Measurement Period

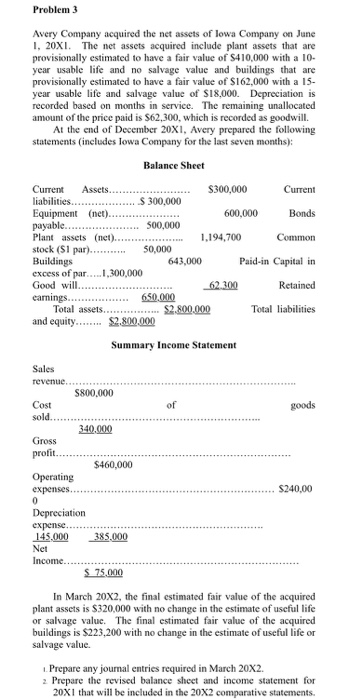

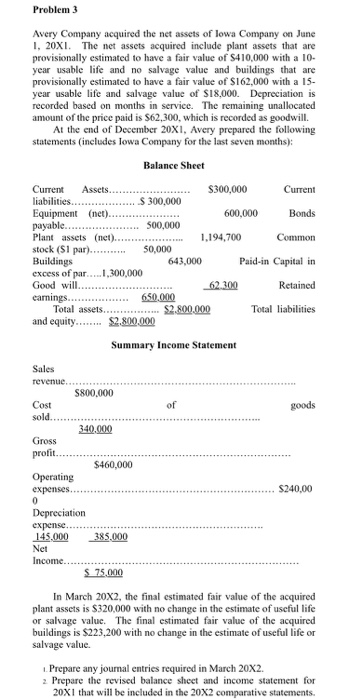

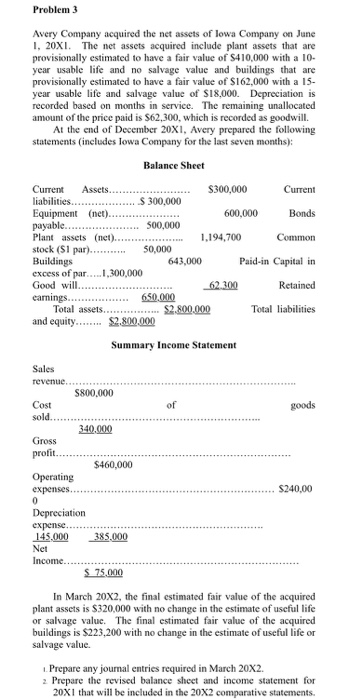

Problem 3 Avery Company acquired the net assets of lowa Company on June , 20XI The net assets acquired include plant assets that are provisionally estimated to have a fair value of $410,,000 with a 10 year usable life and no salvage value and buildings that are provisionally estimated to have a fair value of $162,000 with a 15- year usable life and salvage value of $18,000. Depreciation is recorded based on months in service. The remaining unallocated amount of the price paid is S62,300, which is recorded as goodwill. At the end of December 20X1, Avery prepared the following statements (includes lowa Company for the last seven months): Balance Sheet Assets Current liabilities Equipment (net) payable Plant assets (net).. stock (S1 par). Buildings excess of par..1,300,000 Good will. S300,000 Current $ 300,000 600,000 Bonds 500,000 1,194,700 Common 50,000 Paid-in Capital in 643,000 62.300 Retained 650,000 $2.800,000 earnings... Total assets and equity.. Total liabilities $2.800,000 Summary Income Statement Sales revenue. S800,000 Cost sold.. of goods 340,000 Gross profit $460,000 Operating expenses.. $240,00 0 Depreciation xpense.. 145.000 385,000 Net Income S 75,000 In March 20X2, the final estimated fair value of the acquired plant assets is $320.000 with no change in the estimate of useful life or salvage value. The final estimated fair value of the acquired buildings is $223,200 with no change in the estimate of useful life or salvage value. Prepare any journal entries required in March 20X2 2 Prepare the revised balance sheet and income statement for 20X1 that will be included in the 20X2 comparative statements. Problem 3 Avery Company acquired the net assets of lowa Company on June , 20XI The net assets acquired include plant assets that are provisionally estimated to have a fair value of $410,,000 with a 10 year usable life and no salvage value and buildings that are provisionally estimated to have a fair value of $162,000 with a 15- year usable life and salvage value of $18,000. Depreciation is recorded based on months in service. The remaining unallocated amount of the price paid is S62,300, which is recorded as goodwill. At the end of December 20X1, Avery prepared the following statements (includes lowa Company for the last seven months): Balance Sheet Assets Current liabilities Equipment (net) payable Plant assets (net).. stock (S1 par). Buildings excess of par..1,300,000 Good will. S300,000 Current $ 300,000 600,000 Bonds 500,000 1,194,700 Common 50,000 Paid-in Capital in 643,000 62.300 Retained 650,000 $2.800,000 earnings... Total assets and equity.. Total liabilities $2.800,000 Summary Income Statement Sales revenue. S800,000 Cost sold.. of goods 340,000 Gross profit $460,000 Operating expenses.. $240,00 0 Depreciation xpense.. 145.000 385,000 Net Income S 75,000 In March 20X2, the final estimated fair value of the acquired plant assets is $320.000 with no change in the estimate of useful life or salvage value. The final estimated fair value of the acquired buildings is $223,200 with no change in the estimate of useful life or salvage value. Prepare any journal entries required in March 20X2 2 Prepare the revised balance sheet and income statement for 20X1 that will be included in the 20X2 comparative statements