Answered step by step

Verified Expert Solution

Question

1 Approved Answer

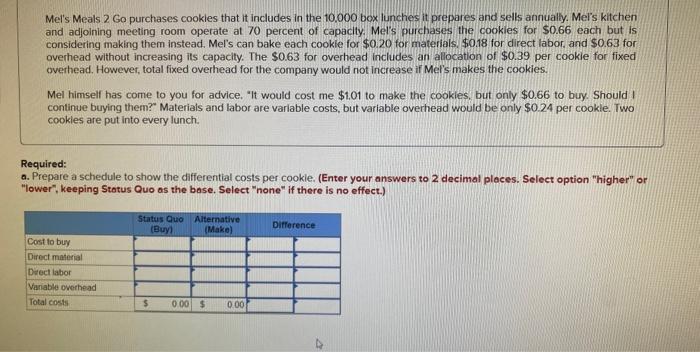

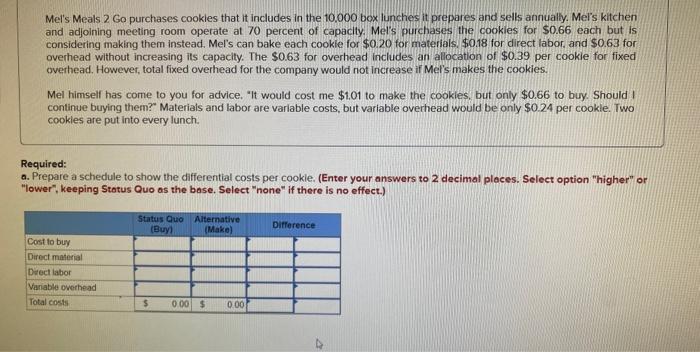

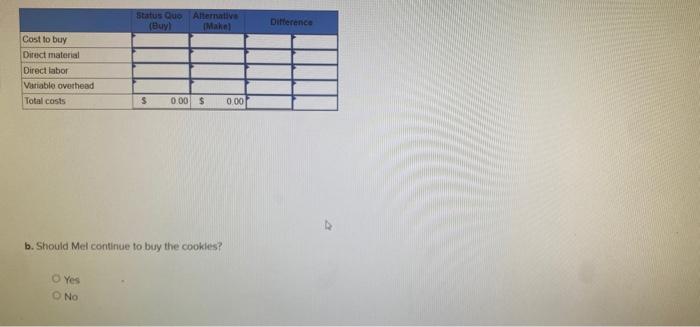

Mel's Meals 2 go purchase cookies that include in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate

Mel's Meals 2 go purchase cookies that include in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate 70 present of capacity. Mel's purchase the cokies for 66 cents each but is conaiderung making then instead. Mel's can bake each cookie for 20 cents for materials. 18 cent for direct labor, and 63 cents for overhead without increasing its capacity. The 63 cents for overhead includes an allocation of 39 cents oer cookie for fixed overhead. However, total fixed overhead for the company would not uncrease uf Mel's makes the cookies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started