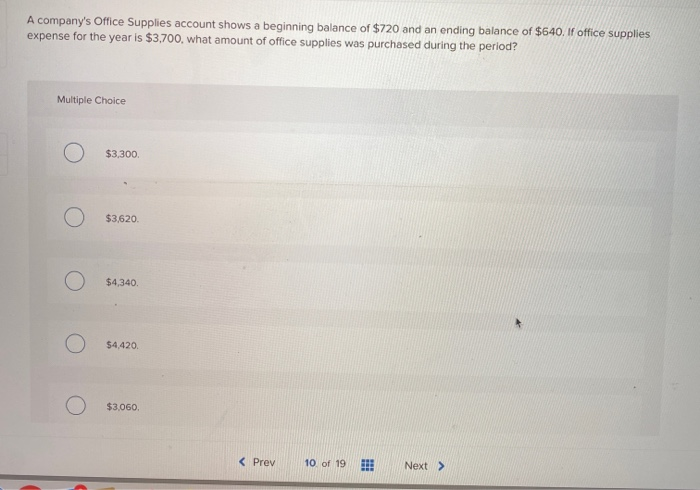

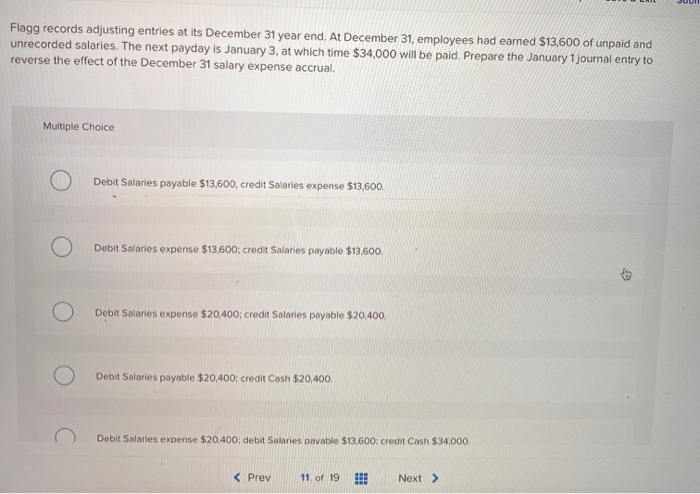

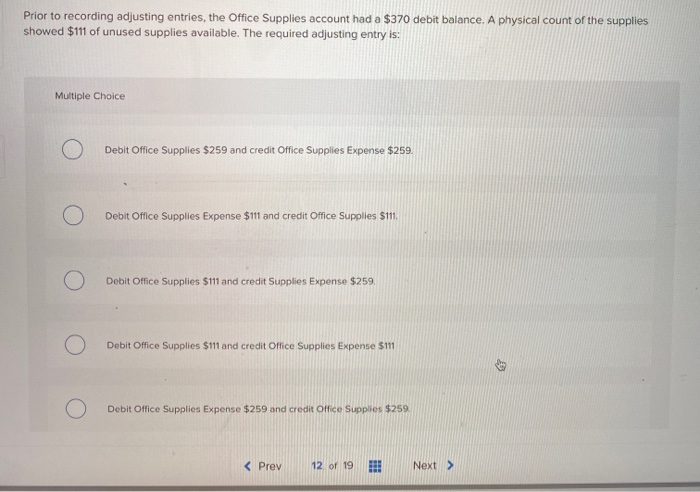

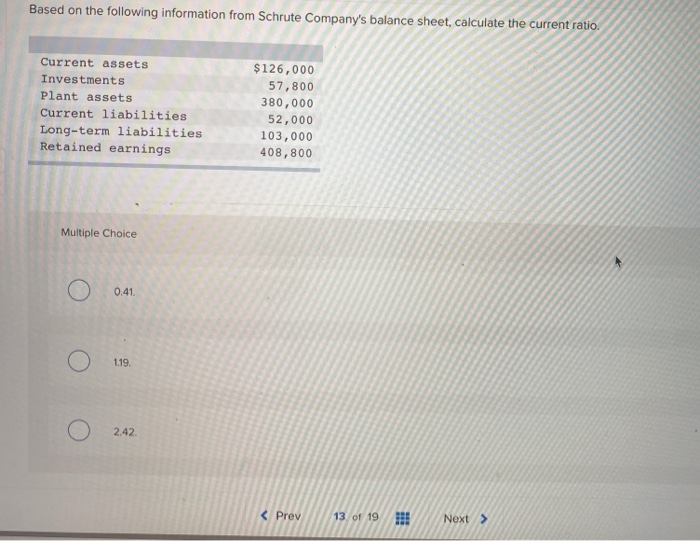

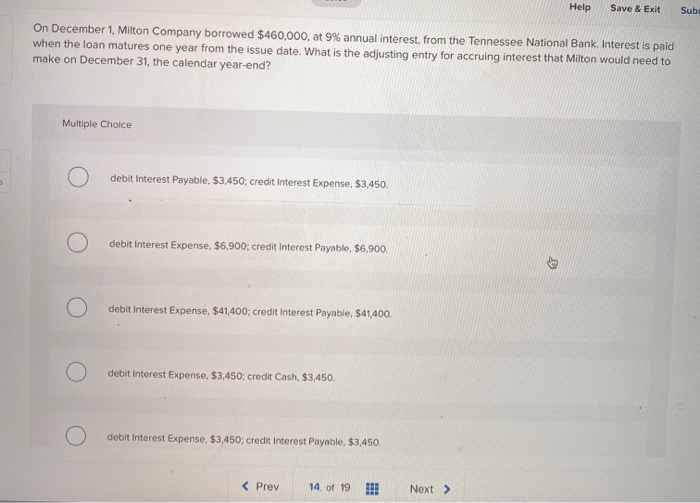

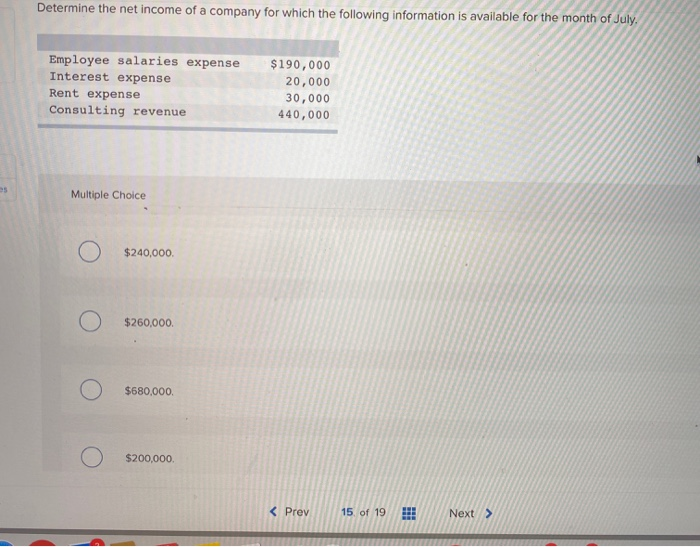

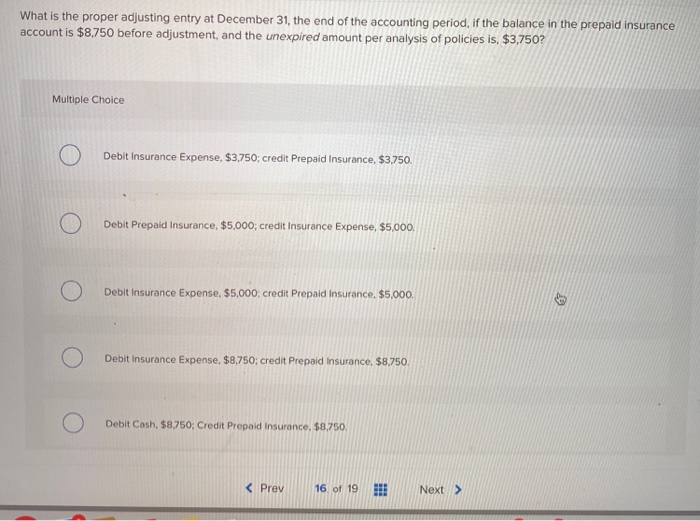

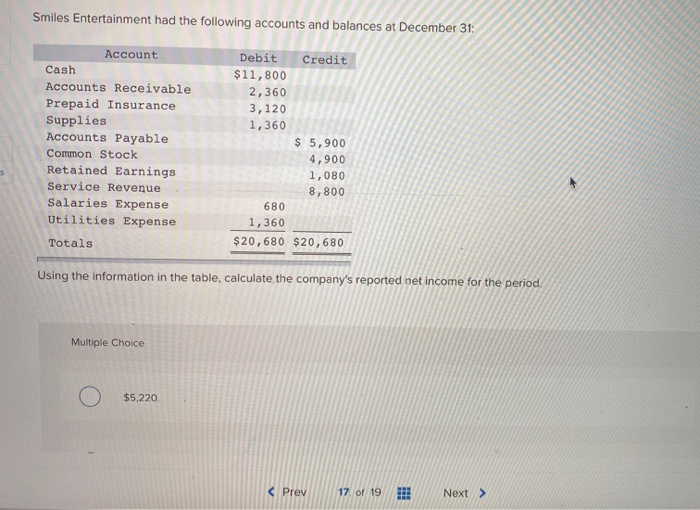

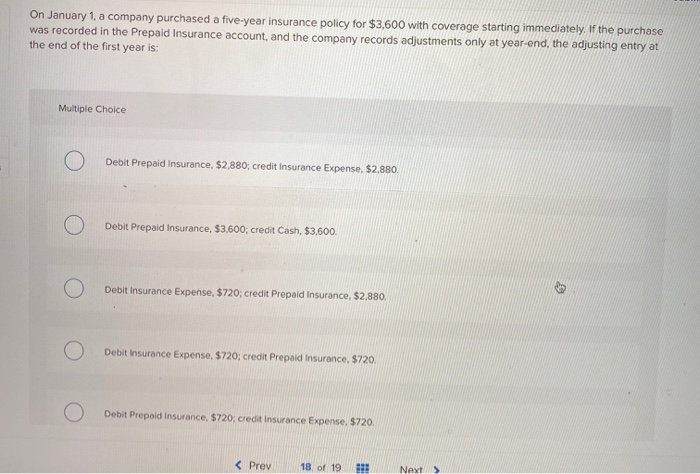

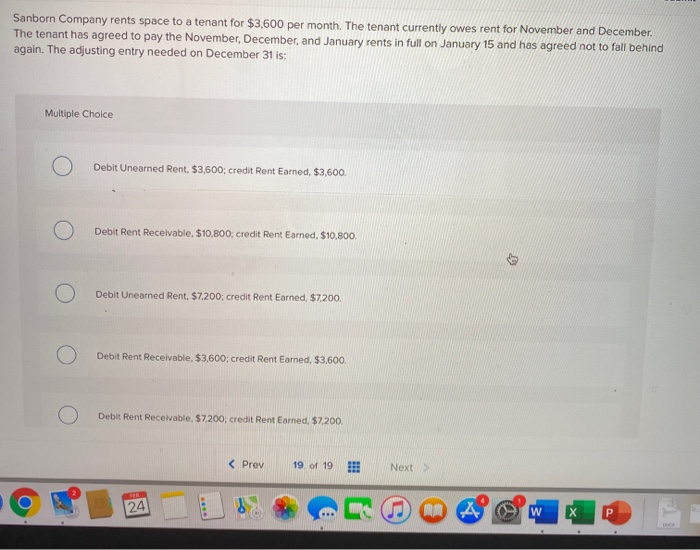

MC Qu. 209 A physical count of supplies on hand... A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,256 of supplies on hand. The general ledger balance before any adjustment is $2,160. What is the adjusting entry for office supplies that should be recorded on May 31? Multiple Choice Debit Supplies Expense $1.256 and credit Supplies $1.256 Debit Supplies Expense $904 and credit Supplies 5904 O Debit Supplies Expense $2.160 and credit Supplies $2160 O O Debit Prepaid Supplies $904 and credit Suppies Expense $904, O A company's Office Supplies account shows a beginning balance of $720 and an ending balance of $640. If office supplies expense for the year is $3,700, what amount of office supplies was purchased during the period? Multiple Choice Flagg records adjusting entries at its December 31 year end. At December 31, employees had earned $13,600 of unpaid and unrecorded salaries. The next payday is January 3, at which time $34,000 will be paid. Prepare the January 1 journal entry to reverse the effect of the December 31 salary expense accrual. Multiple Choice Debit Salaries payable $13,600, credit Salaries expense $13,600. Debit Salaries expense $13,600; credit Salaries payable $13,600. Debit Salaries expense $20,400; credit Salaries payable $20,400, 0 Debit Salaries payable $20,400; credit Cash $20,400. 0 C Debit Salaries expense $20.400; debit Salories pavable $13.600: credit Cash $34,000. Prior to recording adjusting entries, the Office Supplies account had a $370 debit balance. A physical count of the supplies showed $111 of unused supplies available. The required adjusting entry is: Multiple Choice O Debit Office Supplies $259 and credit Office Supplies Expense $259. 0 O Debit Office Supplies Expense $111 and credit Office Supplies $11. 