Answered step by step

Verified Expert Solution

Question

1 Approved Answer

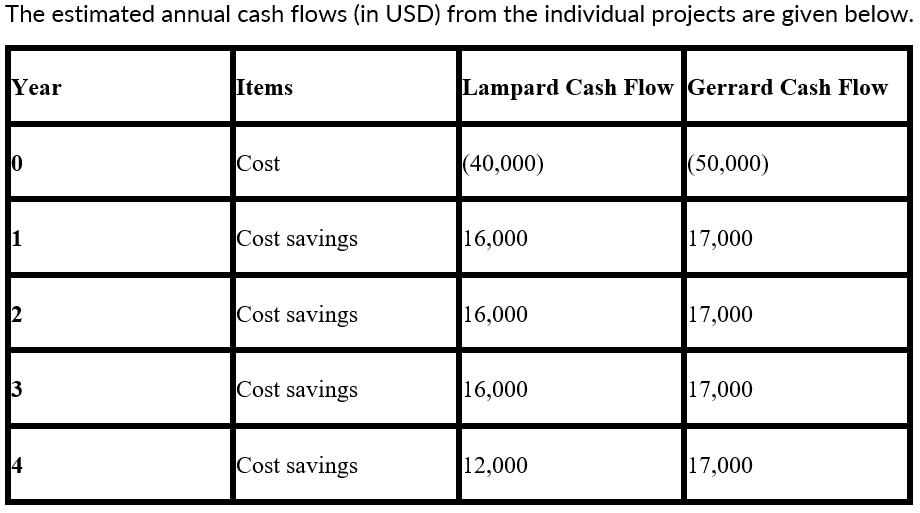

Mega Plc. is planning to decide between the following two projects Lampard and Gerrard.The estimated annual cash flows (in USD) from the individual projects

Mega Plc. is planning to decide between the following two projects – Lampard and Gerrard.The estimated annual cash flows (in USD) from the individual projects are given below. The estimated annual cash flows (in USD) from the individual projects are given below(as shown on the table).

Questions

• Decide which project is better in terms of the period of time taken for the future net cash inflows to match the initial cash outlay (i.e., in terms of the Payback period).

• What if Mega Plc. runs a policy of accepting all projects that pay back within 3 years?

The estimated annual cash flows (in USD) from the individual projects are given below. Year 10 - 2 3 + Items Cost Cost savings Cost savings Cost savings Cost savings Lampard Cash Flow Gerrard Cash Flow (40,000) 16,000 16,000 16,000 12,000 (50,000) 17,000 17,000 17,000 17,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the payback period for each project we need to accumulate the annual cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started