Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Melody Musical Pty Ltd manufactures brass musical instruments for use in Primary and Secondary Schools across Victoria. The company uses a job costing system in

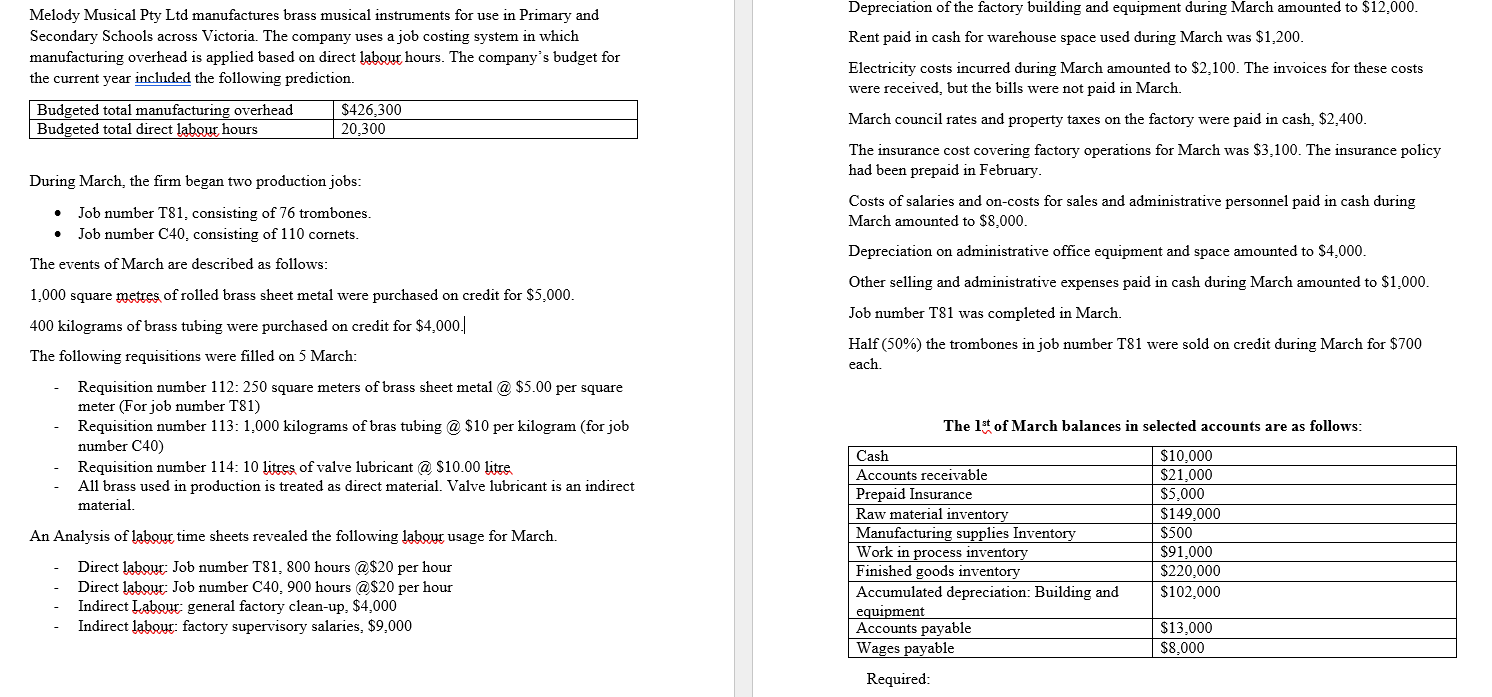

Melody Musical Pty Ltd manufactures brass musical instruments for use in Primary and

Secondary Schools across Victoria. The company uses a job costing system in which

manufacturing overhead is applied based on direct labout hours. The company's budget for

the current year included the following prediction.

During March, the firm began two production jobs:

Job number T consisting of trombones.

Job number C consisting of cornets.

The events of March are described as follows:

square metres of rolled brass sheet metal were purchased on credit for $

kilograms of brass tubing were purchased on credit for $

The following requisitions were filled on March :

Requisition number : square meters of brass sheet metal @$ per square

meter For job number T

Requisition number : kilograms of bras tubing @ $ per kilogram for job

number

Requisition number : litres of valve lubricant @ $ litre

All brass used in production is treated as direct material. Valve lubricant is an indirect

material.

An Analysis of labour time sheets revealed the following labour usage for March.

Direct labous: Job number T hours @$ per hour

Direct labous: Job number C hours @$ per hour

Indirect Labour: general factory cleanup $

Indirect labour: factory supervisory salaries, $

Rent paid in cash for warehouse space used during March was $

Electricity costs incurred during March amounted to $ The invoices for these costs

were received, but the bills were not paid in March.

March council rates and property taxes on the factory were paid in cash, $

The insurance cost covering factory operations for March was $ The insurance policy

had been prepaid in February.

Costs of salaries and oncosts for sales and administrative personnel paid in cash during

March amounted to $

Depreciation on administrative office equipment and space amounted to $

Other selling and administrative expenses paid in cash during March amounted to $

Job number T was completed in March.

Half the trombones in job number T were sold on credit during March for $

each.

The of March balances in selected accounts are as follows: Show the COGM, COGS and IS

Discuss about the efficiency in production process to convert from the raw

materials into Workinprogress and finished goods. Is there any warning signal

shown in the process?

Comment on the overapplied underapplied manufacturing overhead. Identify the

pros and cons of such overhead management pros and cons of such overhead management

Comments on the cash and liquidity management shown in March financial reports

Comments on the Profit and Loss by the end of March.

Recommendation In the recommendation section, you must provide detailed and

justified recommendations based on your case study analysis. Your

recommendations should be wellreasoned and supported by evidencefrom your

findings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started