0 C) Debit Office Supplies $111 and credit Supplies Expense $259. 0 C) Debit Office Supplies $111 and credit Office Supplies Expense $111 0 Debit Office Supplies Expense $259 and credit Office Supplies $259. Based on the following information from Schrute Company's balance sheet, calculate the current ratio Current assets Investments Plant assets Current liabilities Long-term liabilities Retained earnings $126,000 57,800 380,000 52,000 103,000 408,800 Multiple Choice O O O HP Save & SUD On December 1, Milton Company borrowed $460,000, at 9% annual interest, from the Tennessee National Bank. Interest is paid when the loan matures one year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year-end? Multiple Choice O debit Interest Payable, $3,450; credit Interest Expense, $3,450. debit interest Expense. $6,900, credit Interest Payable, $6,900. 0 debit interest Expense, $41,400; credit Interest Payable, $41,400. 0 debit interest Expense, $3,450: credit Cash, $3,450. 0 debit interest Expense. $3,450; credit Interest Payable, $3,450. 0 Determine the net income of a company for which the following information is available for the month of July. Employee salaries expense Interest expense Rent expense Consulting revenue $190,000 20,000 30,000 440,000 Multiple Choice $240,000. $260,000. $680.000. $200,000. What is the proper adjusting entry at December 31, the end of the accounting period, if the balance in the prepaid insurance account is $8,750 before adjustment, and the unexpired amount per analysis of policies is, $3,750? Multiple Choice O Debit Insurance Expense. $3,750, credit Prepaid Insurance, $3,750. 0 O Debit Prepaid Insurance, $5,000; credit Insurance Expense, $5,000. 0 Debit Insurance Expense, $5,000 credit Prepaid Insurance. $5,000 Debit insurance Expense, $8,750; credit Prepaid insurance. $8,750. 