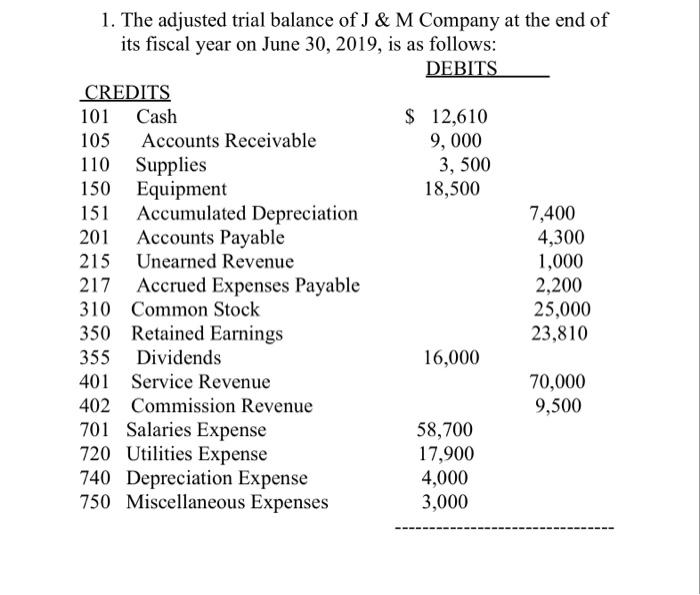

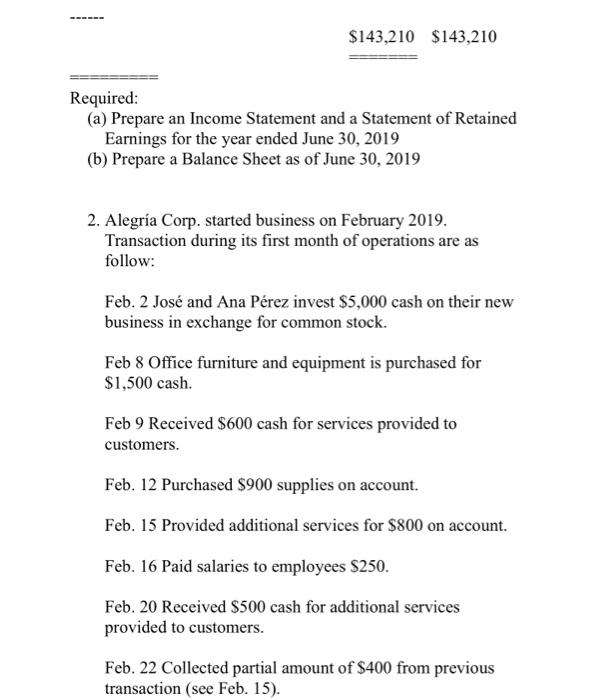

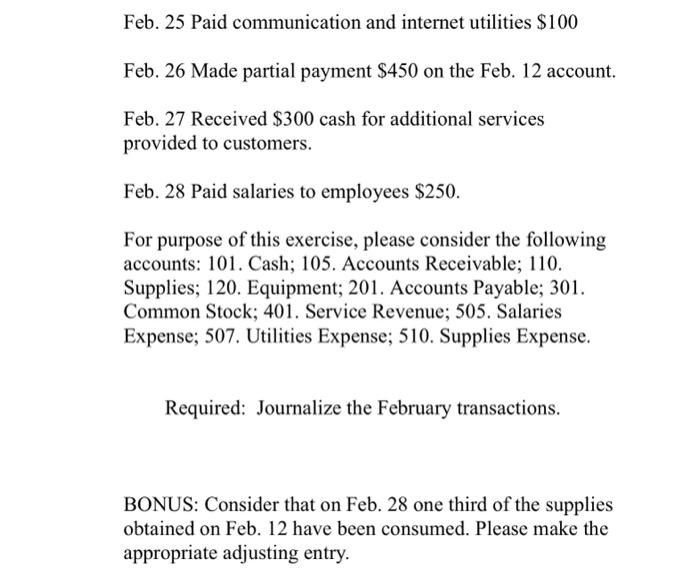

Required: (a) Prepare an Income Statement and a Statement of Retained Earnings for the year ended June 30, 2019 (b) Prepare a Balance Sheet as of June 30, 2019 2. Alegria Corp. started business on February 2019. Transaction during its first month of operations are as follow: Feb. 2 Jos and Ana Prez invest $5,000 cash on their new business in exchange for common stock. Feb 8 Office furniture and equipment is purchased for $1,500 cash. Feb 9 Received $600 cash for services provided to customers. Feb. 12 Purchased $900 supplies on account. Feb. 15 Provided additional services for $800 on account. Feb. 16 Paid salaries to employees $250. Feb. 20 Received $500 cash for additional services provided to customers. Feb. 22 Collected partial amount of $400 from previous 1. The adjusted trial balance of J \& M Company at the end of its fiscal year on June 30,2019 , is as follows: Feb. 25 Paid communication and internet utilities $100 Feb. 26 Made partial payment $450 on the Feb. 12 account. Feb. 27 Received $300 cash for additional services provided to customers. Feb. 28 Paid salaries to employees $250. For purpose of this exercise, please consider the following accounts: 101. Cash; 105. Accounts Receivable; 110. Supplies; 120. Equipment; 201. Accounts Payable; 301. Common Stock; 401. Service Revenue; 505. Salaries Expense; 507. Utilities Expense; 510. Supplies Expense. Required: Journalize the February transactions. BONUS: Consider that on Feb. 28 one third of the supplies obtained on Feb. 12 have been consumed. Please make the appropriate adjusting entry. Required: (a) Prepare an Income Statement and a Statement of Retained Earnings for the year ended June 30, 2019 (b) Prepare a Balance Sheet as of June 30, 2019 2. Alegria Corp. started business on February 2019. Transaction during its first month of operations are as follow: Feb. 2 Jos and Ana Prez invest $5,000 cash on their new business in exchange for common stock. Feb 8 Office furniture and equipment is purchased for $1,500 cash. Feb 9 Received $600 cash for services provided to customers. Feb. 12 Purchased $900 supplies on account. Feb. 15 Provided additional services for $800 on account. Feb. 16 Paid salaries to employees $250. Feb. 20 Received $500 cash for additional services provided to customers. Feb. 22 Collected partial amount of $400 from previous 1. The adjusted trial balance of J \& M Company at the end of its fiscal year on June 30,2019 , is as follows: Feb. 25 Paid communication and internet utilities $100 Feb. 26 Made partial payment $450 on the Feb. 12 account. Feb. 27 Received $300 cash for additional services provided to customers. Feb. 28 Paid salaries to employees $250. For purpose of this exercise, please consider the following accounts: 101. Cash; 105. Accounts Receivable; 110. Supplies; 120. Equipment; 201. Accounts Payable; 301. Common Stock; 401. Service Revenue; 505. Salaries Expense; 507. Utilities Expense; 510. Supplies Expense. Required: Journalize the February transactions. BONUS: Consider that on Feb. 28 one third of the supplies obtained on Feb. 12 have been consumed. Please make the appropriate adjusting entry