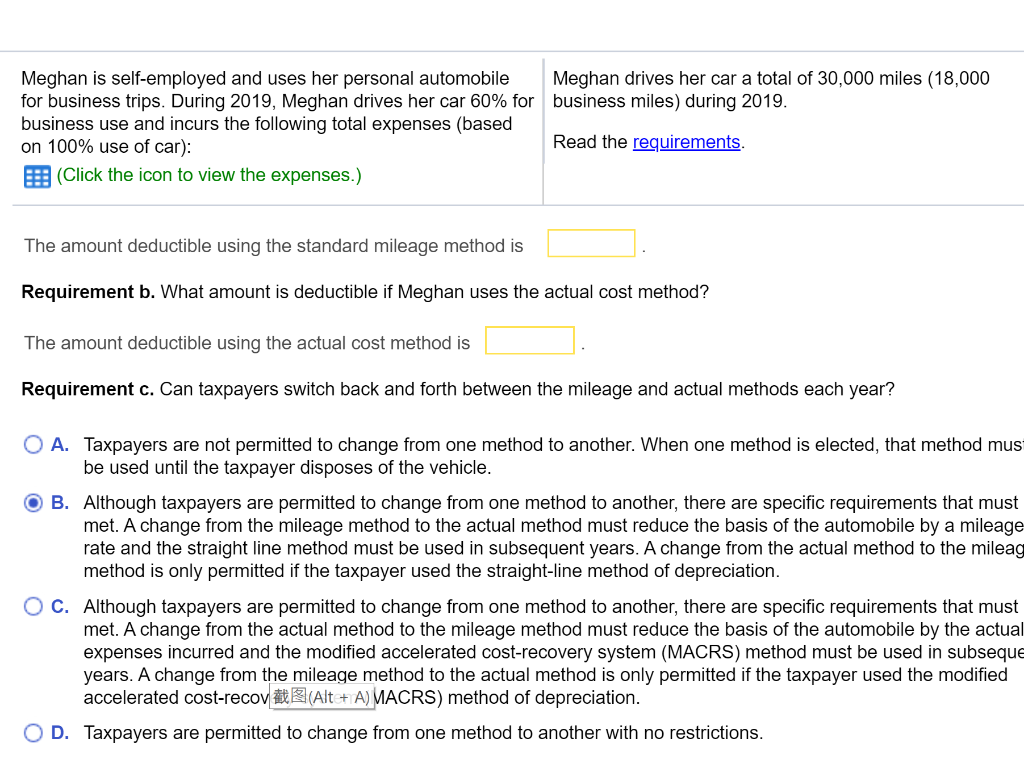

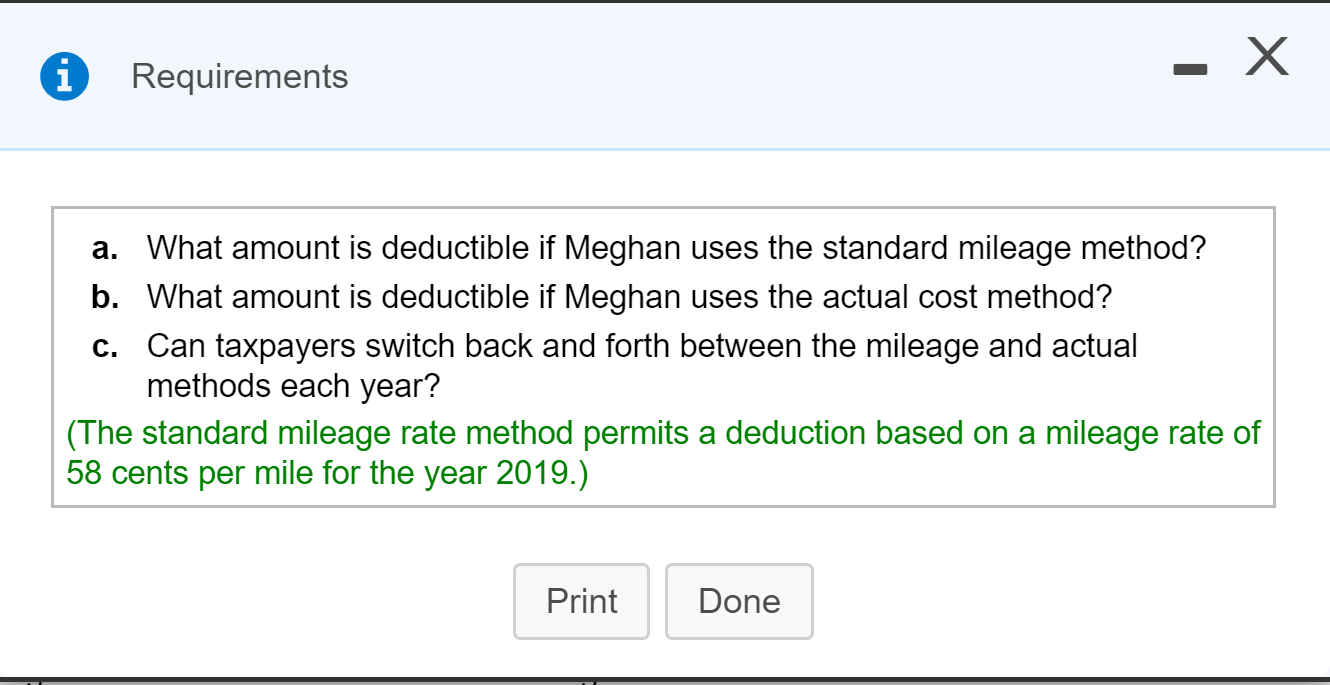

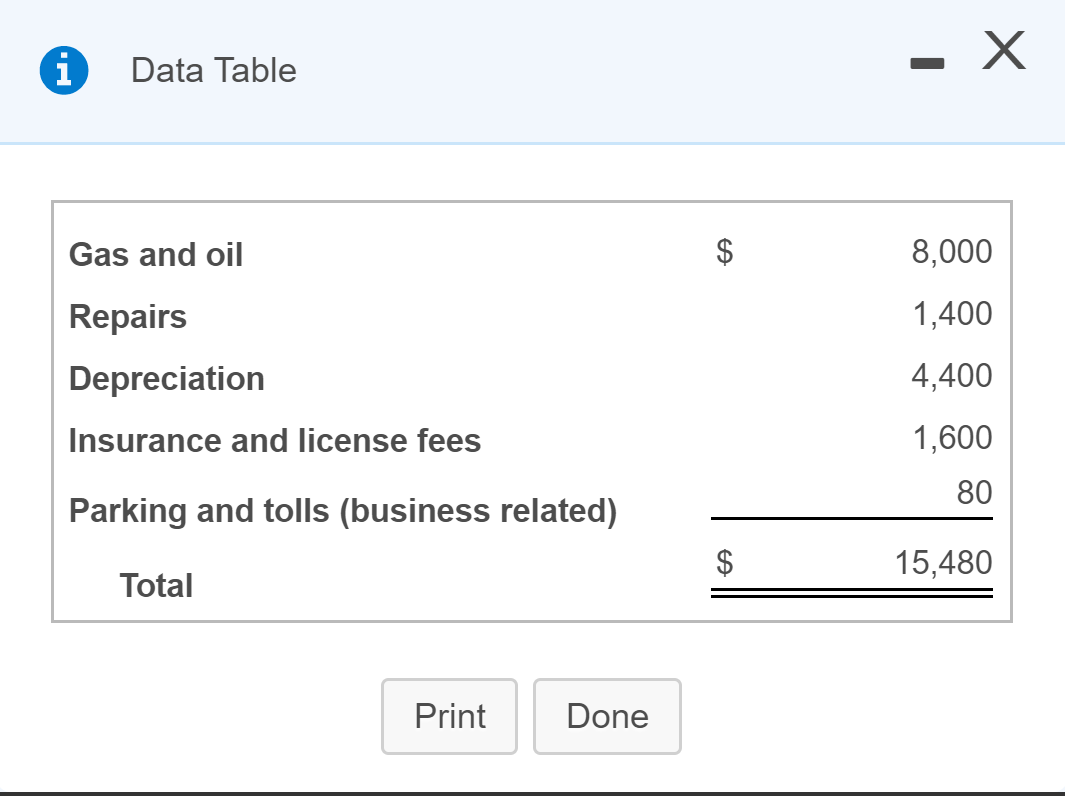

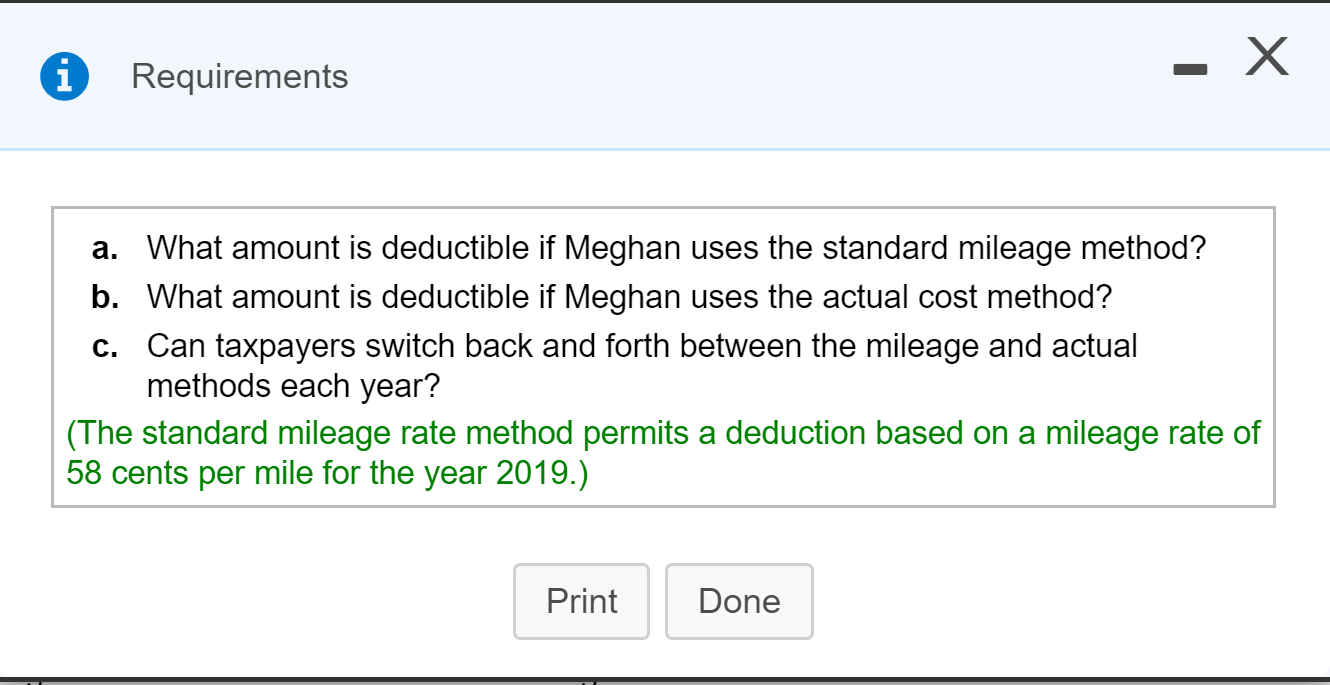

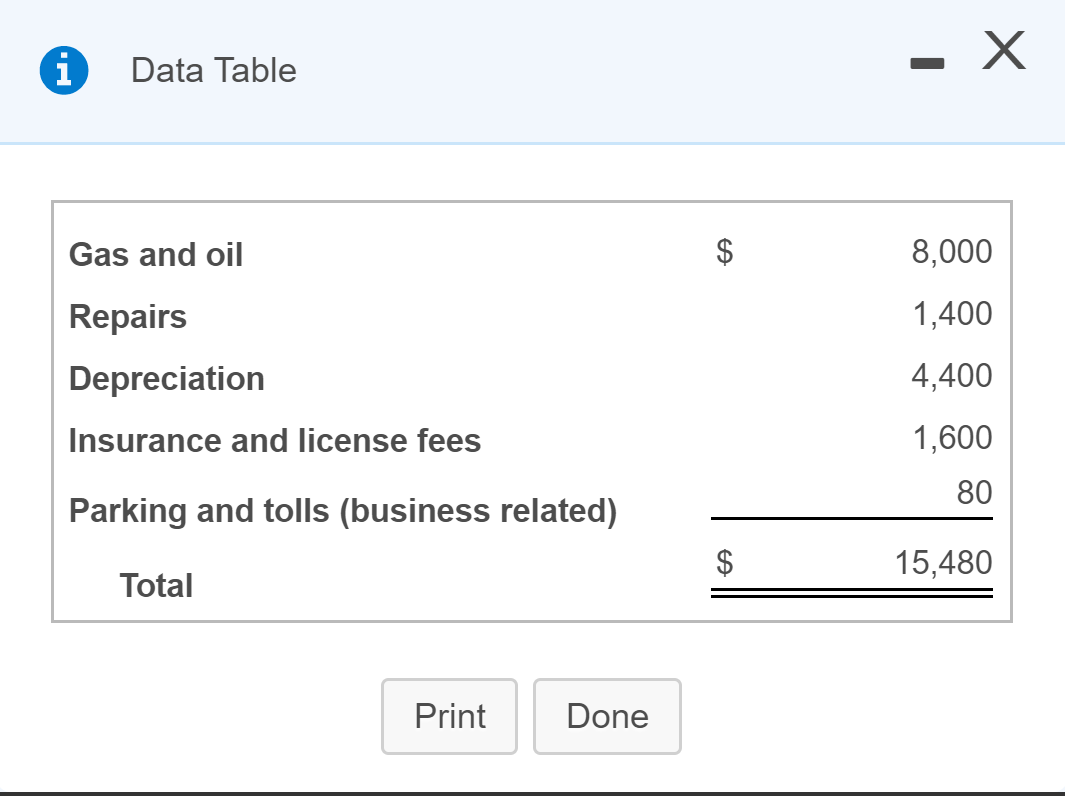

Meghan is self-employed and uses her personal automobile Meghan drives her car a total of 30,000 miles (18,000 for business trips. During 2019, Meghan drives her car 60% for business miles) during 2019. business use and incurs the following total expenses (based on 100% use of car): Read the requirements. (Click the icon to view the expenses.) The amount deductible using the standard mileage method is Requirement b. What amount is