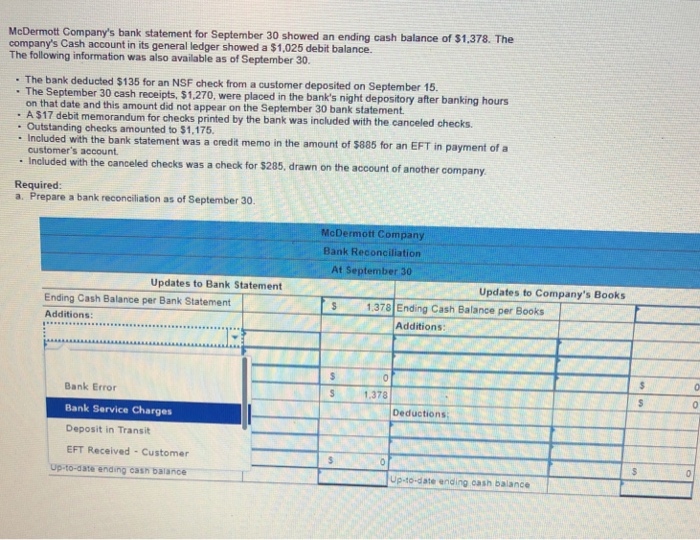

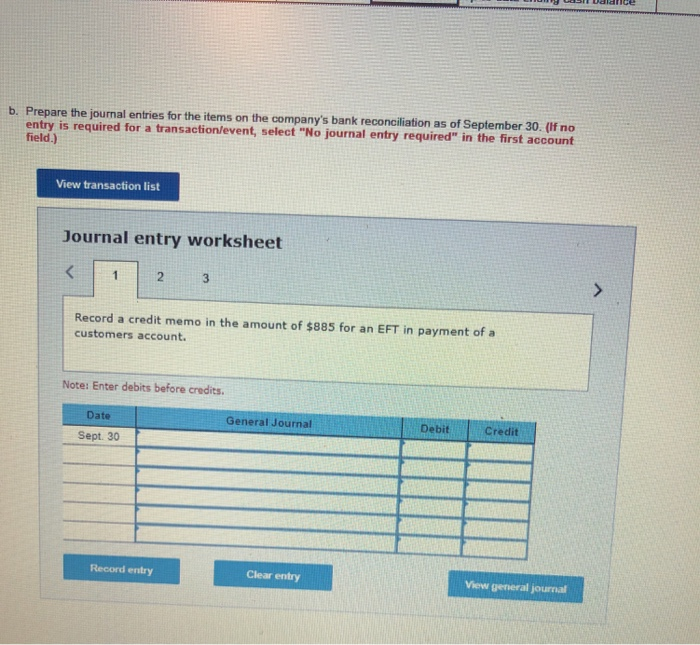

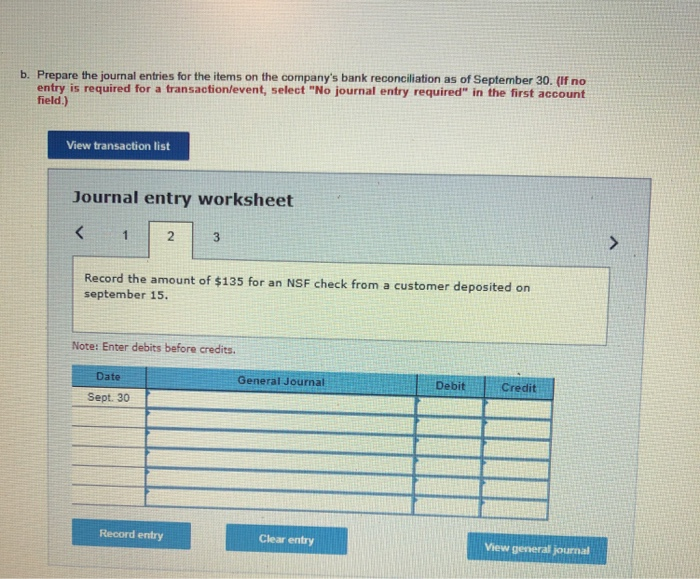

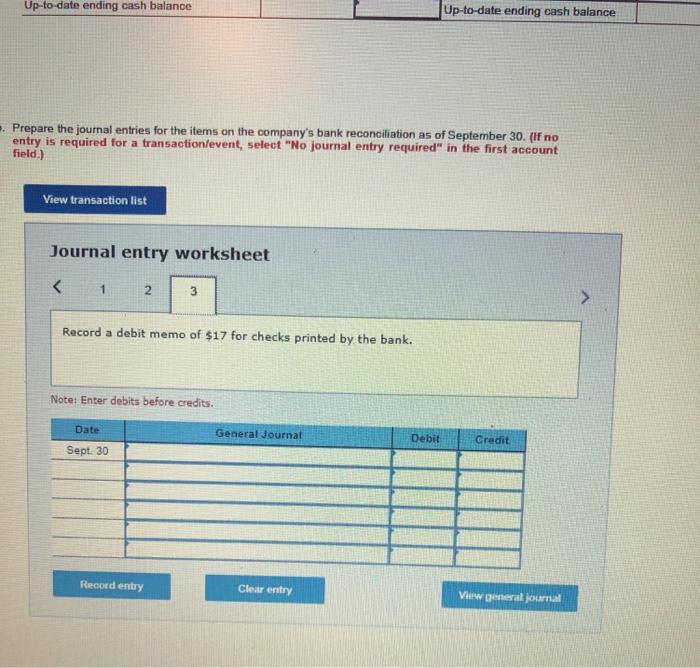

McDermott Company's bank statement for September 30 showed an ending cash balance of $1,378. The company's Cash account in its general ledger showed a $1,025 debit balance. The following information was also available as of September 30. - The bank deducted $135 for an NSF check from a customer deposited on September 15. ber 30 cash receipts, $1,270, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the September 30 bank statement : A $17 debit memorandum for checks printed by the bank was included with the canceled checks. Outstanding checks amounted to $1,175. Included with the bank statement was a credit memo in the amount of $885 for an EFT in payment of a Included with the canceled checks was a check for $285, drawn on the account of another compan Required: customer's account a. Prepare a bank reconciliaton as of September 30. McDermott Company Bank Reconciliation At September 30 Updates to Company's Books Updates to Bank Statement 31.370 Ending Cash Balsnce per Beoks Ending Cash Balance per Bank Statement Additions Additions Bank Error Bank Service Charges Deposit in Transit EFT Received Customer 1,378 Deductions Up-to-date ending cash balance Up-to-date ending cash balance b. Prepare the journal entries for the items on the company's bank reconciliation as of September 30. (lf no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record a credit memo in the amount of $885 for an EFT in payment of a customers account. Note: Enter debits before credits Debit Credit General Journal Date Sept. 30 Clear entry Record entry View general journal b. Prepare the journal entries for the items on the company's bank reconciliation as of September 30. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the amount of $135 for an NSF check from a customer deposited on september 15. Note: Enter debits before credits. Debit Credit Date General Journal Sept. 30 Record entry Clear entry View general journal Up-to-date ending cash balance Up-to-date ending cash balance Prepare the journal entries for the items on the company's bank reconciliation as of September 30. (lf no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record a debit memo of $17 for checks printed by the bank. Note: Enter debits before credits. Date General Journal Credit Debit Sept. 30 Clear entry Record entry View general journal