0 ) Debit Cash, $8.750; Credit Prepaid Insurance $8750. Smiles Entertainment had the following accounts and balances at December 31: Account Cash Accounts Receivable Prepaid Insurance Supplies Accounts Payable Common Stock Retained Earnings Service Revenue Salaries Expense Utilities Expense Totals Debit Credit $11,800 2,360 3,120 1,360 $ 5,900 4,900 1,080 8,800 680 1,360 $20,680 $20,680 Using the information in the table, calculate the company's reported net income for the period. Multiple Choice O $5,220 On January 1, a company purchased a five-year insurance policy for $3,600 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: Multiple Choice ) Debit Prepaid Insurance, $2,880; credit Insurance Expense. $2.880. O C) Debit Prepaid Insurance, $3,600, credit Cash, $3,600 O Debit insurance Expense, $720; credit Prepaid Insurance, $2,880. O Debit Insurance Expense, $720; credit Prepaid Insurance, 5720 O Debit Prepaid insurance, $720; credit insurance Expense. 5720 O Sanborn Company rents space to a tenant for $3,600 per month. The tenant currently owes rent for November and December. The tenant has agreed to pay the November, December, and January rents in full on January 15 and has agreed not to fall behind again. The adjusting entry needed on December 31 is: Multiple Choice O Debit Unearned Rent, $3,600; credit Rent Earned, $3,600. c ) Debit Rent Receivable. $10.800 credit Rent Earned, $10.800 O O Debit Unearned Rent, 57.200, credit Rent Earned $7.200. O Debit Rent Receivable, $3,600; credit Rent Earned, $3,600. O Debit Rent Receivable, $7.200; credit Rent Earned, $7.200 O ONECOS$113 MC Qu. 209 A physical count of supplies on hand... A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,256 of supplies on hand. The general ledger balance before any adjustment is $2,160. What is the adjusting entry for office supplies that should be recorded on May 31? Multiple Choice Debit Supplies Expense $1.256 and credit Supplies $1.256 Debit Supplies Expense $904 and credit Supplies 5904 O Debit Supplies Expense $2.160 and credit Supplies $2160 O O Debit Prepaid Supplies $904 and credit Suppies Expense $904, O A company's Office Supplies account shows a beginning balance of $720 and an ending balance of $640. If office supplies expense for the year is $3,700, what amount of office supplies was purchased during the period? Multiple Choice Flagg records adjusting entries at its December 31 year end. At December 31, employees had earned $13,600 of unpaid and