Question

Thanksgiving Inc. had three products in its ending inventory at December 31, 2016. Turkey has a profit margin of 15% of the sales price and

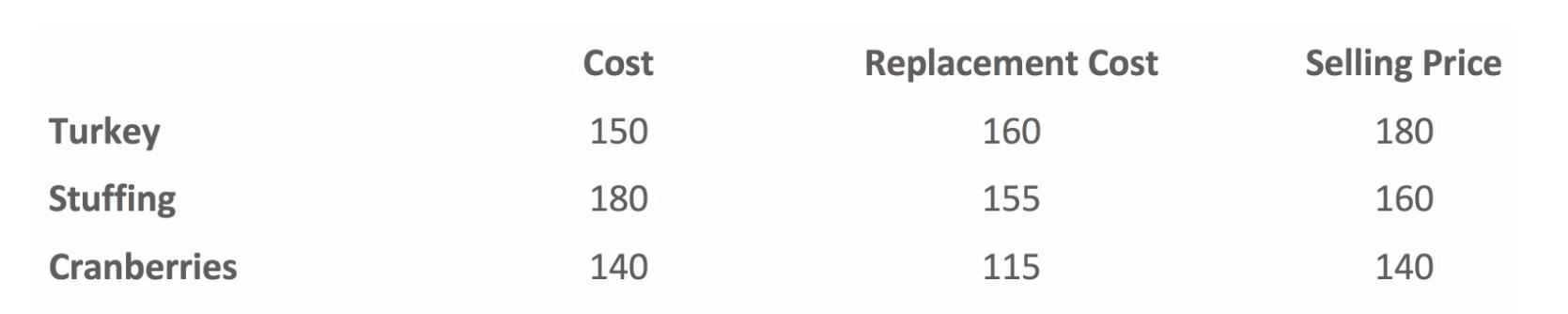

Thanksgiving Inc. had three products in its ending inventory at December 31, 2016. Turkey has a profit margin of 15% of the sales price and a profit margin of 10% for both stuffing and cranberries. When Thanksgiving sells its products, it usually incurs selling costs equal to 5% of the selling price. The chart below gives further information about each product:

- Determine LCNRV for the Turkey, Stuffing, and Cranberries individually.

- What is the amount of the write-down required under U.S. GAAP?

- What is the amount of the write-down required under IFRS?

- If assessed on an overall (meal) basis, what would be the write-downs?

- How would your answer to a. change, if we got into a time machine and were talking about December 31, 2014?

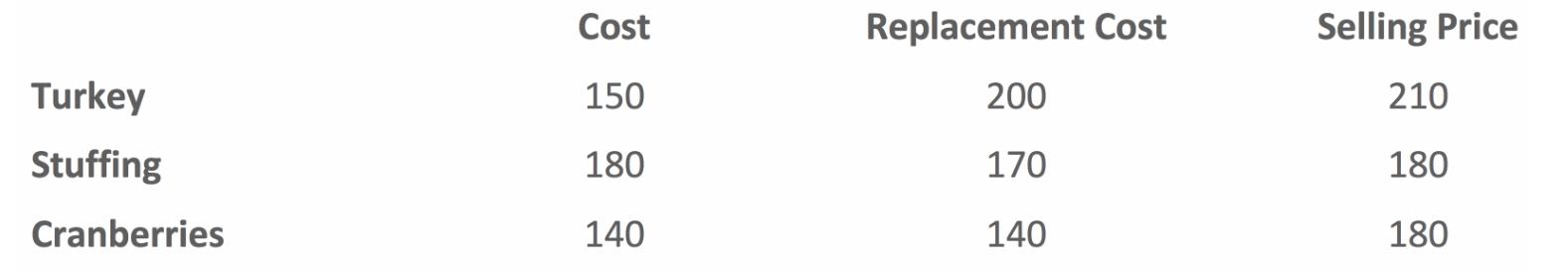

Thanks giving Still had the same three products in its inventory at December 31, 2017, described below:

Thanks giving still has a profit margin of 15% of the sales price and a profit margin of 10% for both stuffing and cranberries. When Thanksgiving sells its products, it usually incurs selling costs equal to 5% of the selling price. The chart below gives further information about each product:

- Using an item-by item basis, what is the amount of write-down reversal (if any) required using US GAAP?

- Using an item-by-item basis, what is the amount of write-down reversal (if any) required using IFRS?

- What are the necessary journal entries.

Turkey Stuffing Cranberries Cost 150 180 140 Replacement Cost 160 155 115 Selling Price 180 160 140

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions well walk through them step by step Its important to understand that the Lower of Cost or Net Realizable Value LCNRV rule requires that inventories are stated at the lower of c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started