Answered step by step

Verified Expert Solution

Question

1 Approved Answer

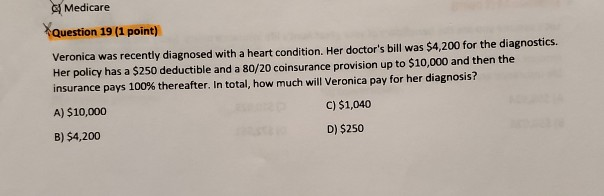

Medicale Question 19 (1 point) Veronica was recently diagnosed with a heart condition. Her doctor's bill was $4,200 for the diagnostics Her policy has a

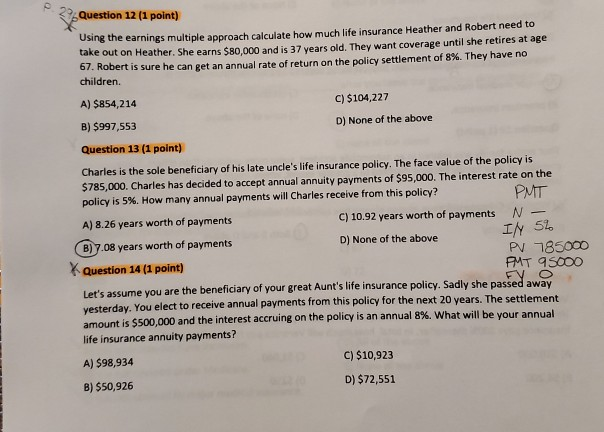

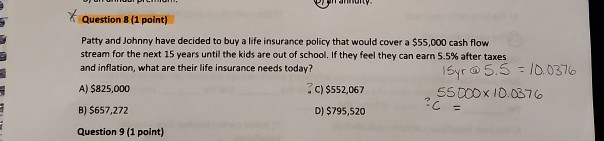

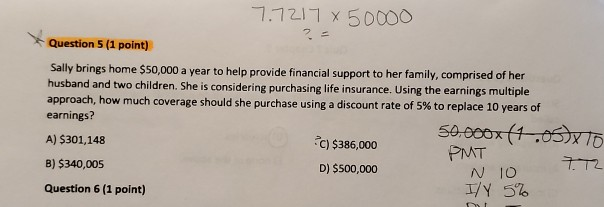

Medicale Question 19 (1 point) Veronica was recently diagnosed with a heart condition. Her doctor's bill was $4,200 for the diagnostics Her policy has a $250 deductible and a 80/20 coinsurance provision up to $10,000 and then the insurance pays 100% thereafter. In total, how much will Veronica pay for her diagnosis? A) $10,000 C) $1,040 B) $4,200 D) $250 Question 12 (1 point) Using the earnings multiple approach calculate how much life insurance Heather and Robert need to take out on Heather. She earns $80.000 and is 37 vears old. They want coverage until she retires at age 67. Robert is sure he can get an annual rate of return on the policy settlement of 8%. They have no children. A) $854,214 C) $104,227 B) $997,553 D) None of the above Question 13 (1 point) Charles is the sole beneficiary of his late uncle's life insurance policy. The face value of the policy is $785,000. Charles has decided to accept annual annuity payments of $95,000. The interest rate on the policy is 5%. How many annual payments will Charles receive from this policy? A) 8.26 years worth of payments C) 10.92 years worth of payments N- B) 7.08 years worth of payments D) None of the above I/H 5% PV 785000 Question 14 (1 point) AMT 95000 Let's assume you are the beneficiary of your great Aunt's life insurance policy. Sadly she passed away vesterday. You elect to receive annual payments from this policy for the next 20 years. The settlement amount is $500,000 and the interest accruing on the policy is an annual 8%. What will be your annual life insurance annuity payments? PMT A) $98,934 C) $10,923 D) $72,551 B) $50,926 Pildi. * Question 8 (1 point) Patty and Johnny have decided to buy a life insurance policy that would cover a $55,000 cash flow stream for the next 15 years until the kids are out of school. If they feel they can earn 5.5% after taxes and inflation, what are their life insurance needs today? 15yr @5.5 =10.0376 A) $825,000 C) $552,067 55000X 10.0376 B) $657,272 D) $795,520 -C Question 9 (1 point) 7.7217 x 50000 Question 5 (1 point) Sally brings home $50,000 a year to help provide financial support to her family, comprised of her husband and two children. She is considering purchasing life insurance. Using the earnings multiple approach, how much coverage should she purchase using a discount rate of 5% to replace 10 years of earnings? 50.000x4.05 X 15 A) $301,148 C)$386,000 PMT B) $340,005 D) $500,000 Question 6 (1 point) I/Y 5% N 10 7.72

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started