unrecorded salaries. The next payday is January 3, at which time $34,000 will be paid. Prepare the January 1 journal entry to reverse the effect of the December 31 salary expense accrual. Multiple Choice Debit Salaries payable $13,600, credit Salaries expense $13,600. Debit Salaries expense $13,600; credit Salaries payable $13,600. Debit Salaries expense $20,400; credit Salaries payable $20,400, 0 Debit Salaries payable $20,400; credit Cash $20,400. 0 C Debit Salaries expense $20.400; debit Salories pavable $13.600: credit Cash $34,000. Prior to recording adjusting entries, the Office Supplies account had a $370 debit balance. A physical count of the supplies showed $111 of unused supplies available. The required adjusting entry is: Multiple Choice O Debit Office Supplies $259 and credit Office Supplies Expense $259. 0 O Debit Office Supplies Expense $111 and credit Office Supplies $11. 0 C) Debit Office Supplies $111 and credit Supplies Expense $259. 0 C) Debit Office Supplies $111 and credit Office Supplies Expense $111 0 Debit Office Supplies Expense $259 and credit Office Supplies $259. Based on the following information from Schrute Company's balance sheet, calculate the current ratio Current assets Investments Plant assets Current liabilities Long-term liabilities Retained earnings $126,000 57,800 380,000 52,000 103,000 408,800 Multiple Choice O O O HP Save & SUD On December 1, Milton Company borrowed $460,000, at 9% annual interest, from the Tennessee National Bank. Interest is paid when the loan matures one year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year-end? Multiple Choice O debit Interest Payable, $3,450; credit Interest Expense, $3,450. debit interest Expense. $6,900, credit Interest Payable, $6,900. 0 debit interest Expense, $41,400; credit Interest Payable, $41,400. 0 debit interest Expense, $3,450: credit Cash, $3,450. 0 debit interest Expense. $3,450; credit Interest Payable, $3,450. 