Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MEDLink System Inc. ( MEDLink ) is a privately held company specializing in customized medical software to manage patient records for the medical offices, medical

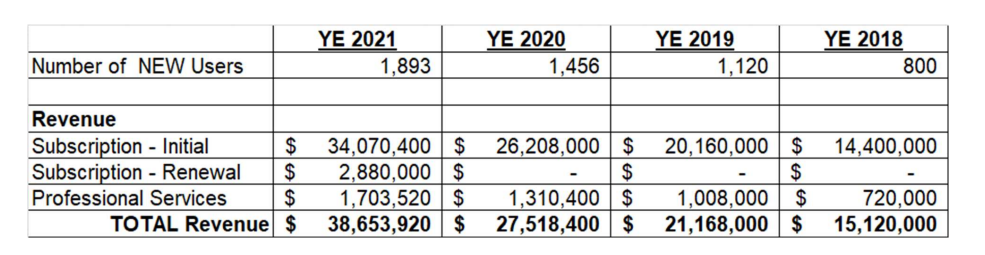

MEDLink System Inc. MEDLink is a privately held company specializing in customized medical software to manage patient records for the medical offices, medical laboratories and hospitals across Canada. MEDLink users are healthcare administrators and professionals lab technicians, nurses and doctors across Canada. The company has been operating from its headquarters in the Lower Mainland of BC since Jan The companys fiscal year end is December For the first time since its inception, an external auditor had been appointed to conduct an audit prior to issuing the financial statements planned for April Revenue The Companys revenue stems from two sources: i subscription and support, and ii professional services. Subscription and support revenues: include subscription fees from customers accessing the Companys enterprise cloud computing services, software license renewals, and support revenue from the sales of support and updates beyond the basic subscription fees. Professional service revenues: include professional and advisory services for process mapping, training and product customization. On average, the professional service revenues are of the subscription and support revenues for the first year. Since its inception, MEDLink would deliver of the services in the same period as the same of sale ie same year when the contract is signed The remaining of the services would be delivered in the following year. Given that all the services would be delivered eventually and that the contract is noncancellable and refundable, the management did not see the need to record revenues at different deliverables. As such, the company has been recording revenue as a single transaction at the point of sale. The price of MEDLink system solution is $ per user over a year period for subscription and support. So if the company signs a contract with a customer on September the company would record $ on that date. At the end of years, there is an annual renewal fee for $ per user. The amount is automatically and fully recognized at the time when the software license expires. For example, if the software expires on June for one user at Clinic A the company will automatically record $ on July assuming that the clinic would renew MEDLinks services. The Company usually invoices its customers two months prior to its renewal date, and its payment terms provide customers within days of invoice. Here are some historical data on the revenue and user count.

tableYE YE YE YE Number of NEW Users,,RevenueSubscription Initial,$$$$Subscription Renewal,$$$$Professional Services,$$$$TOTAL Revenue,$$$$Accounts Receivable:

Given that the customers are financially sound, the management has been allocating a nominal of accounts receivable as uncollectible since its inception. Starting the company abruptly stopped allocating any allowance for uncollectible even though the amount of receivables had grown quite dramatically. One of MEDLinks senior management Harry Spaar who happened to be a shareholder in the company commented writeoff does not exist in our industry so why allocate allowance which will only lower our profitability. In October the company factored with recourse receivables with a carrying amount of $ In exchange, the factor agreed to pay of the face value of the receivables less holdback on the date of transfer. For fiscal year end, the company removed $ from its accounts receivable and recorded an interest expense of $ By February the factor collected a total of of face value of receivables. The company subsequently recorded another $ interest expense in

Required:

Regarding the Revenue and Accounts receivables, provide correct calculations and journal entries for each transaction in compliance with IFRS. Include

your assumptions in the calculationsjournal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started