Question

(MCQ) THE FOLLOWING INFORMATION APPLIES FOR QUESTION 1 TO 15: You are required to calculate the following: 1. Opening capital A 158,042 B 163,042 C

(MCQ) THE FOLLOWING INFORMATION APPLIES FOR QUESTION 1 TO 15:

You are required to calculate the following:

1. Opening capital

A 158,042

B 163,042

C 163,242

D 162,242

2. Credit sales for the year:

A 69,856

B 44,400

C 41,736

D 28,120

3. Total sales for the year

A 72,520

B 75,184

C 66,859

D 69,856

4. Credit purchase for the year

A 59,448

B 59,198

C 56,832

D 48,973

5. Total purchases for the year

A 63,298

B 63,048

C 66,648

D 25,495

6. Cost of goods sold is

A 54,390

B 56,388

C 52,392

D 53,192

7. Gross profit for the year is

A 18,130

B 18,796

C 16,714

D 17,464

8. Insurance expenses in Statement of Profit or Loss should be

A 2,000

B 1,880

C 2,040

D 1,960

9. Net profit for the year is

A 5,559

B 5,874

C 5,859

D 5,574

10. Electricity expenses in the Statement of Profit or Loss should be

A 1,499

B 220

C 20

D 2,878

11. Rental income in the Statement of Profit or Loss should be

A 6,600

B 6,000

C 6,700

D 14,837

12. Depreciation for furniture for the current year is

A 3,000

B 3,097.50

C 3,120

D 3,075

13. Total net book value of non-current asset at the end of the year is

A 100,450

B 85,255

C 85,382.50

D 99,800

14. Total drawings for the year

A 150

B 250

C 100

D 400

15. Capital at the end of the year

A 168,501

B 171,531

C 171,831

D 168,831

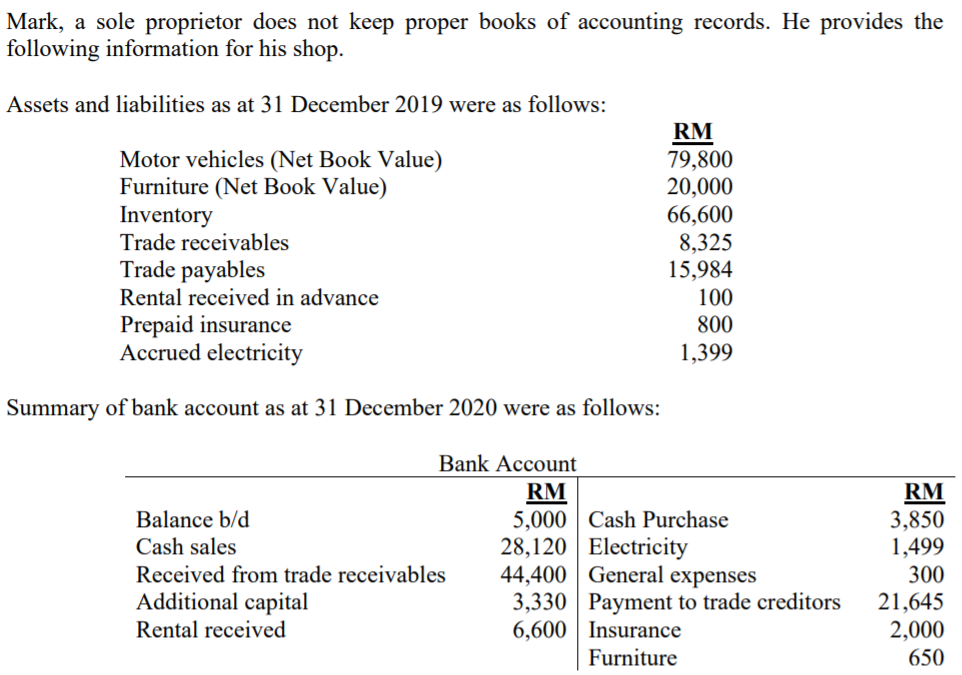

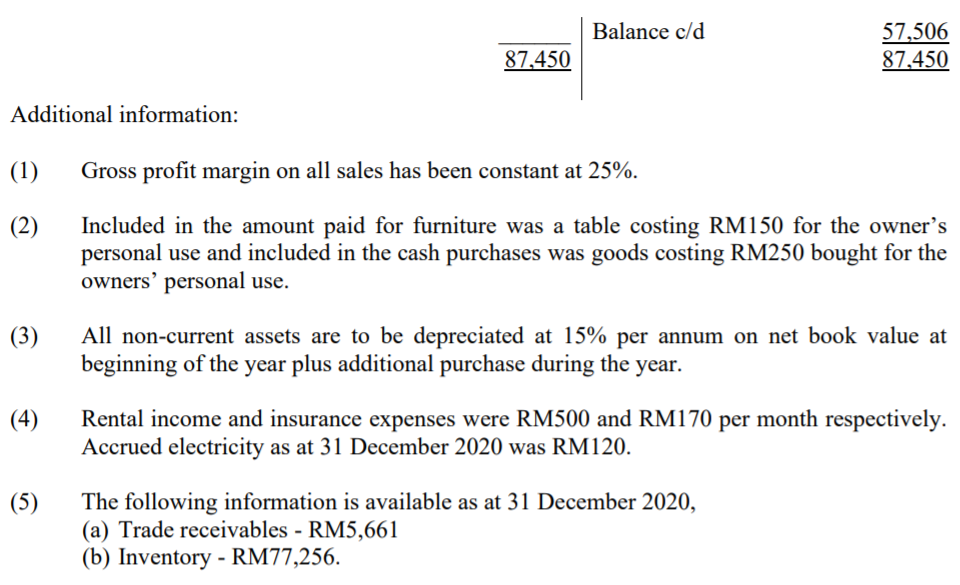

Mark, a sole proprietor does not keep proper books of accounting records. He provides the following information for his shop. Assets and liabilities as at 31 December 2019 were as follows: Motor vehicles (Net Book Value) Furniture (Net Book Value) Inventory Trade receivables Trade payables Rental received in advance Prepaid insurance Accrued electricity RM 79,800 20,000 66,600 8,325 15,984 100 800 1,399 Summary of bank account as at 31 December 2020 were as follows: Bank Account RM Balance b/d 5,000 Cash Purchase Cash sales 28,120 Electricity Received from trade receivables 44,400 General expenses Additional capital 3,330 Payment to trade creditors Rental received 6,600 Insurance Furniture RM 3,850 1,499 300 21,645 2,000 650 Balance c/d 57,506 87,450 87,450 Additional information: (1) Gross profit margin on all sales has been constant at 25%. (2) Included in the amount paid for furniture was a table costing RM150 for the owner's personal use and included in the cash purchases was goods costing RM250 bought for the owners' personal use. (3) All non-current assets are to be depreciated at 15% per annum on net book value at beginning of the year plus additional purchase during the year. (4) Rental income and insurance expenses were RM500 and RM170 per month respectively. Accrued electricity as at 31 December 2020 was RM120. (5) The following information is available as at 31 December 2020, (a) Trade receivables - RM5,661 (b) Inventory - RM77,256Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started