0 Determine the net income of a company for which the following information is available for the month of July. Employee salaries expense Interest expense Rent expense Consulting revenue $190,000 20,000 30,000 440,000 Multiple Choice $240,000. $260,000. $680.000. $200,000. What is the proper adjusting entry at December 31, the end of the accounting period, if the balance in the prepaid insurance account is $8,750 before adjustment, and the unexpired amount per analysis of policies is, $3,750? Multiple Choice O Debit Insurance Expense. $3,750, credit Prepaid Insurance, $3,750. 0 O Debit Prepaid Insurance, $5,000; credit Insurance Expense, $5,000. 0 Debit Insurance Expense, $5,000 credit Prepaid Insurance. $5,000 Debit insurance Expense, $8,750; credit Prepaid insurance. $8,750. 0 ) Debit Cash, $8.750; Credit Prepaid Insurance $8750. Smiles Entertainment had the following accounts and balances at December 31: Account Cash Accounts Receivable Prepaid Insurance Supplies Accounts Payable Common Stock Retained Earnings Service Revenue Salaries Expense Utilities Expense Totals Debit Credit $11,800 2,360 3,120 1,360 $ 5,900 4,900 1,080 8,800 680 1,360 $20,680 $20,680 Using the information in the table, calculate the company's reported net income for the period. Multiple Choice O $5,220 On January 1, a company purchased a five-year insurance policy for $3,600 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: Multiple Choice ) Debit Prepaid Insurance, $2,880; credit Insurance Expense. $2.880. O C) Debit Prepaid Insurance, $3,600, credit Cash, $3,600 O Debit insurance Expense, $720; credit Prepaid Insurance, $2,880. O Debit Insurance Expense, $720; credit Prepaid Insurance, 5720 O Debit Prepaid insurance, $720; credit insurance Expense. 5720 O Sanborn Company rents space to a tenant for $3,600 per month. The tenant currently owes rent for November and December. The tenant has agreed to pay the November, December, and January rents in full on January 15 and has agreed not to fall behind again. The adjusting entry needed on December 31 is: Multiple Choice O Debit Unearned Rent, $3,600; credit Rent Earned, $3,600. c ) Debit Rent Receivable. $10.800 credit Rent Earned, $10.800 O O Debit Unearned Rent, 57.200, credit Rent Earned $7.200. O Debit Rent Receivable, $3,600; credit Rent Earned, $3,600. O Debit Rent Receivable, $7.200; credit Rent Earned, $7.200 O ONECOS$113