Answered step by step

Verified Expert Solution

Question

1 Approved Answer

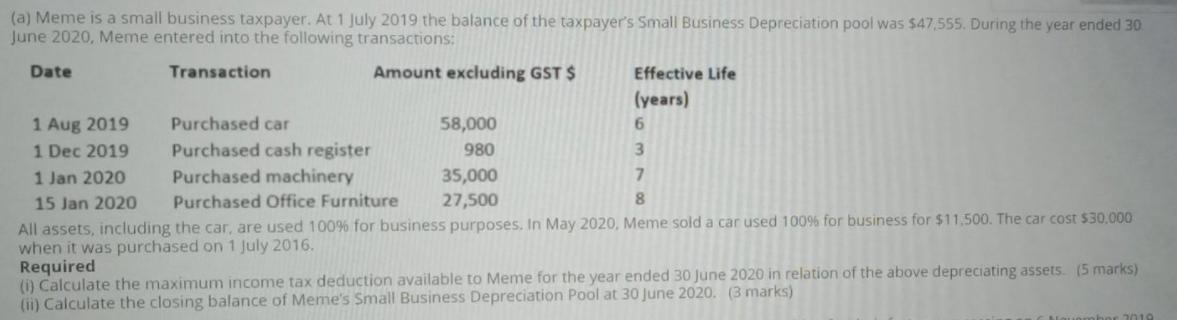

(a) Meme is a small business taxpayer. At 1 July 2019 the balance of the taxpayer's Small Business Depreciation pool was $47,555. During the

(a) Meme is a small business taxpayer. At 1 July 2019 the balance of the taxpayer's Small Business Depreciation pool was $47,555. During the year ended 30 June 2020, Meme entered into the following transactions: Date Transaction Amount excluding GST $ Effective Life (years) 1 Aug 2019 1 Dec 2019 Purchased car 58,000 6. Purchased cash register 980 1 Jan 2020 Purchased machinery 35,000 15 Jan 2020 Purchased Office Furniture 27,500 8 All assets, including the car, are used 100% for business purposes. In May 2020, Meme sold a car used 100% for business for $11,500. The car cost $30,000 when it was purchased on 1 July 2016. Required (i) Calculate the maximum income tax deduction available to Meme for the year ended 30 June 2020 in relation of the above depreciating assets. (5 marks) (ii) Calculate the closing balance of Meme's Small Business Depreciation Pool at 30 June 2020. (3 marks) 2010

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Total Maximum Income Tax Deduction 151480 ii Total Closing balance 103925 Explanation i ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started