Question

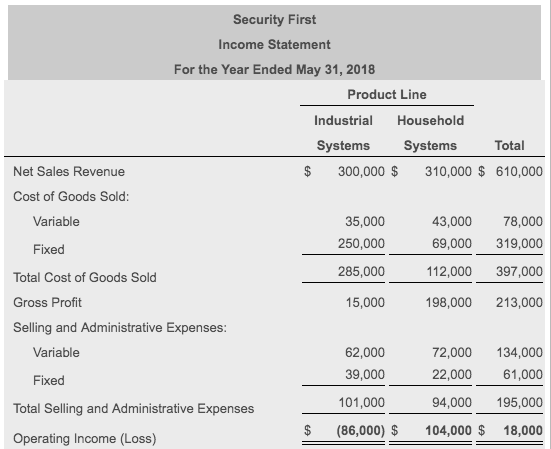

Members of the board of directors of Security First have received the following operating income data for the year ended May 31, 2018: Members of

Members of the board of directors of Security First have received the following operating income data for the year ended May 31, 2018:

Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $82,000 and decrease fixed selling and administrative expenses by $12,000.

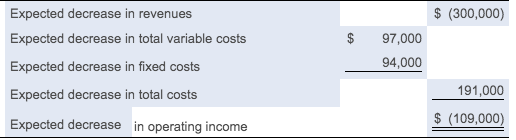

Requirement 1. Prepare a differential analysis to show whether Security First should drop the industrial systems product line. (I already did this requirement)

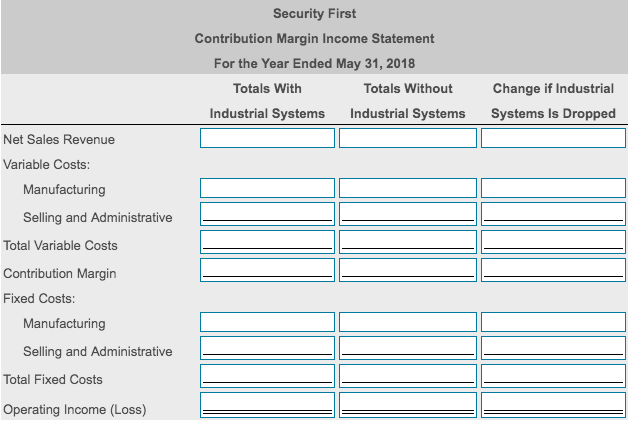

Requirement 2. Prepare contribution margin income statements to show Security First's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to your answer to Requirement 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started