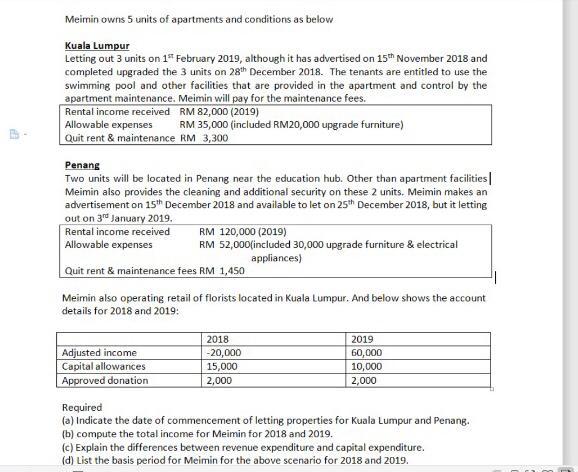

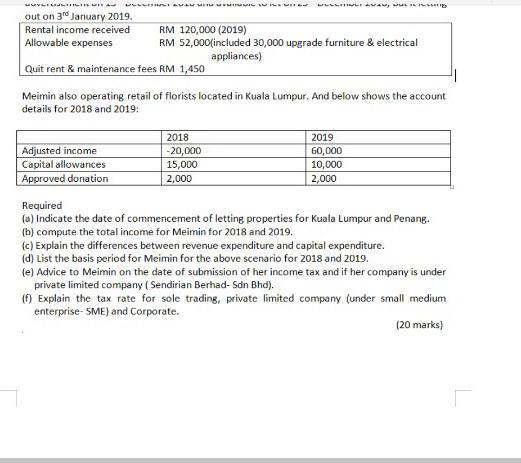

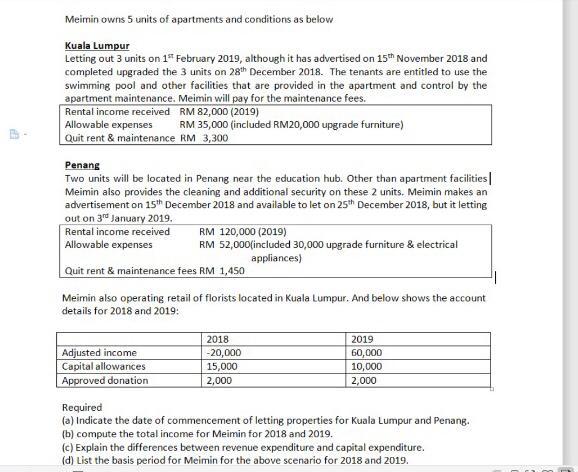

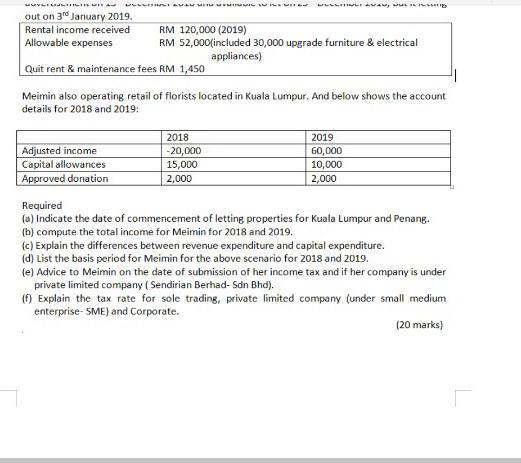

Meimin owns 5 units of apartments and conditions as below Kuala Lumpur Letting out 3 units on 19 February 2019, although it has advertised on 15th November 2018 and completed upgraded the 3 units on 28th December 2018. The tenants are entitled to use the swimming pool and other facilities that are provided in the apartment and control by the apartment maintenance. Meimin will pay for the maintenance fees. Rental income received RM 82,000 (2019) Allowable expenses RM 35,000 (included RM20,000 upgrade furniture) Quit rent & maintenance RM 3,300 Penang Two units will be located in Penang near the education hub. Other than apartment facilities Meimin also provides the cleaning and additional security on these 2 units. Meimin makes an advertisement on 15th December 2018 and available to let on 25th December 2018, but it letting out on 3 January 2019. Rental income received RM 120,000 (2019) Allowable expenses RM 52,000(included 30,000 upgrade furniture & electrical appliances) Quit rent & maintenance fees RM 1,450 Meimin also operating retail of florists located in Kuala Lumpur. And below shows the account details for 2018 and 2019: Adjusted income Capital allowances Approved donation 2018 -20,000 15,000 2,000 2019 60,000 10,000 2,000 Required (a) Indicate the date of commencement of letting properties for Kuala Lumpur and Penang. (b) compute the total income for Meimin for 2018 and 2019. (c) Explain the differences between revenue expenditure and capital expenditure. (d) List the basis period for Meimin for the above scenario for 2018 and 2019. CLICCIRI out on 3rd January 2019. Rental income received RM 120,000 (2019) Allowable expenses RM 52,000(included 30,000 upgrade furniture & electrical appliances) Quit rent & maintenance fees RM 1,450 Meimin also operating retail of florists located in Kuala Lumpur. And below shows the account details for 2018 and 2019: Adjusted income Capital allowances Approved donation 2018 -20,000 15,000 2,000 2019 60,000 10,000 2,000 Required (a) Indicate the date of commencement of letting properties for Kuala Lumpur and Penang. (b) compute the total income for Meimin for 2018 and 2019. (c) Explain the differences between revenue expenditure and capital expenditure. (d) List the basis period for Meimin for the above scenario for 2018 and 2019. (e) Advice to Meimin on the date of submission of her income tax and if her company is under private limited company (Sendirian Berhad- Sdn Bhd). Explain the tax rate for sole trading, private