Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Melton's Pie Company (MPC) is a privately owned local bakery that has just obtained a loan from the bank to be able to open a

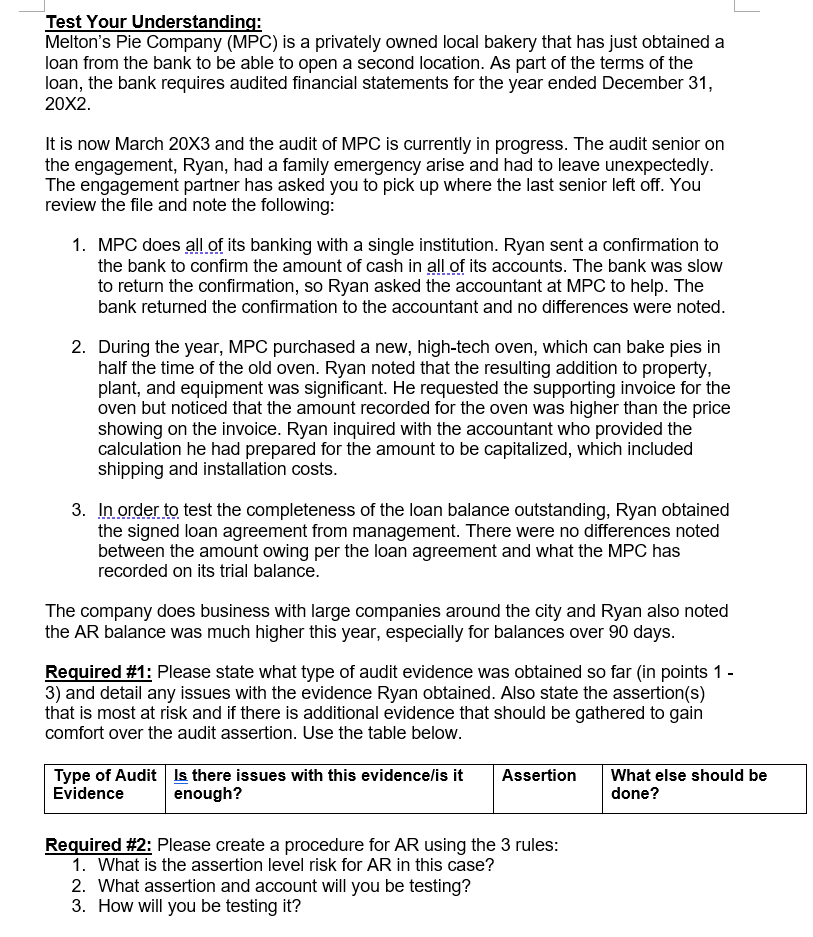

Melton's Pie Company (MPC) is a privately owned local bakery that has just obtained a loan from the bank to be able to open a second location. As part of the terms of the loan, the bank requires audited financial statements for the year ended December 31, 202. It is now March 20X3 and the audit of MPC is currently in progress. The audit senior on the engagement, Ryan, had a family emergency arise and had to leave unexpectedly. The engagement partner has asked you to pick up where the last senior left off. You review the file and note the following: 1. MPC does all of its banking with a single institution. Ryan sent a confirmation to the bank to confirm the amount of cash in all of its accounts. The bank was slow to return the confirmation, so Ryan asked the accountant at MPC to help. The bank returned the confirmation to the accountant and no differences were noted. 2. During the year, MPC purchased a new, high-tech oven, which can bake pies in half the time of the old oven. Ryan noted that the resulting addition to property, plant, and equipment was significant. He requested the supporting invoice for the oven but noticed that the amount recorded for the oven was higher than the price showing on the invoice. Ryan inquired with the accountant who provided the calculation he had prepared for the amount to be capitalized, which included shipping and installation costs. 3. In order to test the completeness of the loan balance outstanding, Ryan obtained the signed loan agreement from management. There were no differences noted between the amount owing per the loan agreement and what the MPC has recorded on its trial balance. The company does business with large companies around the city and Ryan also noted the AR balance was much higher this year, especially for balances over 90 days. Required \#1: Please state what type of audit evidence was obtained so far (in points 1 3 ) and detail any issues with the evidence Ryan obtained. Also state the assertion(s) that is most at risk and if there is additional evidence that should be gathered to gain comfort over the audit assertion. Use the table below. Required \#2: Please create a procedure for AR using the 3 rules: 1. What is the assertion level risk for AR in this case? 2. What assertion and account will you be testing? 3. How will you be testing it

Melton's Pie Company (MPC) is a privately owned local bakery that has just obtained a loan from the bank to be able to open a second location. As part of the terms of the loan, the bank requires audited financial statements for the year ended December 31, 202. It is now March 20X3 and the audit of MPC is currently in progress. The audit senior on the engagement, Ryan, had a family emergency arise and had to leave unexpectedly. The engagement partner has asked you to pick up where the last senior left off. You review the file and note the following: 1. MPC does all of its banking with a single institution. Ryan sent a confirmation to the bank to confirm the amount of cash in all of its accounts. The bank was slow to return the confirmation, so Ryan asked the accountant at MPC to help. The bank returned the confirmation to the accountant and no differences were noted. 2. During the year, MPC purchased a new, high-tech oven, which can bake pies in half the time of the old oven. Ryan noted that the resulting addition to property, plant, and equipment was significant. He requested the supporting invoice for the oven but noticed that the amount recorded for the oven was higher than the price showing on the invoice. Ryan inquired with the accountant who provided the calculation he had prepared for the amount to be capitalized, which included shipping and installation costs. 3. In order to test the completeness of the loan balance outstanding, Ryan obtained the signed loan agreement from management. There were no differences noted between the amount owing per the loan agreement and what the MPC has recorded on its trial balance. The company does business with large companies around the city and Ryan also noted the AR balance was much higher this year, especially for balances over 90 days. Required \#1: Please state what type of audit evidence was obtained so far (in points 1 3 ) and detail any issues with the evidence Ryan obtained. Also state the assertion(s) that is most at risk and if there is additional evidence that should be gathered to gain comfort over the audit assertion. Use the table below. Required \#2: Please create a procedure for AR using the 3 rules: 1. What is the assertion level risk for AR in this case? 2. What assertion and account will you be testing? 3. How will you be testing it Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started