deductible if Meghan uses the actual cost method? The amount deductible using the actual cost method is Requirement c. Can taxpayers switch back and forth between the mileage and actual methods each year? O A. Taxpayers are not permitted to change from one method to another. When one method is elected, that method mus be used until the taxpayer disposes of the vehicle. O B. Although taxpayers are permitted to change from one method to another, there are specific requirements that must met. A change from the mileage method to the actual method must reduce the basis of the automobile by a mileage rate and the straight line method must be used in subsequent years. A change from the actual method to the mileag method is only permitted if the taxpayer used the straight-line method of depreciation. C. Although taxpayers are permitted to change from one method to another, there are specific requirements that must met. A change from the actual method to the mileage method must reduce the basis of the automobile by the actual expenses incurred and the modified accelerated cost-recovery system (MACRS) method must be used in subseque years. A change from the mileage method to the actual method is only permitted if the taxpayer used the modified accelerated cost-recovit (Alt + A) MACRS) method of depreciation. D. Taxpayers are permitted to change from one method to another with no restrictions. Requirements -X a. What amount is deductible if Meghan uses the standard mileage method? b. What amount is deductible if Meghan uses the actual cost method? c. Can taxpayers switch back and forth between the mileage and actual methods each year? (The standard mileage rate method permits a deduction based on a mileage rate of 58 cents per mile for the year 2019.) Print Done - X i Data Table Gas and oil $ 8,000 1,400 Repairs Depreciation 4,400 Insurance and license fees 1,600 80 Parking and tolls (business related) $ 15,480 Total Print Done