Answered step by step

Verified Expert Solution

Question

1 Approved Answer

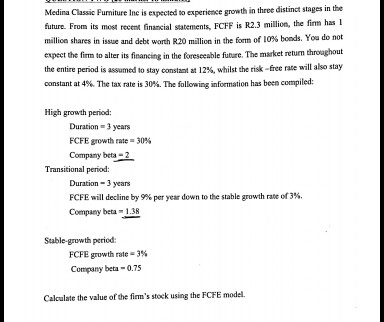

Medina Classic Furniture Inc is expected to experience growth in three district stages in the future. From is most recent financial statements, FCFF is R2.3

Medina Classic Furniture Inc is expected to experience growth in three district stages in the future. From is most recent financial statements, FCFF is R2.3 Million, the firm has 1 million shares in issue and debt worth R20 million in the form of 10% bonds. You do not expect the firm to alter its financing in the foreseeable future. The market return throughout the entire period is assumed to stay constant at 12%, whilst the risk - free rate will also stay constant at 40%. The tax rate is 30%. The following information has been compiled: High growth period: Duration = 3 years FCFF growth rate = 30% Company beta = 2 Transitional period: Duration = 3 years FCFE will decline by 9% per year down to the stable growth rate of 3%. Company beta = 1.38 Stable-growth period: FCFE growth rate = 3% company beta = 0.75 Calculate the value of the firm's stock using the FCFE model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started