Answered step by step

Verified Expert Solution

Question

1 Approved Answer

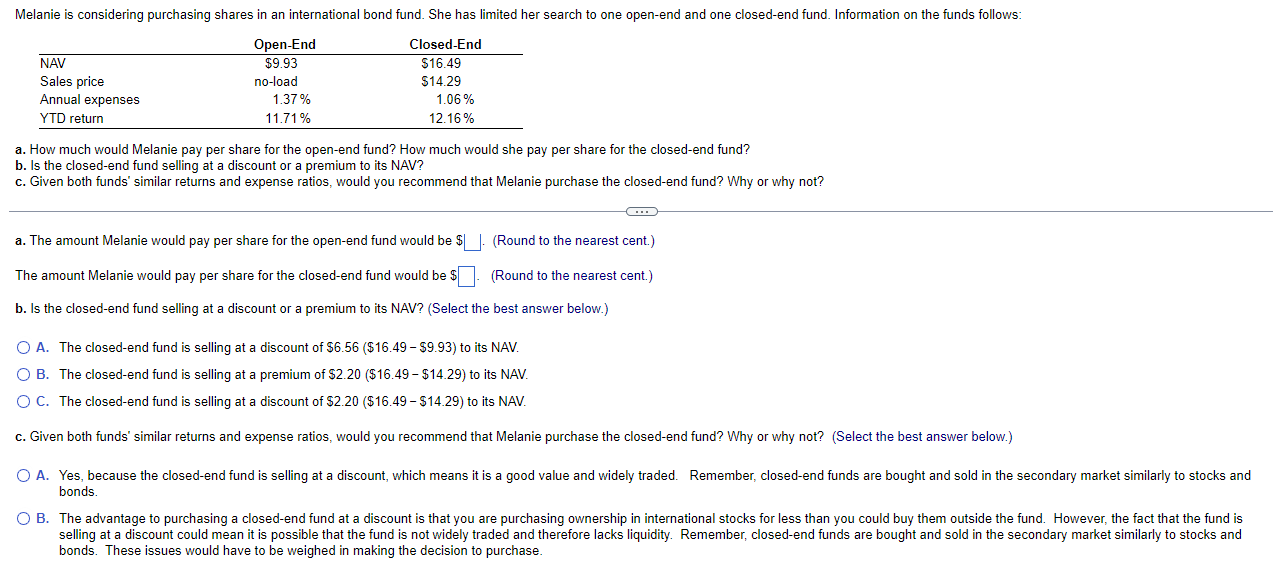

Melanie is considering purchasing shares in an international bond fund. She has limited her search to one open - end and one closed - end

Melanie is considering purchasing shares in an international bond fund. She has limited her search to one openend and one closedend fund. Information on the funds follows:

a How much would Melanie pay per share for the openend fund? How much would she pay per share for the closedend fund?

b Is the closedend fund selling at a discount or a premium to its NAV?

c Given both funds' similar returns and expense ratios, would you recommend that Melanie purchase the closedend fund? Why or why not?

a The amount Melanie would pay per share for the openend fund would beRound to the nearest cent.

The amount Melanie would pay per share for the closedend fund would be $ Round to the nearest cent.

b Is the closedend fund selling at a discount or a premium to its NAV? Select the best answer below.

A The closedend fund is selling at a discount of $$$ to its NAV.

B The closedend fund is selling at a premium of $$$ to its NAV.

C The closedend fund is selling at a discount of $$$ to its NAV.

c Given both funds' similar returns and expense ratios, would you recommend that Melanie purchase the closedend fund? Why or why not? Select the best answer below.

bonds.

bonds. These issues would have to be weighed in making the decision to purchase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started