Question

MD Cosmetics is a leading importer and distributor of drugstore cosmetic brands. They use the perpetual inventory system. They want to calculate the cost of

MD Cosmetics is a leading importer and distributor of drugstore cosmetic brands. They use the perpetual inventory system.

They want to calculate the cost of goods sold and the value of their ending inventory using each of the following methods:

a) First In First Out (FIFO)

b) Last In First Out (LIFO)

c) Weighted Average (WA)

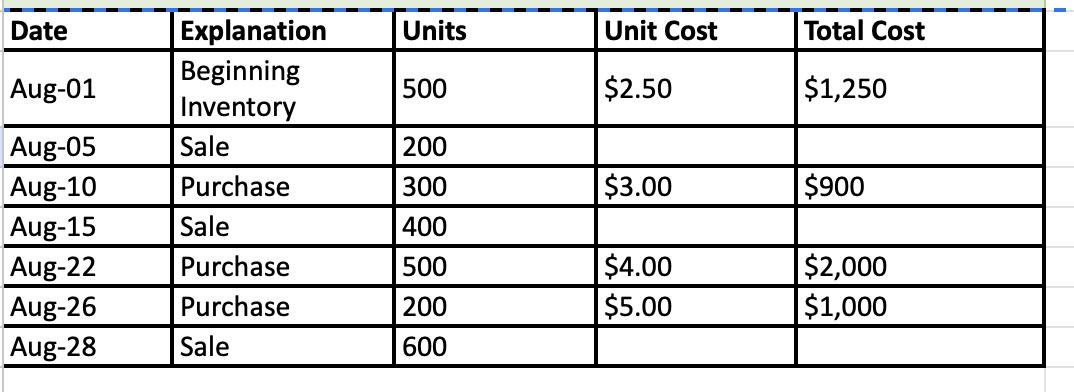

Use the information below along with the tables provided in Excel for each method.

CMD Cosmetics currently uses the Last In First Out (LIFO) method for inventory as they believe it will ensure that they would deliver products that are most in trend and promoted in the market to their customers but realise that the cost of goods sold is the highest under this method.

The most important thing for their customers is price. In addition, cosmetics need to be stored correctly (cool and dry place) and have a shelf life of mainly 12-18 months.

CMD would like to lower down their storage costs. They are wondering if there might be a better method given the nature of their business.

Identify the method that is appropriate to account for inventory in this case, justifying why the method you have identified is appropriate.

Date Aug-01 Aug-05 Aug-10 Aug-15 Aug-22 Aug-26 Aug-28 Explanation Beginning Inventory Sale Purchase Sale Purchase Purchase Sale Units 500 200 300 400 500 200 600 Unit Cost $2.50 $3.00 $4.00 $5.00 Total Cost $1,250 $900 $2,000 $1,000

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided I will help determine the cost of goods sold COGS and ending inventory using FIFO LIFO and WA methods Then we can discuss which method might be more appropriate for M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started