Question

Context & Background In this activity, you'll once again encounter a situation akin to the one you faced with the balance sheet, but now, the

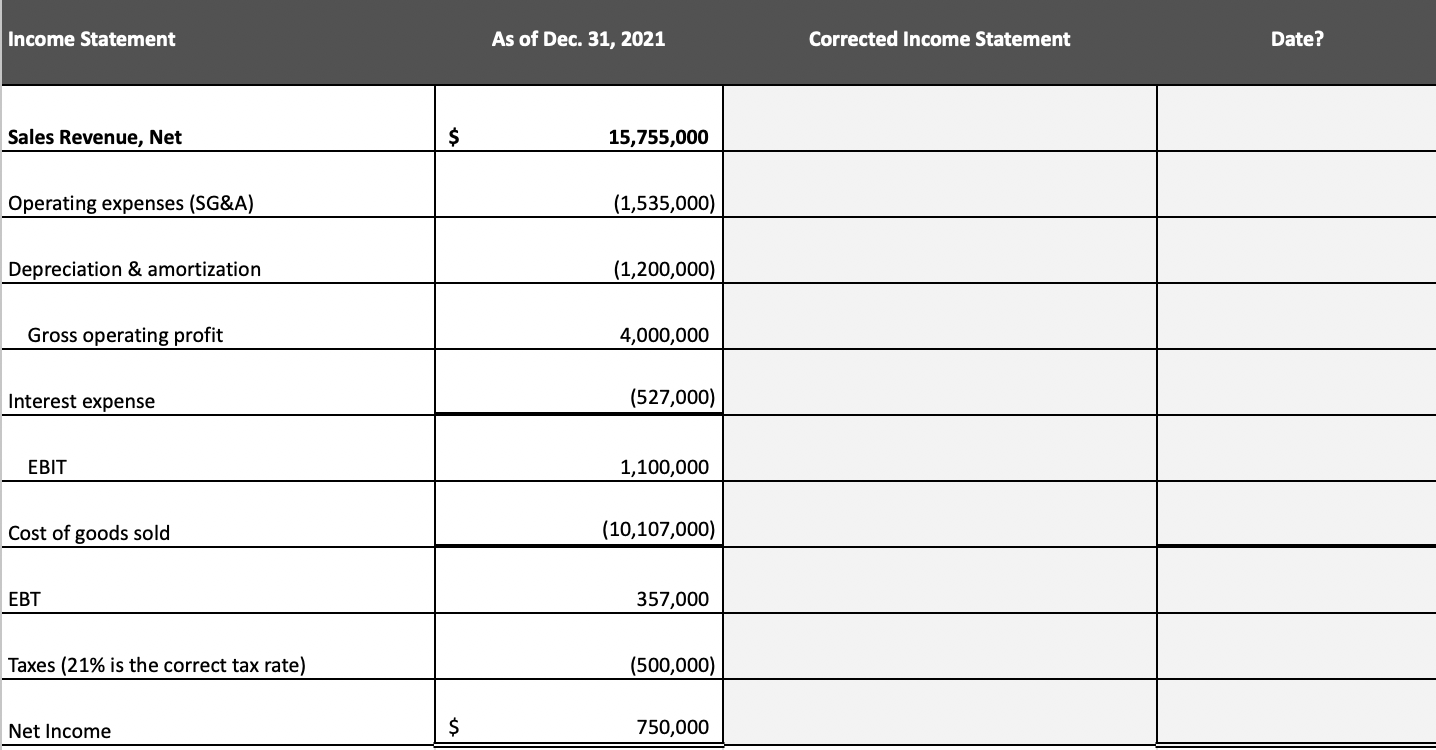

Context & Background In this activity, you'll once again encounter a situation akin to the one you faced with the balance sheet, but now, the focus shifts to reviewing an already compiled income statement.

Recall the Chapter 1 scenario where the person in charge of accounting and finance in your organization resigned unexpectedly. This person had just finished the yearly income statement. They left behind a note affirming the accuracy and completion of this statement.

However, given the discrepancies found in the balance sheet, your manager harbors doubts about this income statement. Given your exemplary work earlier, your manager now trusts you to inspect the income statement, rectify any inconsistencies, and ensure its correctness.

Given your willingness and expertise, you've been handed two primary assignments: Assignment #1: Scrutinize the income statement, pinpoint any inaccuracies, and rectify them. Assignment #2: Post rectification, proceed to answer the set of 10 study questions provided beneath the income statement.

Guidelines for Assignment #1

- With your understanding of the income statement, critically examine it. Remember, this document is presumed to be error-free; however, the onus is on you to guarantee its accuracy. Methodically go over every detail and ascertain the absence of errors.

- Post the identification of discrepancies, make the appropriate amendments in the 'Corrected Income Statement' section (highlighted in yellow).

Dive into Assignment #1! Consider it a jigsaw puzzle. Leveraging your recent grasp of the income statement, you're well-equipped to assist your manager.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started