Answered step by step

Verified Expert Solution

Question

1 Approved Answer

me etsu MEIR signments cussions des ple S bus zes ules borations 365 . te Syllabus Question 1 2 pts For next 4 Questions.

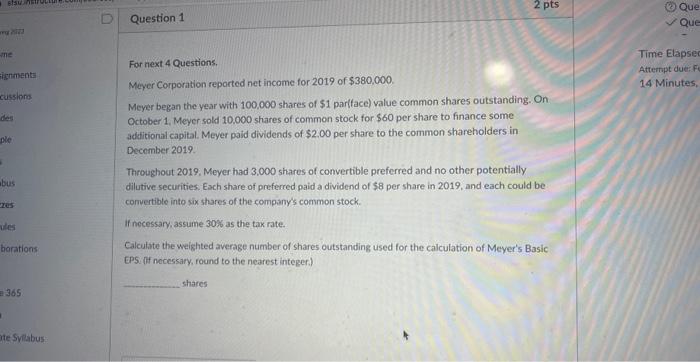

me etsu MEIR signments cussions des ple S bus zes ules borations 365 . te Syllabus Question 1 2 pts For next 4 Questions. Meyer Corporation reported net income for 2019 of $380,000. Meyer began the year with 100,000 shares of $1 par(face) value common shares outstanding. On October 1, Meyer sold 10,000 shares of common stock for $60 per share to finance some additional capital. Meyer paid dividends of $2.00 per share to the common shareholders in December 2019. Throughout 2019, Meyer had 3,000 shares of convertible preferred and no other potentially dilutive securities. Each share of preferred paid a dividend of $8 per share in 2019, and each could be convertible into six shares of the company's common stock. If necessary, assume 30% as the tax rate. Calculate the weighted average number of shares outstanding used for the calculation of Meyer's Basic EPS. (if necessary, round to the nearest integer.) shares Que Que Time Elapsed Attempt due: Fu 14 Minutes,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a question related to the calculation of the weighted average number of shares outst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started