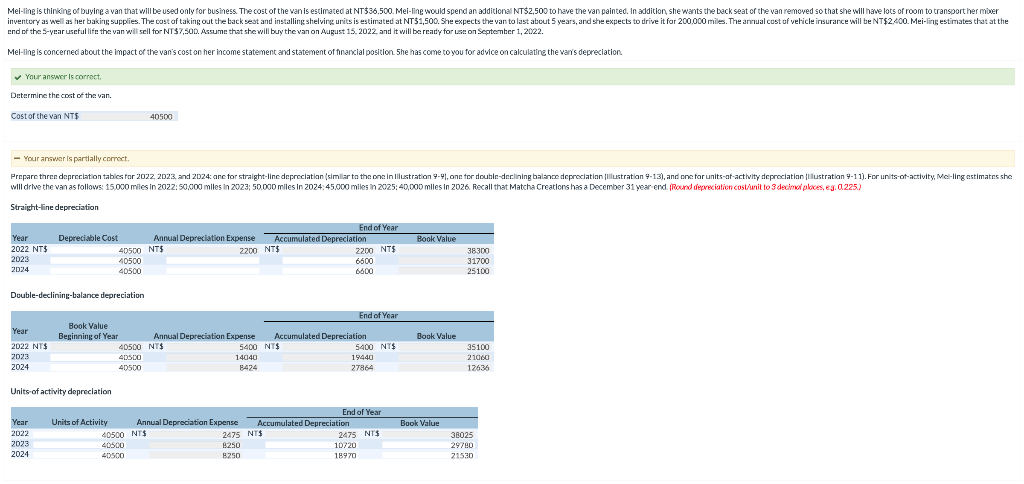

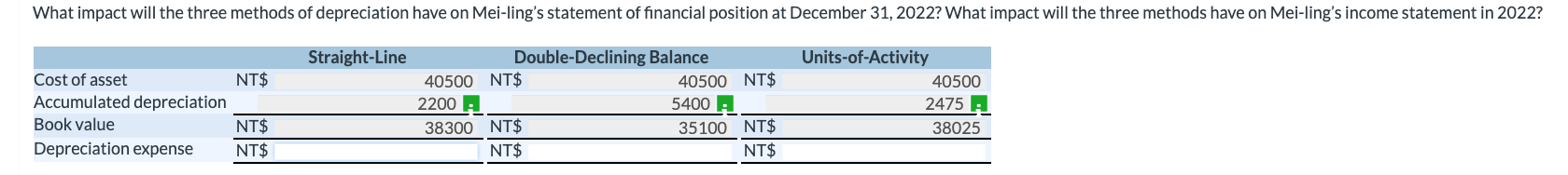

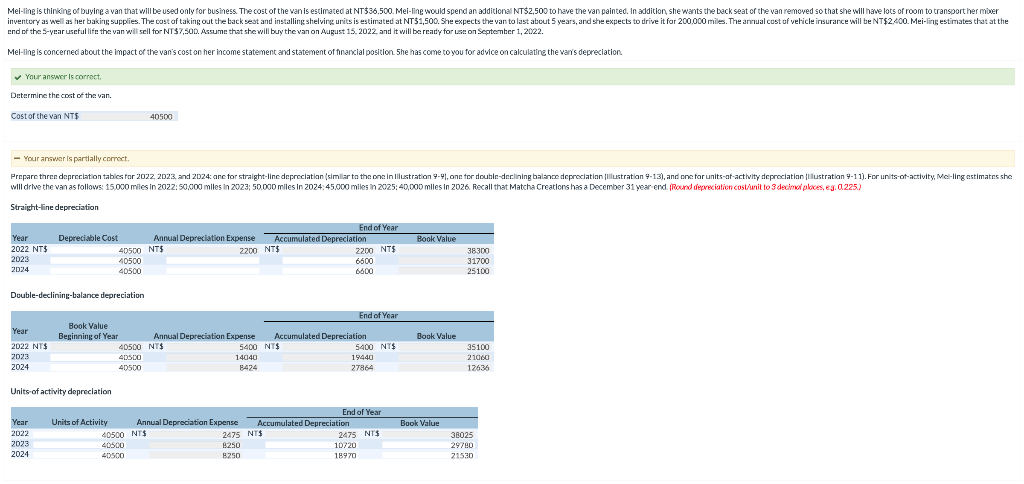

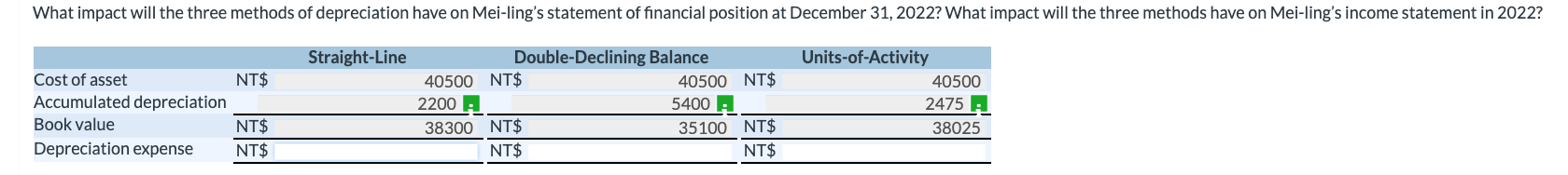

Mei-line is thinkine of buying a van that will be used only for business. The cost of the vanis estimated at NT$36,500 Melling would spend an additional NT$2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mber inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at NT$1,500. She expects the van to last about 5 years, and she expects to drive it for 200.000 miles. The annual cost of vehicle insurance will be NT$2.400. Mei-ling estimates that at the end of the 5-year useful life the van will sell for NT$7,50D. Assume that she will buy the van on August 15.2022. and it will be ready for use on September 1, 2022. Mel-line is concerned about the impact of the van's cost on her income statement and statement of financial position. She has come to you for advice on calculating the van's depreciation Your answer is correct. Determine the cost of the van. Cost of the van NTS 40500 Your answer is partially correct. Prepare three depreciation tables for 2022 2023 and 2024: ane for straight-line depreciation (similar to the one in ilustration 9-9, one for double-declining balance depreciation Illustration 9-13), and one for units-of-activity depreciation Illustration 9-11). For units-of-activity, Mei-ling estimates she will drive the van as follows: 15,000 miles in 2022:50,000 miles in 2023; 50.000 miles in 2024.45.000 miles in 2025: 40,000 miles in 2026 Recall that Matcha Creations has a December 31 year end Round depreciation costanit to 3 decimal places, eg. 0225) Straight-line depreciation Year Book Value 2022 NT$ 2023 2024 Depreciable Cost End of Year Annual Depreciation Expense Accumulated Depreciation 40500 NT$ 2200 NT$ 40500 2200 NTS 40500 6600 38300 31700 25100 Double-declining-balance depreciation Book Value Year 2022 NTS 2023 End of Year Book Value Beginning of Year Annual Depreciation Expense Accumulated Depreciation 40500 NT$ 5400 NT$ 5400 NT$ 40500 14040 19440 40500 8424 27864 35100 21000 12636 2024 Units of activity depreciation Year 2022 Book Value End of Year Units of Activity Annual Depreciation Expense Accumulated Depreciation 40500 NTS 2475 NT$ 2475 NT$ 40500 B250 10720 40500 18970 2023 2024 38025 29780 21530 4250 What impact will the three methods of depreciation have on Mei-ling's statement of financial position at December 31, 2022? What impact will the three methods have on Mei-ling's income statement in 2022? Straight-Line Double-Declining Balance 40500 NT$ 40500 NT$ 2200 A 5400 A 38300 NT$ 35100 NT$ NT$ NT$ Units-of-Activity 40500 2475 