limited company (under small medium enterprise-SME) and Corporate. (20 marks) Meimin owns 5 units of apartments and conditions as below Kuala Lumpur Letting out 3 units on 19 February 2019, although it has advertised on 15th November 2018 and completed upgraded the 3 units on 28th December 2018. The tenants are entitled to use the swimming pool and other facilities that are provided in the apartment and control by the apartment maintenance. Meimin will pay for the maintenance fees. Rental income received RM 82,000 (2019) Allowable expenses RM 35,000 (included RM20,000 upgrade furniture) Quit rent & maintenance RM 3,300 Penang Two units will be located in Penang near the education hub. Other than apartment facilities Meimin also provides the cleaning and additional security on these 2 units. Meimin makes an advertisement on 15th December 2018 and available to let on 25th December 2018, but it letting out on 3 January 2019. Rental income received RM 120,000 (2019) Allowable expenses RM 52,000(included 30,000 upgrade furniture & electrical appliances) Quit rent & maintenance fees RM 1,450 Meimin also operating retail of florists located in Kuala Lumpur. And below shows the account details for 2018 and 2019: Adjusted income Capital allowances Approved donation 2018 -20,000 15,000 2,000 2019 60,000 10,000 2,000 Required (a) Indicate the date of commencement of letting properties for Kuala Lumpur and Penang. (b) compute the total income for Meimin for 2018 and 2019. (c) Explain the differences between revenue expenditure and capital expenditure. (d) List the basis period for Meimin for the above scenario for 2018 and 2019. CLICCIRI out on 3rd January 2019. Rental income received RM 120,000 (2019) Allowable expenses RM 52,000(included 30,000 upgrade furniture & electrical appliances) Quit rent & maintenance fees RM 1,450 Meimin also operating retail of florists located in Kuala Lumpur. And below shows the account details for 2018 and 2019: Adjusted income Capital allowances Approved donation 2018 -20,000 15,000 2,000 2019 60,000 10,000 2,000 Required (a) Indicate the date of commencement of letting properties for Kuala Lumpur and Penang. (b) compute the total income for Meimin for 2018 and 2019. (c) Explain the differences between revenue expenditure and capital expenditure. (d) List the basis period for Meimin for the above scenario for 2018 and 2019. (e) Advice to Meimin on the date of submission of her income tax and if her company is under private limited company (Sendirian Berhad- Sdn Bhd). Explain the tax rate for sole trading, private limited company (under small medium enterprise-SME) and Corporate. (20 marks)