A Cost of asset NT$ Accumulated depreciation Book value NT$ Depreciation expense NT$ Mei-line is thinkine of buying a van that will be used only for business. The cost of the vanis estimated at NT$36,500 Melling would spend an additional NT$2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mber inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at NT$1,500. She expects the van to last about 5 years, and she expects to drive it for 200.000 miles. The annual cost of vehicle insurance will be NT$2.400. Mei-ling estimates that at the end of the 5-year useful life the van will sell for NT$7,50D. Assume that she will buy the van on August 15.2022. and it will be ready for use on September 1, 2022. Mel-line is concerned about the impact of the van's cost on her income statement and statement of financial position. She has come to you for advice on calculating the van's depreciation Your answer is correct. Determine the cost of the van. Cost of the van NTS 40500 Your answer is partially correct. Prepare three depreciation tables for 2022 2023 and 2024: ane for straight-line depreciation (similar to the one in ilustration 9-9, one for double-declining balance depreciation Illustration 9-13), and one for units-of-activity depreciation Illustration 9-11). For units-of-activity, Mei-ling estimates she will drive the van as follows: 15,000 miles in 2022:50,000 miles in 2023; 50.000 miles in 2024.45.000 miles in 2025: 40,000 miles in 2026 Recall that Matcha Creations has a December 31 year end Round depreciation costanit to 3 decimal places, eg. 0225) Straight-line depreciation Year Book Value 2022 NT$ 2023 2024 Depreciable Cost End of Year Annual Depreciation Expense Accumulated Depreciation 40500 NT$ 2200 NT$ 40500 2200 NTS 40500 6600 38300 31700 25100 Double-declining-balance depreciation Book Value Year 2022 NTS 2023 End of Year Book Value Beginning of Year Annual Depreciation Expense Accumulated Depreciation 40500 NT$ 5400 NT$ 5400 NT$ 40500 14040 19440 40500 8424 27864 35100 21000 12636 2024 Units of activity depreciation Year 2022 Book Value End of Year Units of Activity Annual Depreciation Expense Accumulated Depreciation 40500 NTS 2475 NT$ 2475 NT$ 40500 B250 10720 40500 18970 2023 2024 38025 29780 21530 4250 What impact will the three methods of depreciation have on Mei-ling's statement of financial position at December 31, 2022? What impact will the three methods have on Mei-ling's income statement in 2022? Straight-Line Double-Declining Balance 40500 NT$ 40500 NT$ 2200 A 5400 A 38300 NT$ 35100 NT$ NT$ NT$ Units-of-Activity 40500 2475 A Cost of asset NT$ Accumulated depreciation Book value NT$ Depreciation expense NT$